Are These Renewable Energy Stocks On Your Watchlist? 3 To Consider

Renewable energy stocks have dominated the stock market for the majority of 2020 and continue to do so now. As Joe Biden was inaugurated this week, the top renewable energy stocks kept on surging upwards. This is no surprise given his plans for the clean energy sector. You’ve likely heard of the billions which the Biden administration has pledged to put into the development of renewable energy technology. Well, mere hours after being inaugurated, Biden has already signed executive orders to rejoin the Paris Climate Agreement. This resulted in the pullback of a major oil and gas project in Alaska. In turn, this reduces the amount of non-renewable energy in the U.S. but also reinforces the need for renewable energy.

Is It A Good Time To Invest In The Renewable Energy Sector Now?

Well, for seasoned and new investors alike, this does present a unique opportunity for sure. For one thing, valuations in the sector are mostly conservative compared to the sky-high price tags on some tech stocks. Moreover, with investments in the form of global green initiatives, I could see steady growth for the industry.

Even now, investors are looking for the best renewable energy stocks to add to their watchlist. Take Shanghai-based JinkoSolar (NYSE: JKS) for example, it is the world’s largest solar panel manufacturer. JKS stock is currently looking at gains of over 220% in the past year. Another top renewable energy stock now would be SolarEdge (NASDAQ: SEDG) who has surged by over 190% over the same period. Notably, these two companies are key players in the solar power industry. Current estimates suggest that solar power generation could account for 20% of the world’s electricity supply by 2050. With that in mind, you might want to consider these three solar stocks that are heating up in the stock market today.

Read More

- Could These Be The Best Tech Stocks To Watch Ahead of February?

- Is Ford (F) Stock A Better EV Stock To Buy Than Nio & Tesla Right Now?

Best Renewable Energy Stocks To Watch Next Week

- Enphase Energy Inc. (NASDAQ: ENPH)

- Canadian Solar Inc. (NASDAQ: CSIQ)

- SunPower Corporation (NASDAQ: SPWR)

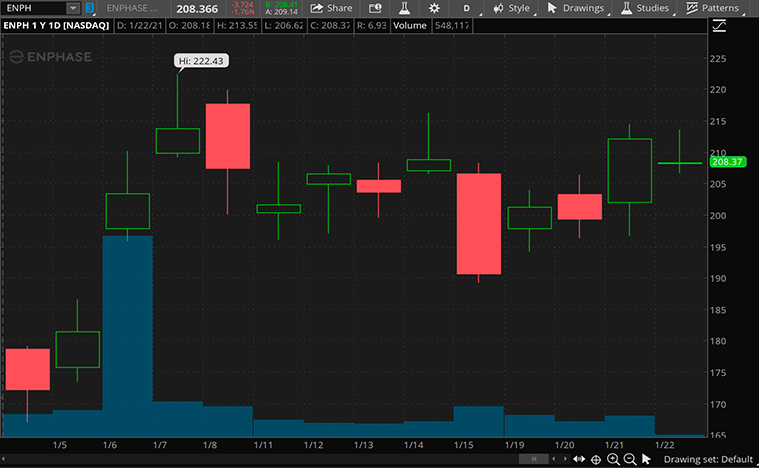

Enphase Energy

Enphase is a name most renewable energy investors are familiar with. For the uninitiated, the company designs and manufactures home energy solutions. The company has shipped over 30 million solar microinverters and approximately 1.3 million home energy systems to over 130 countries. Clearly, Enphase is no newcomer to solar energy. ENPH stock sitting at gains of 570% in the past year is a testament to this as well. Despite its fantastic run in this time, analysts seem to believe it still has room to grow.

Earlier this week, J.P. Morgan (NYSE: JPM) raised its price target for ENPH stock to $230 a share. General optimism aside, Enphase has been keeping busy over the last few weeks as well. In brief, the company expanded its existing commitments with clients to include battery storage. This was the case with its network member Solar Optimum, and Sunnova Energy (NYSE: NOVA). Through these reinforced partnerships, Enphase received more exposure for its growing list of offerings. Seeing how confident its clients are, Enphase is flexing its expertise in the industry. For investors, this could mean big gains as more people turn to the company for their home energy needs.

Back in October, the company reported bringing in $178.5 million in total revenue for the quarter. It also saw a 225% year-over-year leap in cash on hand which added up to over $661 million in cash on hand. I can imagine that as its partnerships and clientele continue to grow, so will its financials. Given all of this, do you think ENPH stock is a top renewable energy stock now?

[Read More] Are These The Best Entertainment Stocks To Watch Right Now?

