Looking For The Best Retail Stocks To Buy Before February?

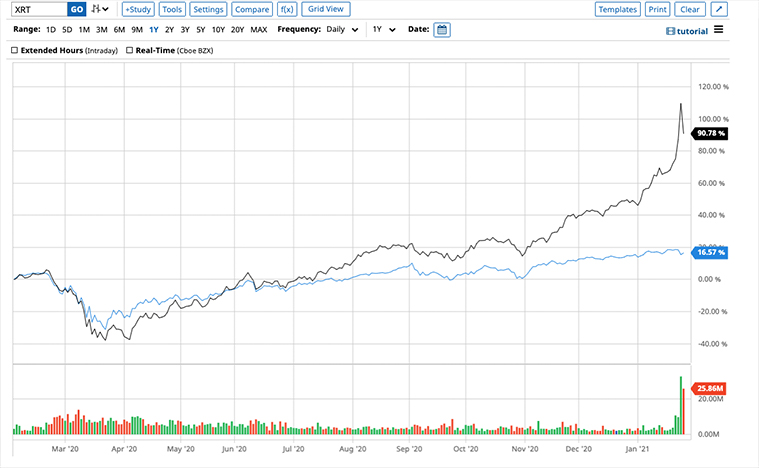

Retail stocks have been on fire recently. We see how some of these stocks have sky-rocketed in valuation in the last few weeks. These businesses normally use a brick-and-mortar model to earn their revenue, so of course, they were decimated last year when the pandemic hit the U.S. These stocks have come a long way since many struggled to stay open last year. One thing for certain, the pandemic has reshaped retail in ways that are likely to last long after all of this is over. In retrospect, the pandemic had not changed consumer behavior but only shifted it to e-commerce. Examples of top retail stocks that have adapted to the pandemic so far are Target (NYSE: TGT) and Amazon (NASDAQ: AMZN).

So what’s happening in the retail industry lately? Why have some of these stocks exploded in growth and witnessed unprecedented gains in such a short time? It all started when retail traders banded together on an online discussion board called WallStreetBets on Reddit to push a bunch of stocks up. As these stocks were also the target of short selling by the hedge-fund industry, a David vs. Goliath comparison began between these retail traders and hedge-funds. These retail traders are targeting heavily shorted stocks to squeeze them to new highs. With that in mind, here is a list of the best retail stocks that investors could consider buying.

Top Retail Stocks To Buy [Or Sell] Now

- GameStop Corp. (NYSE: GME)

- Bed Bath and Beyond Inc. (NASDAQ: BBBY)

- ContextLogic Inc. (NYSE: WISH)

- National Beverage Corp. (NASDAQ: FIZZ)

GameStop Corp.

GameStop is a consumer electronics, video game, and gaming merchandise retailer that has made headlines recently. Despite the stock skyrocketed to $475.02 per share pre-market, the stock has plunged more than 32.44% as of 3:50 p.m. ET. This came after Robinhood and TD Ameritrade restricted the trading of GME stock. As mentioned earlier, this retail stock seems to be the target of retail traders attempting to crush short-sellers and drive the company’s price ‘to the moon’. The stock has even caught the attention of Tesla (NASDAQ: TSLA) CEO Elon Musk who tweeted in support of this retail stock.

Earlier this month, GameStop reported its worldwide sales results for the nine-week holiday period that ended on January 2, 2021. The company saw a 309% increase in e-commerce sales for this period. Net sales for the period were $1.77 billion, a 3.1% decrease compared to 2019. It cited that strong console demand was offset by store closures under the company’s planned densification strategy. However, the company has also added Ryan Cohen, the co-founder of successful e-commerce company Chewy (NYSE: CHWY) into its Board of Directors. This could very well be the first step for GameStop to expand its e-commerce operations. All things considered, will you consider adding GME stock to your portfolio?

Read More

- 3 Top Biotech Stocks To Watch Before Next Week

- Apple (AAPL) Vs Microsoft (MSFT): Which Is A Better Tech Stock To Buy Right Now?

Bed Bath & Beyond Inc.

Bed Bath & Beyond or BBBY, is a chain of domestic merchandise retail stores. The company has many stores in the U.S., Canada, and Mexico. The company is an omnichannel retailer that has a wide assortment of merchandise in the home, baby, beauty, and wellness markets. BBBY stock has doubled in the last week. The company, like GameStop, has attracted a lot of attention from retail traders.

Earlier this month, the company reported its third-quarter fiscal with improved financial performance. It posted a 94% increase for its core digital comparable growth and a 77% hike in its total enterprise comparable sales growth. BBBY also posted a positive cash flow generation of $244 million and reduced its gross debt by half a billion. The company also reported that it has $1.5 billion in cash and investments. For its holiday sales performance in the U.S., BBBY results were in line or stronger than the broader retail market.

