Electric vehicles (EVs) are becoming more popular as consumers seek more environmentally friendly and sustainable transportation options. Advances in technology, government incentives, and a growing awareness of the environmental impact of fossil fuels are driving the trend toward EVs. As a result, the electric vehicle market is rapidly expanding and is expected to expand further in the coming years.

As a result, investing in electric vehicle (EV) stocks can provide investors with exposure to this rapidly growing market. EV stocks encompass a wide range of companies involved in the production and development of EVs, as well as the production of the components that go into EVs, such as batteries, charging infrastructure, and renewable energy solutions. With the global demand for EVs expected to continue to increase, these companies are well-positioned to benefit from this growth.

To summarize, investing in EV stocks allows investors to participate in the growth of the electric vehicle market. While investing in individual EV stocks is risky, a well-diversified portfolio of EV stocks can provide an attractive long-term return. Investors should carefully consider the risks and rewards of investing in EV stocks. Considering this, here are three top EV stocks to watch in the stock market during this shortened holiday week.

EV Stocks To Watch Right Now

- Tesla Inc. (NASDAQ: TSLA)

- General Motors Company (NYSE: GM)

- Ford Motor Company (NYSE: F)

Tesla (TSLA Stock)

Leading off, Tesla Inc. (TSLA) is a well-known manufacturer of electric vehicles, energy storage systems, and solar panels. The company has a reputation for innovation and sustainability and is considered a leader in the electric vehicle market.

Late last month, Tesla reported its fourth-quarter 2022 financial results. In the report, the company announced Q4 2022 earnings of $1.22 per share and revenue of $24.3 billion. This is better than the consensus estimates for the quarter which were earnings per share of $1.13 on revenue of $26.2 billion. Additionally, Tesla reported ad 37.2% increase in revenue versus the same period, the previous year.

Since the beginning of 2023, shares of TSLA stock have rebounded by 86.74% year-to-date. Meanwhile, during Tuesday morning’s trading session, Tesla stock is trading down on the day by 3.31% at $201.80 per share.

[Read More] REIT Stocks To Buy Now? 2 To Know

General Motors (GM Stock)

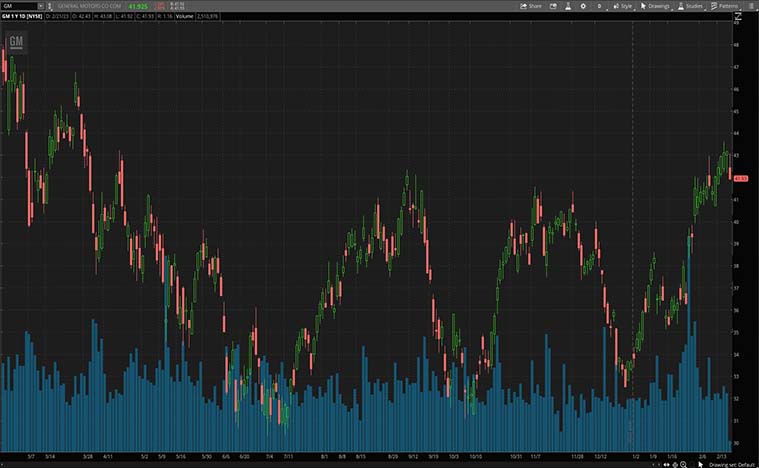

Next, General Motors Company (GM) is a major player in the automotive industry, producing a wide range of cars, trucks, and electric vehicles. With a long history of innovation and a commitment to electrifying its product portfolio, GM is well-positioned to benefit from the growth of the electric vehicle market.

At the beginning of the month, General Motors announced its Q1 2023 cash dividend. In detail, the company’s board of directors approved a cash dividend of $0.09 per share for the first quarter of 2023. The dividend will be payable to all common shareholders who are on record as of the close of trading on March 3, 2023, and will be distributed on March 16, 2023. As a result, GM offers its shareholders a 0.86% annual dividend yield.

Year-to-date, shares of General Motors are up 23.92% so far. While, during Tuesday’s mid-morning trading session, GM stock is trading lower on the day by 2.90% at $41.92 per share.

[Read More] 3 Copper Mining Stocks To Watch In February 2023

Ford Motor Company (F Stock)

Last but not least, Ford Motor Company (F) is a leading producer of cars, trucks, and SUVs. The company has a long history of innovation and is focused on electrifying its product portfolio to keep pace with the growth of the electric vehicle market.

Earlier this month, Ford Motor Company announced its 4th quarter 2022 financial results. In detail, the company posted Q4 2022 earnings of $0.51 per share, along with revenue of $44.0 billion. For context, Wall Street consensus estimates for the quarter were earnings per share of $0.60 and revenue of $40.4 billion. Moreover, revenue grew by 16.7% versus the same period, the prior year.

So far in 2023, shares of Ford Motor stock are up 6.25% year-to-date. Additionally, during Tuesday’s mid-morning trading session, F stock is trading lower on the day so far by 3.69% at $12.42 per share.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!