The natural gas industry has been steadily growing for the past decade. As more and more companies are investing in this energy source. Natural gas is a clean-burning fuel. This makes it an attractive option for investors who are looking for ways to add value to their portfolios. In this article, we will be discussing the various benefits of investing in natural gas stocks and why they may be a good choice for your portfolio.

What Are Natual Gas Stocks?

Natural gas stocks are shares of ownership in public companies that specialize in producing, processing, and/or distributing natural gas. These companies engage in the exploration and production, transportation, storage, refining, marketing, and distribution of both conventional and unconventional sources of natural gas.

Investing in these stocks can provide investors with exposure to the energy sector without having to directly own any physical assets. Or take on the additional risk associated with other energy investments such as oil & gas exploration or production. With this in mind, here are two natural gas stocks to check out in the stock market right now.

Natural Gas Stocks To Watch Now

- Coterra Energy Inc. (NYSE: CTRA)

- Kinder Morgan Inc. (NYSE: KMI)

Coterra Energy (CTRA Stock)

First up, Coterra Energy (CTRA) is an independent exploration and production company. The company has operations in Appalachia and the Permian Basin. Just last month, Coterra reported its third-quarter 2022 financial results.

In detail, the company posted Q3 2022 earnings of $1.39 per share and revenue of $2.5 billion. For context, Wall Street’s consensus estimates for the quarter were earnings of $1.34 per share, and revenue estimates of $2.4 billion. Also, Coterra announced a whopping 472.2% increase in revenue versus the same period, a year prior. Additionally, the company reported that its natural gas production for the third quarter averaged 2,807 million cubic feet per day (MMcfpd).

In 2022 so far, shares of CTRA stock have increased by 30.20%, outperforming the broader markets year-to-date. Meanwhile, CTRA stock is set to open Thursday’s trading session at around $26 a share.

[Read More] 3 Defense Stocks To Watch In The Stock Market Now

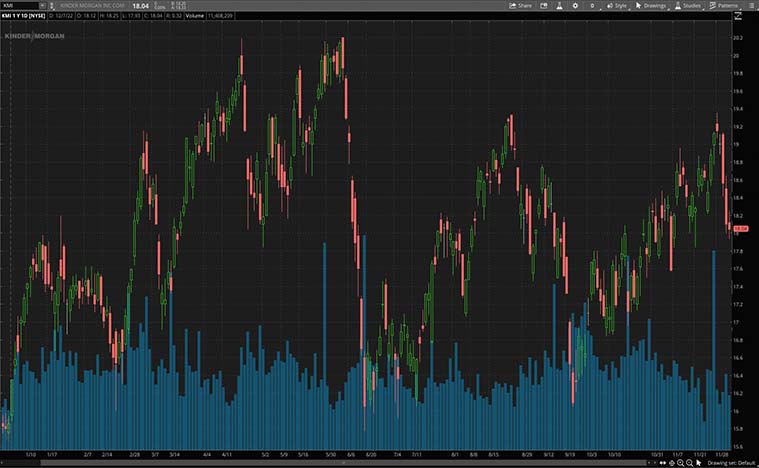

Kinder Morgan (KMI Stock)

Next, Kinder Morgan (KMI) is a leading energy infrastructure company in North America. They operate the continent’s largest natural gas pipeline network and are involved in almost every aspect of the energy business – from production, storage, processing, and transportation to retail sales.

In October, Kinder Morgan reported its third-quarter 2022 financial and operating results. In detail, the company notched in earnings of $0.25 per share, along with revenue of $5.2 billion for Q3 2022. What’s more, revenue increased by 35.4% versus the same period, in 2021.

Moving along, year-to-date shares of KMI stock have advanced by 10.34%, which outperforms the broader markets so far in 2022. While, during Thursday’s premarket trading session, KMI stock is set to open the trading day at around $18.20 a share.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!