Last week, the company also announced the completion of the sale of Cost Plus World Market to Kingswood Capital Management. This is part of the company’s efforts to streamline its portfolio. It will help fund its transformation and allow it to focus on its core businesses. With so many exciting things happening to the company, will you consider buying BBBY stock?

[Read More] Could These 3 Stocks Be The Next GameStop According To Reddit Investors?

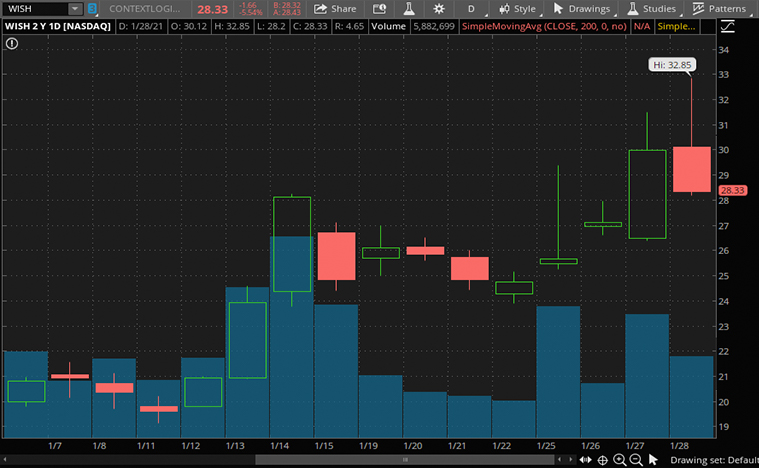

ContextLogic Inc.

ContextLogic operates an e-commerce platform called Wish that facilitates transactions between sellers and buyers. It is one of the largest and fastest-growing e-commerce platforms. It connects over 100 million monthly active users in over 100 countries to an impressive 500,000 merchants worldwide. WISH stock has been up by over 20% since its IPO in December.

Wish’s platform is based on a personalized and visual browsing experience that is comparable to how one browses a physical retail store. The company says that no two user feeds are the same and its platform will enable a discovery-based and entertaining shopping experience. In the company’s third-quarter fiscal in December, ContextLogic reported revenue of $606 million, a 32% increase year-over-year. It also has a highly capital efficient model with $1 billion in cash. The company also utilizes data science to its advantage and is core to its business. Given the company’s solid track record, do you think WISH stock is a top retail stock to buy?

[Read More] Should Investors Consider Tesla (TSLA) Stock After It Missed Earnings Expectations?

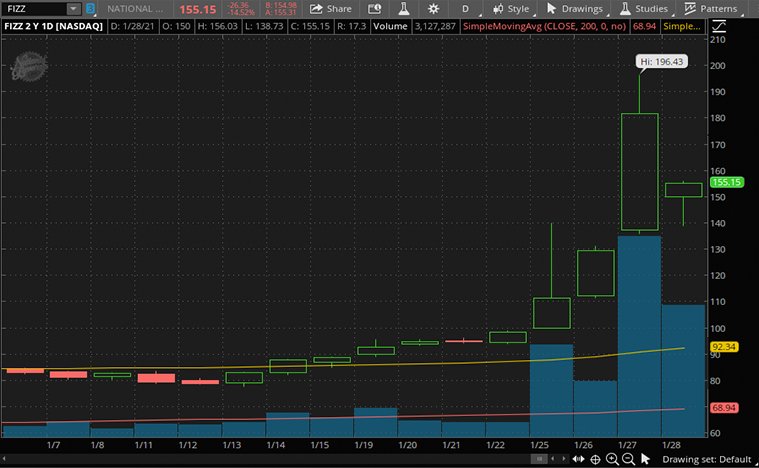

National Beverage Corp.

National Beverage is a beverage developer and manufacturer based in Florida. It is the fifth-largest soft drink company in the U.S. The company has a distinctive portfolio of sparkling waters, juices, and energy drinks. FIZZ stock has more than doubled year-to-date and shows no signs of stopping. Last week, the company announced its payment date, January 29, 2021, for its previously announced $6.00 per share cash dividend. Since 2014, the company has paid total cash dividends of $20.56 per share, or nearly $1 billion.

The company posted its second-quarter financials last month as well. It reported net sales were up by 8%, at $272 million. Operating profit increased to 22.7% of sales and National Beverage also reported a net income of $47.2 million. This would be the fourth consecutive quarter of year-over-year revenue and earnings growth and the company also anticipates its next quarter to reflect this positive continuity. Given all of this, will you consider owning FIZZ stock?