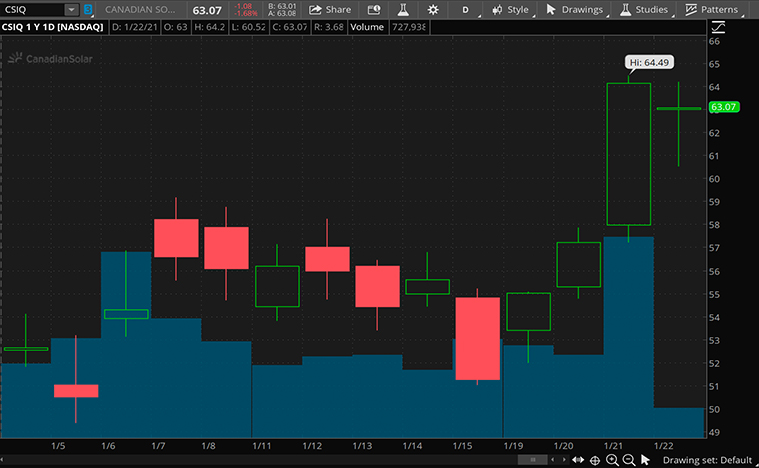

Canadian Solar

Another top renewable energy stock to watch would be Canadian Solar or CS for short. The company manufactures solar photovoltaic (PV) modules and manages large-scale solar projects. More importantly, CSIQ stock is sitting on gains of over 190% over the past year and closed at a new all-time high yesterday. Adding to general industry tailwinds, the company also finalized a massive new deal yesterday.

CS will collaborate with private equity firm, Windel Capital to develop 1.4 gigawatts (GW) worth of solar projects in the U.K. The initial projects in the pipeline are expected to achieve “ready-to-build” status by the second half of 2021. As it stands, the overall project will take place over 18 months. Given the sheer size of this project, CSIQ stock appears to be in a good place now. If anything, CS shows no signs of slowing down as it expands into the growing energy market in the U.K. Should it play its cards right, CSIQ stock could be looking at substantial growth in the long run.

In its recent quarter fiscal posted in November, the company reported total revenue of over $914 million. Additionally, it saw a 109% surge in cash on hand year-over-year to the tune of $1.1 billion. CEO Dr. Shawn Qu summarized, “I am pleased to report another strong set of results for the third quarter. We continued to focus on executing our strategy, overcoming market challenges, and delivering long-term returns.” Considering its current trajectory, we could be looking at exciting times ahead for CSIQ stock. Would you agree?

[Read More] Looking For The Best Electric Vehicle Stocks To Buy Before February? 3 Names To Watch

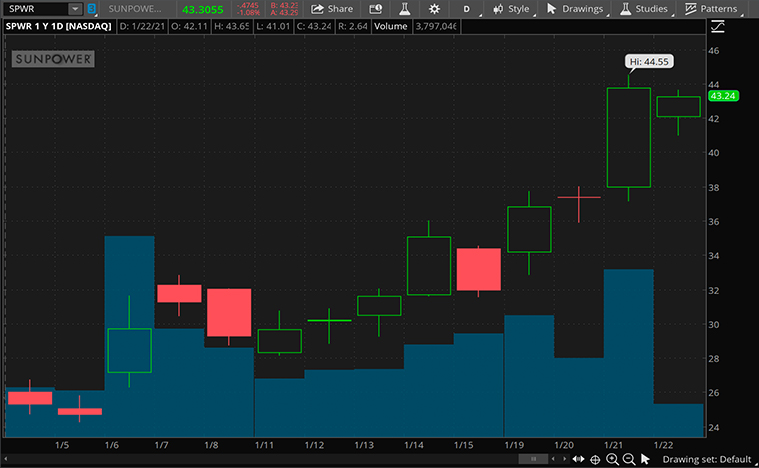

SunPower

Following that, we will be looking at California-based solar energy company, SunPower. In brief, the company designs and manufactures PV cells and solar panels. SPWR stock has been on a tear for the past year, rising by more than 660%. Just this week, it has gained over 35% in the share price. Along with the current renewable tailwinds, it also announced a new partnership yesterday.

EnergyONE Renewables will be collaborating with SunPower to market its products to the Kansas City metro. Through this agreement, EnergyONE can sell SunPower’s solar offerings to Kansas City home and commercial building owners alike. EnergyONE hailed SunPower’s products as the “best of the best” which speaks to SunPower’s 36 years of experience in the industry. From this, you can see that SunPower continues to establish its leading position in the industry. Ideally, this could set the company up to ride solar expansion tailwinds in the U.S. to greater heights.

A closer look at its financials will also reveal that SunPower is confident of its ability to perform in the foreseeable future. In October, the company raised its fiscal year 2020 net income guidance to a top line of about $200 million. It also reported growth of 71% in its cash on hand year-over-year with a sum of $324 million for the quarter. CEO Tom Werner said, “Our solid third-quarter results reflect the strong demand for our industry-leading solutions in both our residential and commercial markets.” Could this set up another stellar year for SPWR stock? Your guess is as good as mine.