Are Small Cap Stocks Worth Betting On?

Small-cap stocks have a tendency to react to the news. Headlines can sometimes be a catalyst for the massive swings in share prices. But I think we all can agree that there’s a lot more than just reading headlines. Blue-chip stocks need big dollar value gains to achieve meaningful returns, in terms of percentage of course. For smaller cap stocks, even penny movements can translate into double-digit percentage gains. As a result, these low-priced stocks generally see much more speculative activities rather than actual fundamentals that drive momentum.

Apart from the fact that lower-priced stocks move quickly, small-cap stocks also don’t necessarily need ground-breaking news prior to big movements in their stocks. For instance, Genius Brands International (GNUS Stock Report) had a massive breakout of 26 folds this year before sliding on Thursday. That’s expected, though, as certain investors wanted to cash out their positions. But GNUS stock provides us an example of how small-cap stocks can rally without any specific news.

Small-cap stocks usually follow their own market trends and are independent of how the broader market is performing. What’s really intrigued me is that many investors only look at headlines instead of full press releases. The more experienced trader looks at the headlines and all the key information within a press release. More often than not, headlines with ‘hype’ words would initiate a breakout. But as we digest the details, there’s a high likelihood that the shares would pullback.

Read More

Best Small Cap Stocks To Watch: XpresSpa Group

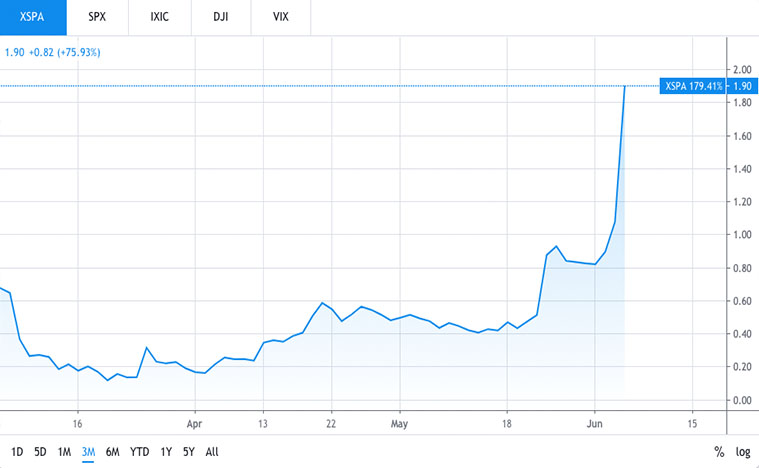

Shares of XpresSpa Group (XSPA Stock Report) were trading sharply higher on Thursday. The upswing could either be due to the reverse split deal to buy company shares or the company’s new business initiative that revolves around Covid-19. As far as we are concerned, reverse splits can be good or bad. It can be good if the company does it to attract new investors that are willing to pump in some cash that isn’t increasingly dilutive. On the flip side, it can be bad if the company simply boosts its share price via a reverse split on less than ideal debt terms.

XSPA stock is 200% higher year to date. Actually, it would be a ten-bagger stock if you invested in March. So, what is really the driving force for such a sustainable rally that drove the share price above $1? That could be because the company has been developing a division specifically for Covid-19 testing. What’s enticing for investors is that on May 22, the company announced a contract with JFK International Airport for Covid-19 screening and testing. The economy is set to reopen once again with many airlines starting to add flights this summer. And with Covid-19 unlikely to go away anytime soon, can we expect the services provided by XpresSpa to continue benefiting XSPA shareholders?

Best Small Cap Stocks To Watch: Hertz Global Holdings

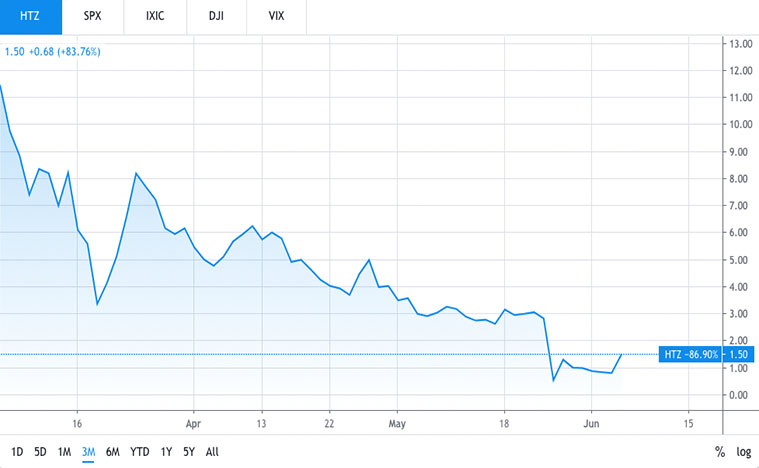

Hertz Global Holdings (HTZ Stock Report) have had a rough year. The company has officially filed for bankruptcy, and its stock price has plunged under $1 per share recently. For the record, Carl Icahn has unloaded his massive positions in HTZ stock. Investors followed suit, which sent the stock way down to $0.4. Investors who went to swing in and scoop up shares may have doubled, or even tripled their investments if the timing was right.

This week HTZ is back on investors’ radar. The hopes are high for the economy to turn the tide after airline and cruise-line stocks are slowly picking up pace. For instance, if you look at cruise-line stocks such as Norwegian Cruise Line (NCLH Stock Report) and airline stocks such as American Airlines (AAL Stock Report), you would understand what I’m talking about. That said, should investors still buy HTZ stock? After all, it’s not unheard of for companies to rebound after filing for bankruptcy.

It’s always exciting to buy lows and sell highs. But I would personally see how the company restructures itself before investing. When Carl Icahn sold his massive stakes at a loss, is he seeing something that we can’t see? Or should investors take the risks and bank on the reopening economy bringing Hertz business back to life?