Are These Top Tech Stocks On Your Watchlist This Week?

You can’t deny that tech stocks have been on a roll. Some of the top tech stocks continue to bring investors returns even amidst a global health crisis. This is great for tech investors who have been on that train in the stock market since last year. However, there is a new concern that came along with this new year. With Joe Biden as president, there could be efforts to reform tax laws which lead to an increase in taxes.

Well, Wall Street analyst, Brian Fitzgerald brought up a good point saying that Congress is too divided to decide on the matter. He also adds that it could only happen once a broader economic recovery sets in. Seeing as the pandemic is still months away from ending, the tech industry could still have room to grow.

Generally, tech makes up a majority of the world we live in now. If it weren’t for the tech industry we would not have all our gadgets that make life easy now. Whether it is work-from-home stocks like Zoom (NASDAQ: ZM) or consumer tech stocks like Apple (NASDAQ: AAPL), tech sells. Given the versatility of tech, the industry is ripe with options for new and seasoned investors alike. As such, here is a list of four diverse tech stocks to watch in the stock market this week.

4 Top Tech Stocks To Watch This Week

- Uber Technologies Inc. (NYSE: UBER)

- Sea Limited (NYSE: SE)

- PayPal Holdings Inc. (NASDAQ: PYPL)

- Intel Corporation (NASDAQ: INTC)

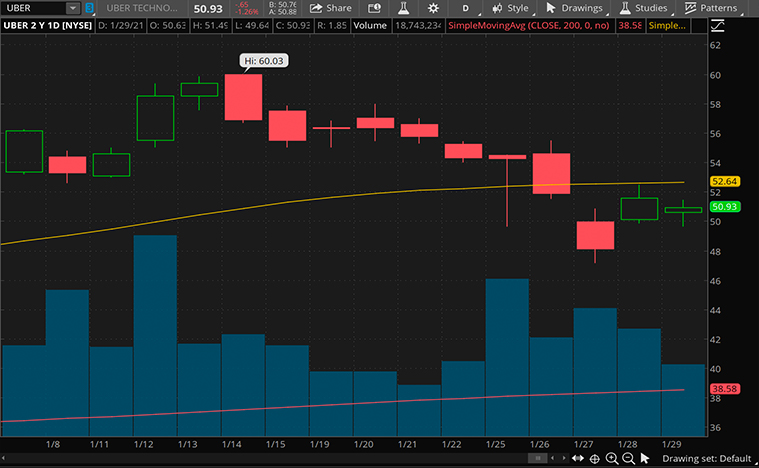

Uber Technologies Inc.

Starting us off is California-based tech company Uber. Before the pandemic hit, the company’s most profitable business was its ride-hailing services. Over the past year, the company has expanded its other divisions heavily. These include its food and package delivery services among others. On Thursday, the company announced a new update to its delivery services in New York. At the same time UBER stock jumped by over 7% during intraday trading.

In the announcement, Uber revealed that it plans to expand its on-demand prescription medication delivery service. The company will be collaborating with Nimble, an emerging prescription delivery service in the U.S. Through this alliance, Uber Eats can now provide New Yorkers with their prescriptions straight from local neighborhood pharmacies. Moreover, customers will be able to access these services within the Uber smartphone app as well. As the company expands its business, it continues to show its resilience amidst these tough times. It could provide investors with another reason to watch UBER stock in the months to come.

In its third-quarter fiscal posted in November, Uber posted total revenue of $3.13 billion. Furthermore, it also ended the quarter with $6.15 billion in cash on hand. After considering how badly the pandemic affected its core business, this is a win for the company. Should investors be watching UBER stock ahead of its fourth-quarter fiscal scheduled on February 10? You tell me.

Read More

- MasterCard (MA) vs Visa (V): Which Is A Better Financial Stock To Buy?

- Looking For The Best Biotech Stocks To Buy? 1 Reported Earnings Today

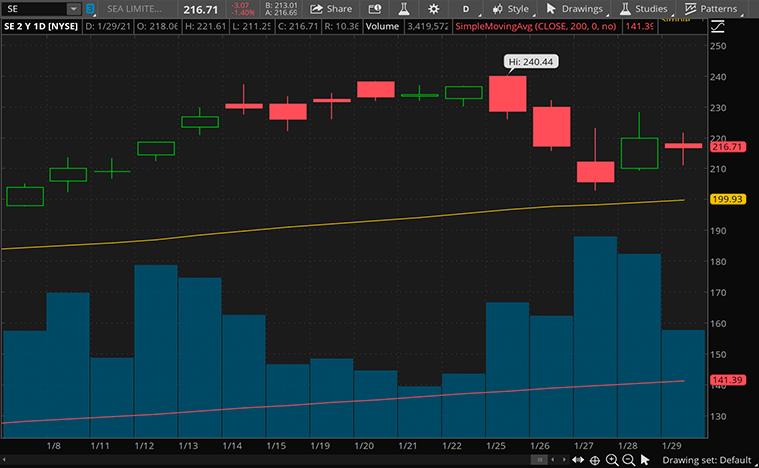

Sea Limited

Sea Limited is another tech stock to watch right now. The consumer internet company is involved in the digital entertainment, e-commerce, and digital financial service industries. It operates through its Garena, Shopee, and SeaMoney subsidiaries respectively. Seeing as it has investments in three pandemic boosted industries, it is no wonder that investors would be watching SE stock. Over the past year, SE stock has gained by over 380% on the stock market. However, Sea Limited’s recent move may show that it is not resting on its laurels yet.

