4 Top Consumer Tech Stocks To Watch This Month

Amidst surging crude oil prices and a lackluster monthly labor report, the stock market today remains mostly unchanged. Nevertheless, investors may want to consider tuning in to consumer tech stocks now. After all, this part of the tech world has and continues to grow at breakneck speed. Now, when it comes to consumer tech, the focus is, well, the consumer. As such, this ranges from the likes of fintech firms such as PayPal (NASDAQ: PYPL) and tech giants like Alphabet (NASDAQ: GOOGL) subsidiary Google. Arguably, some of the biggest names in the tech industry are involved in this business in one way or another. Because of that, the focus could be on the top consumer tech stocks in the stock market now.

For instance, we could take a look at Visa (NYSE: V). Like many leading names in the financial services sector, the company’s offerings are becoming increasingly digital. Through its global payments solutions network, Visa is capable of handling over 65,000 transaction messages per second. Notably, the company’s latest play involves expanding its Buy Now, Pay Later (BNPL) services to Australia. In detail, Visa is partnering up with ANZ, a leading financial service provider in the region. By and large, this is but one instance of the booming consumer tech industry today. Here are four more names to watch in the stock market this month.

Best Consumer Tech Stocks To Watch Today

- Amazon.com Inc. (NASDAQ: AMZN)

- Uber Technologies Inc. (NYSE: UBER)

- Microsoft Corporation (NASDAQ: MSFT)

- Square Inc. (NYSE: SQ)

Amazon.com Inc.

First on this list of consumer tech stocks, we have Amazon, a multinational conglomerate that focuses on e-commerce, artificial intelligence, and digital streaming. It has a wide portfolio of consumer-centric products and services like Prime, Alexa, and Kindle among others. Given the scale of its operations, the company is one of the largest online marketplaces in the world. On October 4, 2021, the company unveiled its Black Friday-worthy deals earlier than ever ahead of the holiday season.

This would give customers access to incredible holiday savings no across every category. In addition to Black Friday-worthy deals that have started, the company also unveiled the new Holiday Gift List to let customers share gift ideas for everyone in their household with relatives and friends. Impressively, the company is also investing heavily in its employees in anticipation of the holiday season.

Dave Clark, CEO of worldwide consumer at Amazon had this to say, “Customers can confidently shop early knowing they are receiving incredible deals starting today, letting them get a head start on their holiday to-do lists so they can truly enjoy the holiday season. And I want to thank our incredible team around the world for everything they do each day to support each other and our customers—I couldn’t be prouder to work with you all.” With that in mind, is AMZN stock worth investing in right now?

Read More

- 4 Artificial Intelligence Stocks To Watch Right Now

- Best Lithium Battery Stocks To Buy Now? 4 To Know

Uber Technologies Inc.

Following that, we have Uber Technologies, a tech company with services that include ride-hailing, food delivery, package delivery, and freight transportation. The company has operations all over the world and has capitalized on the boom in the food delivery business during the pandemic. With over 100 million active platform consumers in nearly 10,000 cities across approximately 71 countries where Uber is available, the company is a titan in the delivery industry.

In August, it reported its second-quarter financials for 2021. Diving in, its gross bookings reached an all-time high of $21.9 billion, up by 114% year-over-year. It also reported a net income of $1.1 billion and revenue of $1.91 billion for the quarter. This is driven by Uber’s investment in recovery by investing in drivers and it has made strong progress with monthly active drivers and couriers in the U.S. increasing by nearly 420,000 during this quarter. All things considered, should investors be on the lookout for UBER stock?

[Read More] 4 Robotics Stocks To Watch Amid Rising Shifts To Automation

Microsoft Corporation

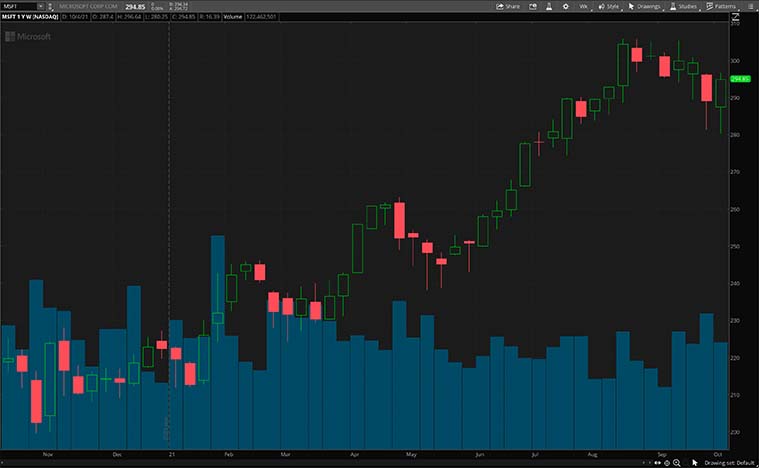

Microsoft is a tech titan that produces personal computers, software, and other consumer electronics. It recently launched its latest iteration of the beloved Windows operating system, Windows 11. It boldly claims that with this new OS, a new era for the PC begins as it is packed with new features and improvements. MSFT stock has enjoyed gains of over 38% in the past year alone.

On October 7, 2021, the company announced that it has acquired Ally.io to help revolutionize how organizations use technology to bring deeper connections to work and results in the hybrid world. Ally.io is a leading objective and key results (OKR) company and will be joining the Microsoft Viva family as part of its employee experience platform (EXP). EXP is designed to help companies embrace the new digital work life. The OKR category is a fast-growing and emerging space and Ally.io is leading the way as one of the most loved tools on the market. Customers find the Ally.io experience flexible, easy to use with quick time-to-value. For these reasons, should you consider buying MSFT stock?

[Read More] Top Stocks To Buy Now? 4 Renewable Energy Stocks For Your Watchlist

Square Inc.

Topping off our list today is Square. For the most part, this California-based fintech firm has and continues to connect merchants with consumers throughout the pandemic. This would be the case as its digital payments services and comprehensive solutions are more relevant than ever. Evidently, we could take a look at the company’s latest fiscal quarter report to see this. Back in August, Square saw massive year-over-year surges of 143% in total revenue and 1,433% in earnings per share. With the company’s upcoming earnings call being less than a month away, could SQ stock be a top watch in the stock market now?

Well, for one thing, Jefferies (NYSE: JEF) analyst Trevor Williams seems to think so. Yesterday, Williams upgraded SQ stock to a Buy rating and hit it with a price target of $300. This would indicate a potential upside of 21% from its current price tag of $238.49. According to the analyst, Square is looking at a “long growth runway”, naming it a “must own” in the current market. He cited the company’s ongoing acquisition of BNPL service provider Afterpay as a key factor for this update. All in all, Afterpay would serve as Square’s answer to the surging demand for BNPL services among consumers now. Ideally, as the company works to integrate Afterpay with its flagship services, we could be looking at an exciting holiday season for Square. Would you say the same for SQ stock?