Are These The Best Real Estate Stocks To Buy Now?

Real estate stocks have gotten incredibly cheap lately, and it’s easy to understand why. Many experts believe that various parts of the sector will never go back to normal again. This comes after many companies have requested most of their employees to work from home. This could lead to less demand for office space in the future, which helps companies save some costs. On the retail side, the sector is expected to be hit by a wave of tenant bankruptcies and permanently decreased traffic. If this virus continues to affect our economy the same way for an extended period, we might not be surprised to see residential real estate taking a hit. This comes as some may be looking for cheaper dwellings.

Yet, the market is looking ahead to better times. Although some of the real estate stocks have since recovered along with the broader market, not all have come back equally. Recently, residential and industrial real estate investment trusts (REITs) had seen some uptick in their performances, and that’s mainly due to the federal government’s stimulus and the reopening economy. However, retail and office REITs remain under pressure.

The long discussion of allowing employees to work from home is becoming a reality. Never would I guess that it would happen in this form and at such an unprecedented pace. Well, who would have guessed? We are seeing companies like Facebook (FB Stock Report) and Twitter (TWTR Stock Report) starting to allow some employees to work permanently from home. That shift would reduce the need for office space, which in turn contributes to the negative sentiment towards office REITs. As such, let’s take a closer look at some of the best real estate stocks and REITs out there in the market right now.

Read More

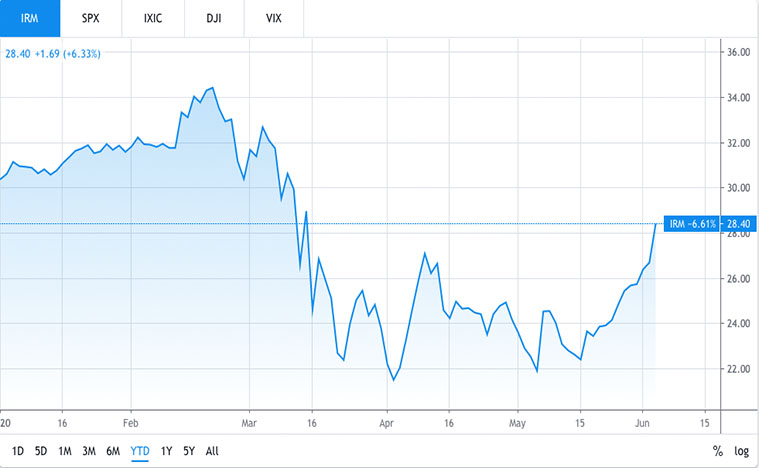

Best Real Estate Stocks To Buy Or Sell: Iron Mountain

Most REITs fall nicely into a specific category of properties, such as apartments, office buildings, or shopping malls. Iron Mountain (IRM Stock Report), on the other hand, is somewhat unique compared to traditional REITs. The combination of specialized storage facilities, data centers, and thriving service business is putting this stock on investors’ radar.

Just a little introduction for many stock investors, Iron Mountain specializes in records storage and security for a variety of clients. But that’s not all. It is categorized as a REIT because it owns a massive real estate portfolio, mainly consisting of records-storage facilities. Think of the business as a collection of self-storage properties, except these are not targeting individual users. The company is also looking ahead to the future business climate. It is quietly starting to amass a portfolio of data centers and build on its digital solutions and data protection footprints. In terms of data center capacity, Iron Mountain is now in the top 10, and it’s fair to assume that they are not slowing down anytime soon.

The company saw its first-quarter net operating income increase by 2.1%. That’s highly positive especially when other REITs are still struggling to overcome the impact of Covid-19. What’s interesting to me is that the storage business continues to support Iron Mountain’s expansion into higher-growth data centers, which grew net operating income by 10% in the first quarter. Investors were clearly glad with the positive performance of the company during these trying times. As such, would IRM stock be a top real estate stock to buy right now?

