4 Cryptocurrency Stocks To Check Out This Week

Cryptocurrency stocks have become a way for many investors to gain exposure to digital currencies. For investors who may not want to own crypto directly, investing in companies in the crypto space would be a viable way to jump on the crypto bandwagon. Besides, there was also a report in The Wall Street Journal that the Federal Reserve will be releasing a paper exploring the use of central bank digital currencies (CBDCs) in the U.S. economy. This would mark the central bank’s first concrete step towards exploring the use of digital currencies and potentially pave the way for a Fed-backed digital dollar.

Should this materialize, more people would warm up to the idea of cryptocurrencies. We have already seen companies such as Square (NYSE: SQ) allowing its users to buy and sell bitcoins on its Cash App. In recent years, Bitcoin has been a steady revenue stream for the company. Even Tesla’s (NASDAQ: TSLA) CEO Elon Musk has recently suggested that the company will likely accept cryptocurrencies for a Tesla again in the future. As cryptocurrencies continue to gain traction and adoption, investors are also keeping close tabs on the industry. With that in mind, here is a list of the top cryptocurrency stocks in the stock market now.

Best Crypto Stocks To Buy [Or Sell] This Month

- Coinbase Global Inc (NASDAQ: COIN)

- Riot Blockchain Inc (NASDAQ: RIOT)

- Hut 8 Mining Corp (NASDAQ: HUT)

- Paypal Holdings Inc (NASDAQ: PYPL)

Coinbase Global

First, we have the financial technology company Coinbase. Essentially, the company provides end-to-end financial infrastructure and technology. It primarily focuses on building a cryptoeconomy, a transparent financial system using cryptocurrencies that leverage crypto assets. In fact, its platform now enables more than 43 million retail users in over 100 countries.

So, as cryptocurrencies continue to gain popularity, so will the company’s revenue stream. But the company is not resting on its laurels just yet. Last month, Coinbase raised $2 billion of senior notes to bolster its already strong balance sheet. The use of proceeds may include product development, as well as potential investments or acquisitions.

When we look at its previous earnings report, Coinbase exceeded expectations during its second quarter. It reported revenue of $2.33 billion, exceeding expectations of $1.78 billion by Refinitiv. Out of which, $1.9 billion were transaction revenue and $100 million in subscription and services. Moreover, its transacting users grew to 8.8 million, up by 44% from the previous quarter. Safe to say, the company is growing on the right track as cryptocurrencies remain a hot topic among investors. With that in mind, would COIN stock be a buy for you?

Read More

- 4 Artificial Intelligence Stocks To Watch Right Now

- Best Lithium Battery Stocks To Buy Now? 4 To Know

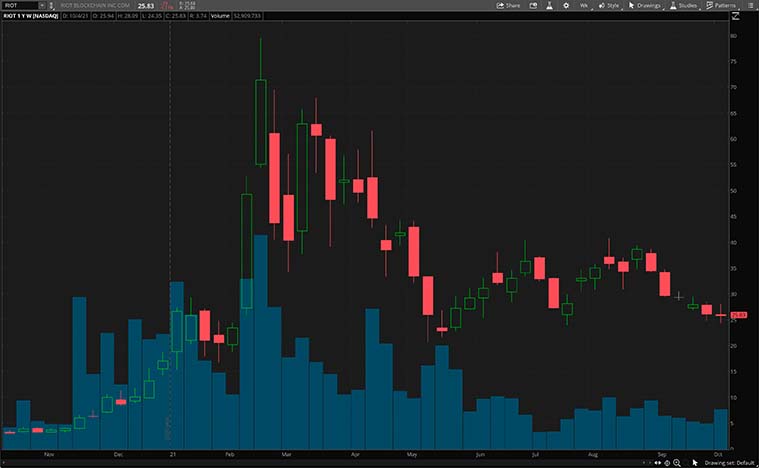

Riot Blockchain

Following that, we will be looking at Riot. Put simply, the company focuses on gaining exposure to the blockchain ecosystem through its cryptocurrency mining operations. In addition, it also has internally developed businesses and targeted investments in the crypto sector. Through its current strategy, Riot is looking to become one of the largest low-cost producers of Bitcoin in North America.

In August, the company announced its second-quarter earnings. The company posted increased mining revenue to a record $31.5 million, representing a staggering increase of 1540% year-over-year. This has naturally led to a record net income of $19.3 million, as compared to a net loss of $10.6 million in last year’s quarter. All these are a direct result of the company’s absolute focus on Bitcoin mining and growing its mining operations.

Despite its impressive performance, the company is not one that rests on its laurels. On Wednesday, Riot announced its September production and operations updates. It was able to produce 406 BTC, an increase of 346% year-over-year. As of September 30, 2021, the company now holds approximately 3,534 BTC and all of which were produced by its self-mining operations. Given these considerations, would you say RIOT stock is one of the top cryptocurrency stocks to buy right now?

[Read More] 4 Robotics Stocks To Watch Amid Rising Shifts To Automation

Hut 8 Mining

Another cryptocurrency company on the rise would be Hut 8. It is a Canada-based mining and blockchain infrastructure company. Essentially, it engages in the business of utilizing specialized equipment to solve computational problems to validate transactions on the bitcoin blockchain. Well, the rise of cryptocurrency has certainly given life to the company. HUT stock has risen more than 1200% just within the past year.

Last month, Hut 8 was certified as an authorized MicroBT Repair Centre for Canada. The agreement allows the company to complete in-warranty work on MicroBT miners for all of North America on-site in Medicine Hat, Alberta. Therefore, its Alberta-based technicians will have greater access to the resources they need to efficiently service its miners. We can expect long-term financial benefits and stronger relations between the companies through this partnership.

The company also provided its September production update earlier this week. It appears that 264 Bitcoin were mined, resulting in an average production rate of 9.11 Bitcoin per day. For now, 100% of the self-mined Bitcoin will be deposited into custody. This is consistent with the company’s long-term holding strategy. The initial target was to have over 5,000 self-mined Bitcoin by the end of its fourth quarter. However, the company is well ahead of schedule and already has 4,724 as of September 30, 2021. So, do you think HUT stock will have the potential to be one of the top cryptocurrency stocks in the future?

[Read More] Top Stocks To Buy Now? 4 Renewable Energy Stocks For Your Watchlist

Paypal

Last but not least, we have the fintech giant, PayPal. In this day and age, most people would be familiar with the company’s offerings. As an industry leader, PayPal continues to cater to the financial service needs of consumers across the globe today. It has and continues to do so as the ongoing global pandemic drives demand for its services towards newer highs. This year, the company has put plenty of emphasis on integrating cryptocurrencies into its ecosystem.

In September, the company announced its new PayPal app, an all-in-one, a personalized app that offers customers the best place to manage their financial lives. There are new features including PayPal Savings alongside new in-app shopping tools that will enable customers to earn rewards. On top of that, users can now manage their bill payments in a single place while managing cryptocurrency transactions all in one app.

According to Juniper Research, the number of consumers using digital wallets will double to 4.4 billion globally by 2025. Nearly half of consumers cite simplicity as the top reason to use digital wallets. So, PayPal aims to address this via an all-in-one app as the primary destination for customers to easily manage their financial lives. Considering the growth potential of the company, would you add PYPL stock to your portfolio?