Netflix’s Mixed Q4 Results Stirred Attention

Netflix (NASDAQ: NFLX) reported its fourth-quarter results on Tuesday after the stock market closed on January 19. The company surprised many with its exceptional growth rates in subscriber count but fell short of profitability estimates. From the latest fiscal report, the company reported a revenue of $6.64 billion, a 22% increase year over year. While promising on the revenue front, the company’s net income fell nearly 8% to $542 million.

“We have turned this corner where now we can, as we talked about, with $8 billion of cash on the balance sheet, projecting to be cash flow about break-even in 2021 and then positive thereafter,” Netflix Chief Financial Officer Spencer Neumann said in the company’s recorded interview. “We want to return excess cash to our shareholders, so we won’t build a bunch of excess cash.”

But that’s not what investors are paying attention to the most. Rather, it was the jaw-dropping net subscriber numbers that got the ball rolling. The 8.5 million subscribers blew away analysts’ expectations of only 6 million for the quarter. That was an outperformance of over 30%. On top of this, the company also mentioned that it’s considering share buybacks along with the quarterly report. As a result, NFLX stock is surging more than 15% as of 12:47 p.m. ET during Wednesday’s trading session.

Read More

- 3 Bank Stocks To Watch In January 2021

- Are These Tech Stocks Good Investments Right Now? 3 For Your List

Netflix Is Still The Leader In The Increasingly Competitive Market

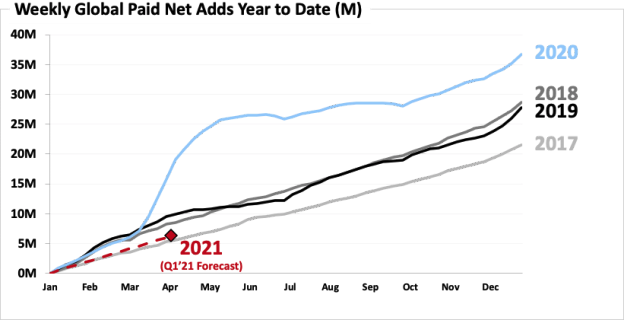

From its report, it’s now clear to many that Netflix is still one of the top streaming stocks to watch in the stock market today. Of course, the cost of making Netflix Originals is not cheap. But that’s what keeps viewers engaged. In addition, original content attracts new subscribers. Crossing the 200 million subscriber mark, adding 37 million in 2020 alone is no easy feat. That’s an impressive growth considering the company is in the midst of intense competition from Disney (NYSE: DIS) and Amazon (NASDAQ: AMZN), just to name a few.

As a comparison, Disney+ may have finished 2020 with 87 million subscribers. Still every time the entertainment powerhouse adds a subscriber, chances are high that he or she is already a Netflix customer. And it seems to me that many are keeping both accounts for more variety when it comes to content streaming. What this tells us is that the streaming war is not exactly a zero-sum game. The increase in Disney+ subscribers doesn’t necessarily come at the expense of Netflix.

Investors may have been frustrated by Netflix’s huge spending to develop original content. However, as the space is getting increasingly crowded with new players, investors have slowly accepted the terms as the streaming giant proved itself out. After all, Netflix has the advantage of spreading its content cost over the large user base.

[Read More] Are These Renewable Energy Stocks On Your January Watchlist? 3 Names To Know

Original Blockbusters Keep Consumers On The Hook

According to The New York Times, recent hits on Netflix include chess drama “The Queen’s Gambit”, period drama “Bridgerton”, and the fourth season of “The Crown”. Over the last decade, the company incurred a debt of over $16 billion to develop its trove of movies and TV shows. That move seems to have paid off handsomely. Evidently, it seems to me that the streaming titan has cemented its position as one of the key content producers and distributors in the world, making it one of the best streaming stocks to buy now. The company also revealed that they will be financing their everyday operations without tapping debt markets anymore. That’s another reason worth celebrating for NFLX stock investors.

What’s more, the company also teased its ambitious plans for 2021. Just last week, Netflix announced that it would release at least 70 original films this year, including Dwayne Johnson’s action blockbuster Red Notice and Leonardo DiCaprio’s political satire Don’t Look Up. This suggests that Netflix needs its original content now more than ever to stay ahead of the game.

[Read More] Making A List Of E-Commerce Stocks To Buy? 3 In Focus

Subscriber Growth Concerns Remain

Commenting on the estimates of subscriber growth moving forward, Kannan Venkateshwar from Barclays Capital said that:

“Just as we talked about, there’s so much uncertainty in the business, we can provide a number but I’m not sure it would be worth it or bankable,” Neumann said. “It’s hard enough to project the next 90 days, let alone the next 12 months. But we feel very good about it as I said is that longer-term growth trajectory.”

With its record number of subscribers, this will no doubt leave investors wondering if growth is peaking. The growth was driven by a spike in demand for TV streaming during the pandemic. But with vaccines rolling out, stay-at-home orders would likely ease in the coming months. And when that happens, will consumers start ditching Netflix? What’s more, Netflix continues to face competition from other rivals, some of which have much deeper pockets. But on the flip side, this concern has been around for a few years now. Investors will have to keep a close eye to see how things evolve going forward.

[Read More] Looking For The Top Biotech Stocks To Watch Right Now? 1 Up 200%+ In One Day

Bottom Line For NFLX Stock

Netflix has been building its portfolio of original TV series and movies in the last few years to sustain its subscriber growth and also keep existing customers loyal. One can see how the company added 8.5 million net memberships in its latest quarter and reported a healthy retention rate for its subscribers. The company plans to end its dependability on debt, and it is an achievement worth a toast. With such exciting developments for the company, is NFLX stock on your list of top stocks to buy right now?