Earlier this week, news broke regarding the company’s e-commerce division Shopee. According to Reuters, the company seems to be eyeing the Latin American e-commerce market. A LinkedIn opening for over three dozen positions based in Brazil was posted by Shopee. Interestingly, Shopee’s Vietnam unit Managing Director, Pine Kyaw, was listed as being the Shopee Brazil head on the platform. If this is the case, we would be looking at Southeast Asia’s largest e-commerce player going up against MercadoLibre (NASDAQ: MELI). Understandably, this marks an extremely ambitious move by the company.

For one thing, Sea Limited has solid financials backing it up. In its third-quarter fiscal reported in November, the company saw a 98% year-over-year leap in total revenue. This added up to a cool $1.21 billion for the quarter. It also reported having $3.51 billion in cash on hand. Given all of this, will you be watching SE stock?

[Read More] 4 Top Epicenter Stocks To Watch Amid Novavax’s Vaccine News

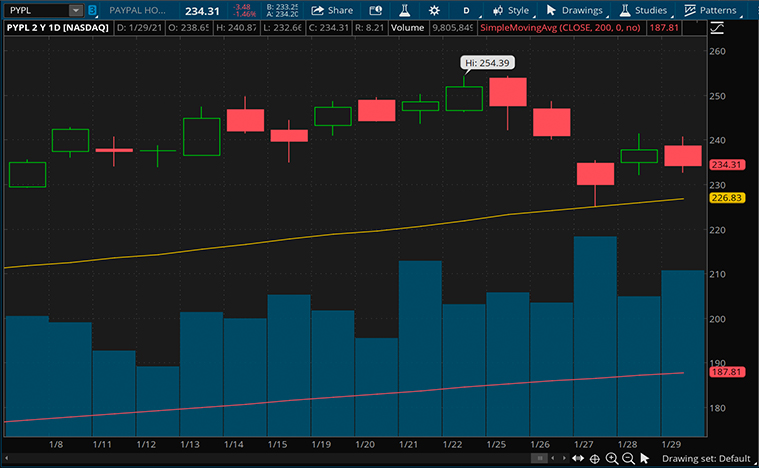

PayPal Holdings Inc.

Following that, we have major fintech player, PayPal. The online payment solutions provider has been making waves lately. From waiving check-cashing fees on stimulus checks to facilitating cryptocurrency purchases, PayPal seems to be firing on all cylinders. Likewise, PYPL stock has surged by over 175% since the March selloffs. Despite having its best year on the market, PayPal does not seem to be slowing down anytime soon.

On January 27, it was announced that PayPal would be collaborating with Netherlands-based e-commerce company Vistaprint. The Cimpress (NASDAQ: CMPR) subsidiary will work together with PayPal to bring contactless payment solutions to small businesses across the U.S. In this arrangement, PayPal’s touch-free payment solution will play a crucial role in enabling small businesses to operate amidst the pandemic. Additionally, the duo is aiming to implement this partnership for Vistaprint’s clients throughout Europe later this year as well. As PayPal continues to expand its market presence and clients, PYPL stock could possibly follow suit.

Back in November, the company reported one of its strongest quarters to date. It brought in total revenue of $5.46 billion. Furthermore, it saw year-over-year jumps of 121% in net income and 120% in earnings per share. As PayPal kicks into high gear, could PYPL stock be looking at another record year? I’ll let you decide.

[Read More] Social Media Stocks To Buy In February 2021? 2 Releasing Earnings Next Week

Intel Corporation

Fourth, we will be looking at semiconductor-giant Intel. Most would agree that the company’s presence in the industry is comparable to Samsung and Taiwan Semiconductor (NYSE: TSM). Despite its reputation, INTC stock has been trading sideways, for the most part, seeing gains of 12% this month. Nevertheless, the company’s latest investment shows that it still has growth in mind in 2021.

According to Reuters, Intel has invested an additional $475 million in its Vietnam unit. This is on top of the $1 billion it has put towards its state-of-the-art chip assembly facility in Saigon. Overall, the $1.5 billion in investments is supposedly going towards 5G product acceleration. Coupled with its announcement regarding its shift in manufacturing strategy last week, the company seems to have a busy year ahead. Naturally, it would not surprise me if investors had INTC stock on their radars.

If that wasn’t enough, the company released its fourth-quarter fiscal just last week. In it, Intel saw $19.98 billion in total revenue and $5.86 billion in cash on hand. CEO Bob Swan summarized, “We significantly exceeded our expectations for the quarter, capping off our fifth consecutive record year.” Considering its financial position and ambitious moves, could INTC stock be making a comeback this year? Your guess is as good as mine.