Are These The Top Tech Stocks To Watch Next Week?

You can’t deny that tech stocks are among the most prominent sectors in the stock market today. The tech industry as a whole showed resilience in face of the March downturn last year. This was made clear as the tech-heavy Nasdaq Composite gained by over 43% throughout 2020. In fact, the best tech stocks rebounded to new heights as they stepped up to meet changing demands throughout the pandemic. To a certain extent, this could speak towards the ability of said companies to thrive in a post-pandemic world as well.

Take Zoom (NASDAQ: ZM) and Apple (NASDAQ: AAPL) for example. Both companies had their best year on the stock market in 2020. For the latter, cyclical product updates would likely continue to make bank for the company, especially with growing 5G technology. For Zoom, it has made a name for itself as the leading teleconferencing platform. This could bode well as people turn to it as a convenience instead of a necessity in the future. In the tech industry, innovation and adapting is a necessary skill. As such, do you have these top tech stocks to buy on your watchlist going into next week?

4 Top Tech Stocks In Focus Now

- Microsoft Corporation (NASDAQ: MSFT)

- Clearfield Inc. (NASDAQ: CLFD)

- Vuzix Corporation (NASDAQ: VUZI)

- Salesforce.com Inc. (NYSE: CRM)

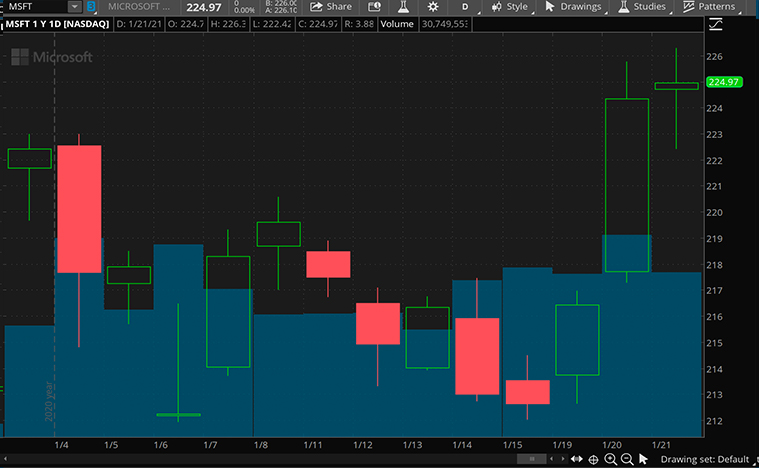

Microsoft Corporation

Starting us off is a tech giant that is undoubtedly a household name Microsoft. The company maintains and markets the leading PC operating system in the world, Microsoft Windows. On top of that, the company has integrated most of its enterprise offerings into the cloud. Not to mention, MSFT stock has surged to new heights throughout the current pandemic. It popped by over 3% during intraday trading Wednesday, placing it within reach of its all-time high back in September. With Microsoft slated to post its second-quarter results next Tuesday, could MSFT stock has more room for growth?

Looking at its recent financials posted in October, the company appears to be gaining momentum. Microsoft saw green across the board as it brought in over $37 billion in total revenue. The company cited its strong demand for its cloud offerings as a driving factor. Excellent quarter aside, Microsoft has not been resting on its laurels lately as well.

Earlier this week, the company entered a long-term strategic relationship with General Motors (NYSE: GM) and self-driving car company Cruise. Cruise is a subsidiary of General Motors. The trio will work together to commercialize a line of autonomous vehicles. Notably, Microsoft will be doing the heavy lifting on the software end of the deal. Microsoft is not only making its entry into the emerging autonomous vehicle market but is doing so with an automotive veteran. Could this mean big gains for MSFT stock down the line? You tell me.

Read More

- Making A List Of Gold Stocks To Buy Now? 4 Names To Know

- Is Ford (F) Stock A Better EV Stock To Buy Than Nio & Tesla Right Now?

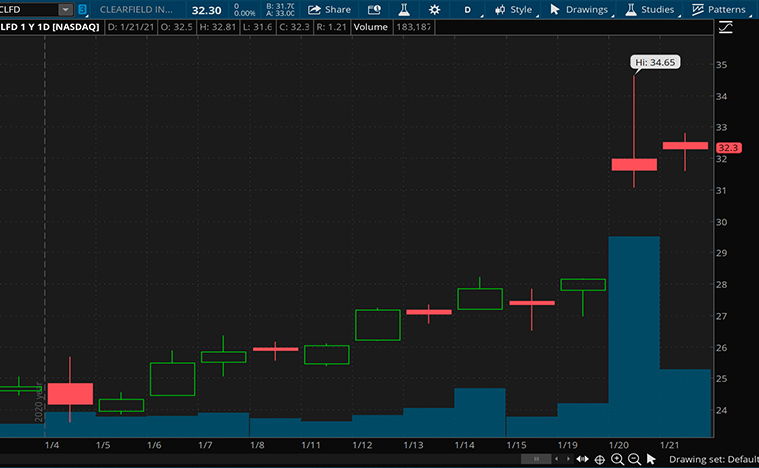

Clearfield Inc.

