Are These The Best Blue Chip Stocks To Buy Now?

Blue chip stocks are some of the most sought-after investments in the stock market today. And for good reason: blue chips typically represent large, well-established companies with a history of strong financial performance. This makes them a relatively safe bet for investors, as there is a lower risk that the company will experience sudden setbacks or failure.

Also, Blue chip stocks tend to be less volatile than other types of stocks, meaning that their prices don’t fluctuate as much in response to changes in the market. This stability can help to provide a buffer against losses in other parts of your portfolio. For these reasons, blue chip stocks are often seen as a good choice for long-term investment. If you’re keen on investing in blue chips, here are four top blue chip stocks to check out in the stock market this week.

Blue Chip Stocks To Buy [Or Avoid] Now

- Apple, Inc. (NASDAQ: AAPL)

- Amazon.com, Inc. (NASDAQ: AMZN)

- The Walt Disney Company (NYSE: DIS)

- Mastercard Incorporated (NYSE: MA)

Apple

Apple Inc. is an American multinational technology company headquartered in Apple Park, Cupertino, California, that designs, develops, and sells consumer electronics, computer software, and online services. Most notably, the company’s hardware products include the iPhone smartphone, the iPad tablet computer, the Mac personal computer, the Apple Watch smartwatch, and Apple TV digital media player to name a few. In July, Apple reported stronger-than-expected third quarter earnings results.

In the report, the company posted earnings per share of $1.20 on revenue of $83 billion. This is in comparison with analsyts consensus estimates of earnings per share of $1.14 and revenue of $82.4 billion. In addition, Apple reported it estimates fourth-quarter revenue to be more than $84.92 billion. Moreover, the company’s board of directors have declared a cash dividend of $0.23 per share of the Company’s common stock.

“Our June quarter results continued to demonstrate our ability to manage our business effectively despite the challenging operating environment. We set a June quarter revenue record and our installed base of active devices reached an all-time high in every geographic segment and product category,” commented Luca Maestri, Apple’s CFO. “During the quarter, we generated nearly $23 billion in operating cash flow, returned over $28 billion to our shareholders, and continued to invest in our long-term growth plans.” On Monday, shares of AAPL stock are trading at $169.04 per share. All in all, is AAPL stock a top blue chip stock to watch today?

[Read More] Best Lithium Battery Stocks To Buy Now? 4 To Know

Amazon.com

Amazon.com Inc. is an American multinational technology company based in Seattle, Washington, that focuses on e-commerce, cloud computing, digital streaming, and artificial intelligence. It is considered one of the Big Five companies in the U.S. information technology industry, along with Google (NASDAQ: GOOGL), Apple, Microsoft (NASDAQ: MSFT), and Meta (NASDAQ: META). Amazon has also developed a number of services to accompany its online retail offerings, such as Amazon Prime and Amazon Web Services. Separate from that, the tech giant reported its second quarter results in July.

Diving in, Amazon reported a earnings per share of $0.10 on revenue of $121.2 billion. Compared with the consensus estimates of earnings of $0.15 per share on revenue of $119.5 billion. In addition, Amazon reported upbeat guidance for Q3 2022. In detail, it estimates third-quarter revenue of $125.0 billion to $130.0 billion. While, analysts’consensus revenue estimates are $127.8 billion.

Moreover, earlier this month, Amazon announced they signed an agreement to acquire iRobot. In the news release it says Amazon will acquire iRobot for $61 per share in an all-cash transaction valued at approximately $1.7 billion. Shares of AMZN stock are up over 9% in the last month of trading activity, and currently trades at $134.05 on Monday morning. Considering all this, is AMZN stock a buy right now?

Walt Disney Company

The Walt Disney Company is a diversified global entertainment company with operations in five business segments: Media Networks, Parks and Resorts, Studio Entertainment, Consumer Products, and Interactive. Continuing on, earlier this month, Walt Disney Company announced better-than-expected third quarter earning results.

In detail, Disney reported earnings per share of $1.09 on revenue of $21.5 billion. For context, analysts’ consensus estimates for Q3 were earnings of $0.94 per share on revenue of $20.1 billion. In addition, Walt Disney Company reported a 26.3% revenue increase on a year-over-year basis. Aside from that, the company’s park, experiences, and product revenues for Q3 increased to $7.4 billion, copared to $4.3 billion during the same period, in 2021.

Bob Chapek, CEO at Disney, commented, “We continue to transform entertainment as we near our second century, with compelling new storytelling across our many platforms and unique immersive physical experiences that exceed guest expectations, all of which are reflected in our strong operating results this quarter.” Moreover, in the last month of trading action, DIS stock has recovered by over 13%. DIS stock currently trades at $116.97 as of Monday morning.

[Read More] 3 Cannabis Stocks To Watch Right Now

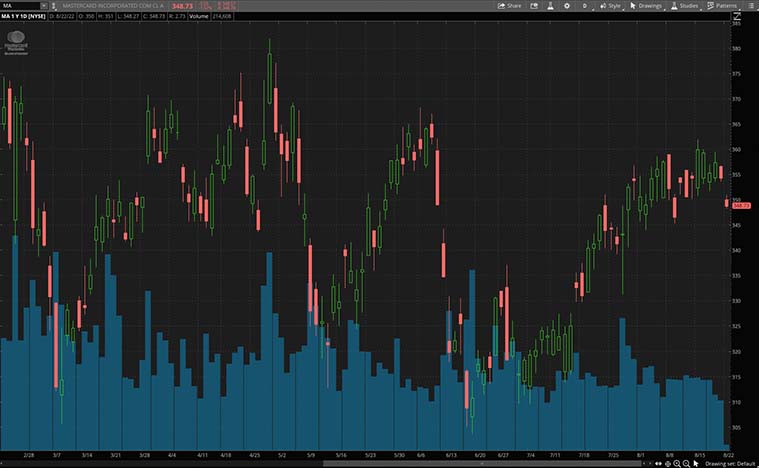

Mastercard

Mastercard Incorporated is an American multinational financial services corporation headquartered in Purchase, New York. The company operates the Mastercard brand, which is one of the two largest global payment processing networks, along with Visa (NYSE: V). Last month, Mastercard reported an earnings beat for the second quarter 2022.

Diving in, Mastercard (MA) posted earnings of $2.56 per share on revenue of $5.6 billion. This is in comparison to Wall Street’s consensus earnings estimate of $2.36 per share on revenue of $5.2 billion. In the second quarter, MA posted a 21.4% increase in revenue on a year-over-year basis.

Michael Miebach, Mastercard CEO commented in his letter to shareholders, “We had strong revenue and earnings growth again this quarter, as overall consumer spending remained robust and cross-border volumes grew 58% versus year ago. “Increasing inflationary pressures have yet to significantly impact overall consumer spending but we will continue to monitor this closely. We have a well-diversified business model and the demonstrated ability to deliver strong operating margins through up and down cycles.” On Monday morning, shares of MA stock are trading at $348.68 per share. With that being said, do you have MA stock on your watchlist right now?

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!