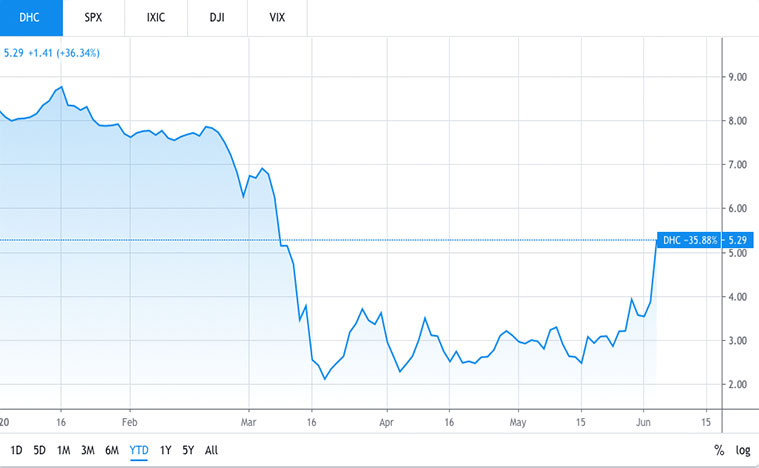

Best Real Estate Stocks To Buy Or Sell: Diversified Healthcare Trust

Shares of healthcare-centric REIT, Diversified Healthcare Trust (DHC Stock Report) rose nearly 50% this week. The trust operates 443 properties spread across 42 states and Washington DC. The company’s portfolio consist of medical facilities, wellness centers, and communities for senior living.

The strong gains in recent weeks were all helped by some big news on the financing front. The ability of the company to issue $1 billion worth of bonds was a very pleasant development to the investors. But there are two sides to everything. While the additional financing provides additional cash to the REIT, the high interest on the debt of 9.75% is worth extra scrutiny. This huge interest on the debt is making investors worried about its impact on the company’s cash flow. Although the debt issuance has bought Diversified Healthcare some buffer to go through the Covid-19 crisis, it certainly comes at a high cost that might jeopardize the portfolio. That said, is DHC stock still a good buy after the strong rally this week?

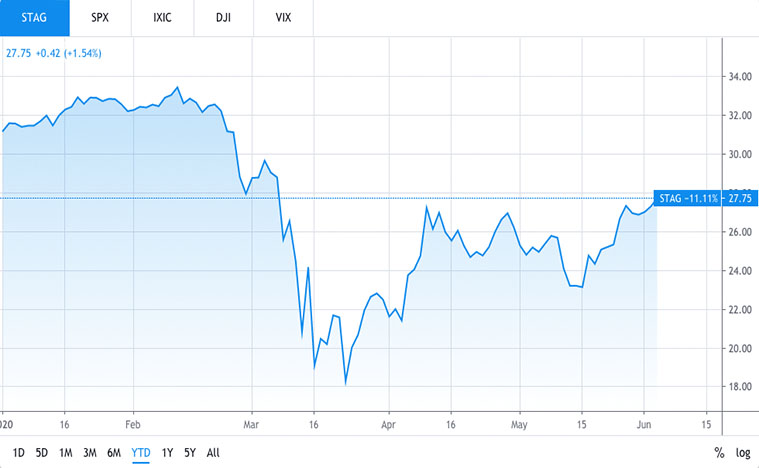

Best Real Estate Stocks To Buy Or Sell: STAG Industrial

Last but not least, STAG Industrial (STAG Stock Report) invests in single-tenant industrial properties throughout the United States. The bulk of their portfolio consists of distribution warehouses with high-credit national tenants. STAG stock and other industrial real estate stocks have in fact benefited from an unexpected source of revenue in the past few years- e-commerce. As more retail businesses move online, a large portion of retail real estate activity has moved into warehouses. Even with the coronavirus outbreak, the company doesn’t see any huge impact on its operations. After all, more online purchases are being made than ever before.

Shares of STAG Industrial also climbed around 45% after the coronavirus-induced market sell-off in March. The movement of its share price is the least volatile on the list. With Amazon (AMZN Stock Report) and other e-retailers participating, industrial space has been rented at a premium. And this premium will translate into profits, and by extension, dividends to investors. One thing’s for sure, the e-commerce business is here to stay. Even if the share price drops to a lower level, dividends shouldn’t be much affected. This makes STAG stock one of the best real estate stocks to buy for dividend income.