Looking For The Best Tech Stocks To Buy Or Sell This Week? These 3 Are In Focus.

After taking a breather earlier this week, tech stocks are back in vogue again. These stocks have had a remarkable year so far. Despite the global stock market crashing in March 2020, the S&P 500 Information Technology Index has been up by 71%. This recovery is so impressive that it even outperformed the S&P 500.

So why are tech stocks so lucrative these days? It does make sense if you think about it. We rely on tech to do almost everything these days. From shopping to consuming media and working, technology is present in all aspects of our lives. For instance, you would be using Microsoft’s (MSFT Stock Report) Office software to carry out office tasks or you could be watching your favorite series on Netflix (NFLX Stock Report). These are all tech offerings that have played a role in improving your quality of life.

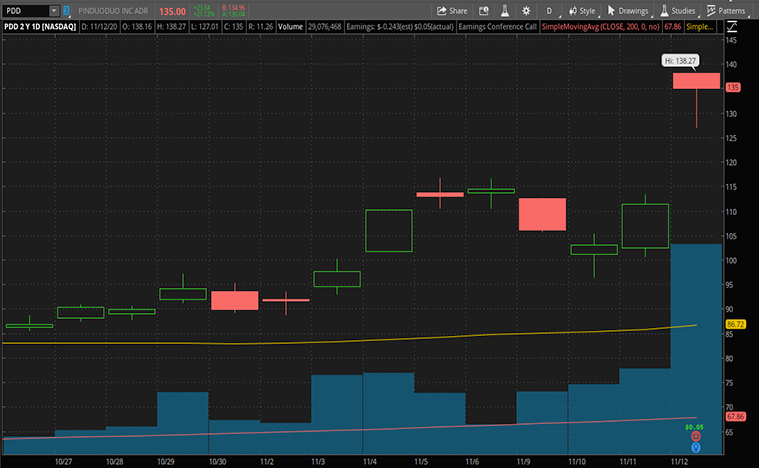

One top tech stock in particular has seen impressive gains today. China’s largest interactive e-commerce platform, Pinduoduo (PDD Stock Report) is skyrocketing as high as 20.85% as of 11.25 a.m. ET. during Thursday’s trading session. Pinduoduo had reported record sales for China’s Singles’ Day, which is the largest physical retail and online shopping day in the world.

The company had also beat analyst expectations with a 92% increase in revenue, at $1.89 billion in its third-quarter fiscal. This significant increase in revenue comes as the lack of travel options had boosted e-commerce in China. For investors looking for stocks that can deliver sustainable growth, could these tech stocks fit the mold?

Read More

- Should Investors Buy These Top Solar Energy Stocks Now? 3 Names To Watch

- Top Cyclical Stocks To Watch With Further Gains Ahead After Promising Vaccine News

Best Tech Stocks To Buy [Or Sell] Before Friday: JD.com Inc

JD.com (JD Stock Report) is an e-commerce company that is headquartered in Beijing. It is one of the biggest business-to-customer (B2C) online retailers in China by transaction volume and revenue. The company sets the standard for online shopping through its commitment to quality and authenticity. JD.com is known to attract premium global brands to its platform. In the second quarter, luxury fashion companies like Prada and Sergio Rossi opened flagship stores on JD.com.

The company had just concluded its Singles’ Day event on November 11 and had reported a total transaction volume of $41.1 billion. JD.com reported a staggering increase of over 200% in sales for high-end gaming laptops and gaming phones. This is a clear indication that with more people staying at home, there is an increase in demand for home products. With that, tech companies like JD.com will stand to benefit.

In the company’s second-quarter fiscal that was posted in August, JD.com had reported a 33.8% increase in revenue of $28.5 billion. The company had also reported a staggering 417.4 million active customer accounts, up by 29.9% year-over-year. JD.com has enjoyed a year-to-date increase of 119% in its share price and now costs $82.84 per share. Despite a 12% dive in share price as China announced that it will be curbing monopolistic behavior for internet platforms, JD.com is well equipped to weather through this latest hurdle. With so many impressive things happening to JD.com, is JD stock a top tech stock to watch?

Best Tech Stocks To Buy Before Friday [Or Sell] Before Friday: Wix

Cloud-based web development services provider Wix.com (WIX Stock Report) has had a spectacular year so far in the stock market. The company is known for its easy to use website builder and offers a variety of customization for its websites. Wix is also one of the tech companies that benefited from the COVID-19 pandemic. The company has enjoyed a year-to-date increase of 98% and is at $255.64 per share.

As more businesses have shifted online, demand for an online presence continues to remain at high levels. Its CEO, Avishai Abrahami said, “Businesses are using Wix more than ever before and we are seeing them utilize our platform to not only help them create a website but also to support them as they manage their business and grow their brands”. This increase in demand had in turn given Wix a revenue of $254.2 million, up by 29% year-over-year. The company also reported that its collections had generated $280.9 million, up by 36% year-over-year.

Despite the 4% decline today as investors fear that a Pfizer (PFE Stock Report) vaccine could finally subdue the pandemic, you can see that people have adapted to this new norm. Businesses being online would mean lower costs and this trend would likely go on in the long run. Wix.com could enjoy this uptrend in revenue as more people adapt to moving their businesses online. The company had stated that it continues to experience strong growth even as parts of the world began to re-open their economies. With that in mind, will you consider having WIX stocks in your portfolio?

[Read More] Top Biotech Stocks To Watch With Recent & Upcoming Events; 3 To Watch

Best Tech Stocks To Buy [Or Sell] Before Friday: Zoom Video Communications Inc.

Zoom Video Communications (ZM Stock Report) could be one of the biggest winners in 2020. The tech stock darling has seen a mind-blowing increase of 526% in share price year-to-date. Many people had flocked to Zoom’s video conferencing services at the start of the pandemic. With lockdowns and work from home orders in place, you can see why. From work meetings to university classes and social gatherings, Zoom has become a household name.

As news of the Pfizer vaccine shows promising results, many investors were concerned that it could curb the growth that Zoom and other tech stocks have experienced during the pandemic. However, shares of Zoom are on the rise again today as investors slowly return to tech stocks after a two-day selloff. The company uses a Freemium business model and users can upgrade to paid tiers to remove time limits, gain cloud storage, host more people, and a plethora of other perks. This along with the pandemic has fueled Zoom’s growth in 2020.

In the company’s latest quarter posted in August, Zoom reported revenue of $663.5 million, up by 355% year-over-year. This was facilitated by a 458% increase in total customers with more than 10 employees at 370,200 customers. This is evident as organizations are addressing their business continuity needs to support the future of working anywhere. With solid figures backing Zoom’s growth, would you say that ZM stocks are an investor’s favorite tech stock to buy?