Stock Market Futures Edging Up Ahead Of Weekly Jobless Data

Stock market futures are marginally higher going into the second last day of trading for 2021. With relatively light trading volumes alongside minimal economic data and earnings events, this is understandable. In terms of economic data, investors could be looking for the latest weekly jobless claims figures. To point out, these figures are expected to come in at 207,000 according to consensus estimates. This would mark a slight increase from last week’s figures, albeit still hanging around pandemic-era lows.

Weighing in on all of this is Bankrate senior economic analyst, Mark Hamrick. He recently noted, “Fortunately, there’s no evidence in this data of a new wave of fresh job loss.” He continued, “New claims are only slightly above the lowest point in decades notched a couple of weeks ago.”

Moreover, Hamrick believes that the current stability would be welcomed given the volatility from Omicron variant concerns and growing inflation. On top of all this, investors also have some interesting stock market news to consider today. As of 7:36 a.m. ET, the Dow, S&P 500, and Nasdaq futures are trading higher by 0.13%, 0.19%, and 0.28% respectively.

Walmart To Dispense Prescriptions For Covid Antiviral Pills From Merck And Pfizer

While biotech stocks may normally grab the main headlines for Covid-related developments, investors should not overlook Walmart (NYSE: WMT). Namely, the retail goliath is now set to dispense prescriptions for antiviral Covid pills. In detail, the company will be doing so via its network of pharmacies across several U.S. states. Furthermore, Walmart will be dispensing the pills from Merck (NYSE: MRK) and Pfizer (NYSE: PFE). Overall, this would be a solid play by the company. This could be the case as both the Delta and Omicron variants continue to wreak havoc on the U.S. population. In fact, the seven-day average for new cases nationwide is now at a record high of over 265,000, according to data from Johns Hopkins University.

On the technical side of things, Walmart is ensuring that consumers have easy access to these services as well. To highlight, the company now provides all the necessary info on a website. Through a store locator service, consumers can search for a Walmart or Sam’s Club pharmacy that offers Covid antiviral pills nearby. The company notes that medications are now available via curbside pickup and/or drive-thru pharmacy windows.

Commenting on all this is Walmart’s SVP of Pharmacy, Kevin Host. He said, “We are committed to working with our state and federal partners to provide access to new treatment options like authorized COVID-19 antiviral medications, as they become available.” With Walmart offering much needed Covid treatments to consumers, WMT stock could be worth watching in the stock market today.

[Read More] Best Lithium Battery Stocks To Buy Now? 4 To Know

Robinhood Eyeing January Launch For Beta Version Of Crypto Wallet

Robinhood (NASDAQ: HOOD) could be turning heads in the stock market now thanks to its latest announcement. As of yesterday, the company is planning to launch the beta version of its cryptocurrency wallet in January 2022. Since launching the alpha version in October, the company has been and is still fine-tuning the service. According to Robinhood’s Crypto COO, Christine Brown, Robinhood is looking to roll the beta out to “tens of thousands of customers”.

In the larger scheme of things, this is a step in the right direction for the company. With its crypto wallet being a long-awaited feature, investors could also be keeping an eye on HOOD stock now. For one thing, this wallet would allow Robinhood’s 18.9 million users to trade and manage their crypto holdings in-app. By adding this feature to its platform, the company would be squaring up against rivals such as Coinbase Global (NASDAQ: COIN). As Robinhood looks to keep up with the competition, I could see HOOD stock being in focus in the stock market now.

Naked Brands Shares Continue To Gain After Reverse Stocks Split

Shares of Naked Brands (NASDAQ: NAKD) are on the rise after a five-day losing streak. Notably, NAKD stock soared by over 14% throughout intraday trading yesterday. Oddly enough, the move comes about a week after the company announced a 1-for-15 stock split. For the most part, investors appear to be picking up on NAKD stock’s recent stint as a meme stock. After all, the company’s shares were on Robinhood’s limit list at a time.

Not to mention, there is also the ongoing merger agreement between Naked Brands and Cenntro Automotive, an electric vehicle (EV) firm. In essence, the company is looking to acquire Cenntro.

CEO Justin Davis-Rice recently explained Naked Brands’ plans moving forward. He said, “This transaction provides Cenntro with working capital to support a substantial backlog, fast-tracks the pathway to a public company, and introduces them to our loyal and enthusiastic shareholder base. After selling and delivering more [electric commercial vehicles] than any other EV company, Cenntro is ready to scale deliveries to an estimated 74,800 vehicle sales to leading consumer companies in 2023 with revenue of $2.1 billion.” Safe to say, we could be looking at exciting times ahead for the company. Whether or not investors should be jumping on NAKD stock because of this remains to be seen.

[Read More] 4 Artificial Intelligence Stocks To Watch Right Now

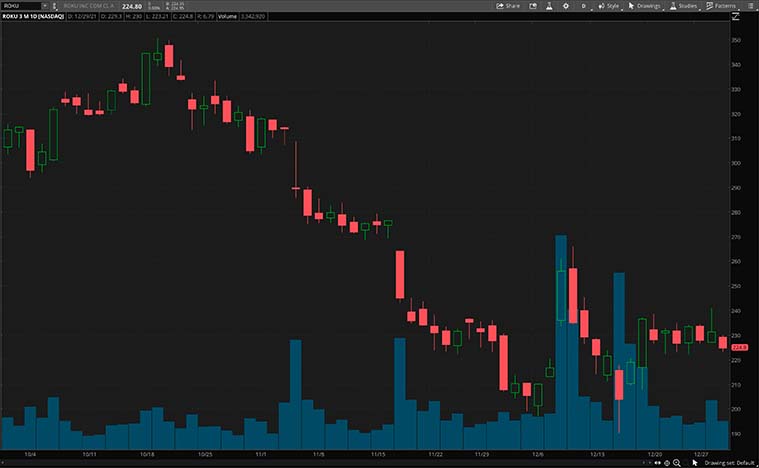

Roku Accelerates TV Ready Program

In other news, Roku (NASDAQ: ROKU) is hard at work expanding its TV Ready Certification program. For those uninitiated, Roku TV Ready is mostly catering to audio/video and consumer electronics firms. Through the program, Roku’s partners can better integrate their tech with Roku’s streaming offerings. In theory, this allows them to enhance their audio products, supporting a wide array of system upgrades. This includes but is not limited to seamless setup, single remote operations, and easy access to home theater settings on screens when connected to a Roku TV. Additionally, Roku also offers a wireless soundbar reference design for partner companies, allowing them to deliver high-performance home theater audio.

Now, Roku’s latest move involves expanding the program internationally to partners in the U.K., Canada, and Mexico. With this move, it seems like the company is eager to refine the viewing experience for consumers. Given the recent deceleration of video streaming trends, this would be a timely upgrade. Nevertheless, Bank of America (NYSE: BAC) analyst Ruplu Bhattacharya seems bullish on ROKU stock. He is maintaining a Buy rating on the stock with a price target of $360 per share. This would suggest an upside of about 60% from its price of $224.80 as of yesterday’s closing bell. Considering all these, investors could be eyeing ROKU stock now.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!