Following that is Minnesota-based tech company, Clearfield. In brief, it manufactures and distributes passive connectivity products. Clearfield’s products are a vital part of delivering broadband services to the general population. Accordingly, CLFD stock has seen steady growth over the past year with gains of over 120%. In a time where digital communication is so heavily relied on, Clearfield services would be paramount.

Just last month, the company announced that Midco Communications was utilizing its offerings. This is because of how Clearfield was able to accommodate Midco’s unique situation. To elaborate, Midco’s service area encompasses rural communities located in harsh environments. Clearfield managed to deliver resilient yet effective products even in those conditions. This resulted in Midco being able to bring high-speed broadband connectivity to its clients in the region. If anything, this shows the adaptive capabilities of Clearfield which could bode well for CLFD stock moving forward.

The company also reported solid financials back in November. It brought in revenue of $27.3 million and saw a 57% year-over-year rise in earnings per share. On top of that, it also reported a 63% increase in cash on hand in the same period. As Clearfield is slated to post its earnings on January 28, will you be adding CLFD stock to your watchlist?

[Read More] Are These The Best Entertainment Stocks To Watch Right Now?

Vuzix Corporation

Another top tech stock in the limelight now would be Vuzix. The multinational tech firm is a supplier of wearable display technology. It integrates virtual reality (VR) and augmented reality (AR) technology into its work as well. Interestingly, VUZI stock surged by over 21% during Wednesday’s trading session. This coincides with the announcement of its latest collaboration.

In detail, Vuzix announced that it will be collaborating with virtual care company, Hippo Technologies. The agreement will see the integration of Hippo’s comprehensive medical care platform and Vuzix’s wearable tech. In turn, this would open up another paradigm of mobile computing in the healthcare sector. The end product of this alliance would allow clinicians to videoconference and access relevant medical information in real-time. In theory, this would make for more efficient virtual care which has been a growing necessity amidst the current pandemic. Considering all of this, I can see why investors are flocking to VUZI stock.

Last week, the company released a financial update regarding its fourth-quarter sales figures. It reported a year-over-year revenue spike of over 100% equating to $4 million. This surpassed Wall Street estimates of $3.5 million and marks a new revenue record for Vuzix. With all this in mind, could VUZI stock be looking at new all-time highs this year? Your guess is as good as mine.

[Read More] Looking For The Best Electric Vehicle Stocks To Buy Before February? 3 Names To Watch

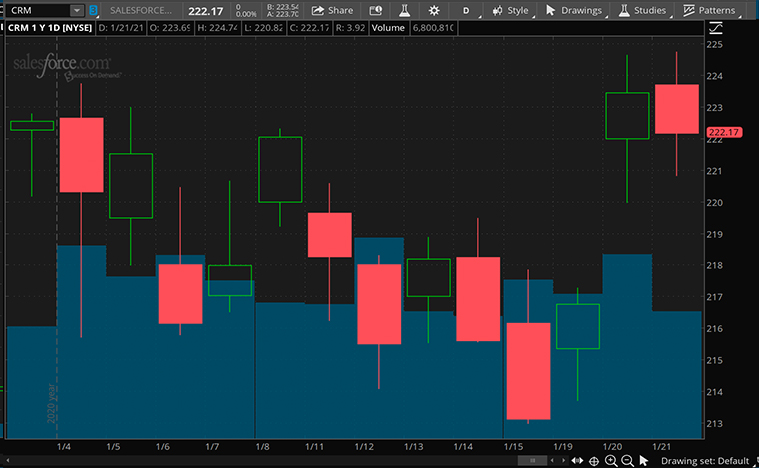

Salesforce.com Inc.

Topping off our list is software giant, Salesforce. For the uninitiated, it is a leading provider of customer relationship management (CRM) software. Its suite of CRM enterprise applications has become a go-to for companies undergoing digital acceleration. Unsurprisingly, CRM stock is looking at gains of over 75% since the March lows.

Based on its recent quarter fiscal posted in December, the company appears to be in a strong financial position as well. It reported total revenue of over $5.4 billion with a net income of $1.08 billion for the quarter. Coupled with $3.72 billion in cash on hand, the company seems well-positioned to make the most of the current quarter.

In recent news, the company led a $15 million investment into Indian tech startup Darwinbox. Darwinbox is a cloud-based human resource (HR) management platform that is looking to expand its market reach in the region. To point out, over 500 firms rely on Darwinbox’s HR platform. Seeing as Darwinbox’s core business synergizes with Salesforce’s, this is a great play by the company. Salesforce India CEO Arundhati Bhattacharya explained, “India is home to one of the world’s youngest populations, and by 2050, it is expected to account for over 18% of the global working-age population.” He went on to say that this makes Darwinbox’s tech platform all the more crucial. As Salesforce is making investments into the massive Indian market, could CRM stock be in for another stellar year? That remains to be seen.