Are These 2 Financial Stocks A Buy During This Pandemic?

Financial stocks like many other stocks saw a large drop once the global pandemic started. Most if not all financial stocks saw a dip in share price around February 24th, 2020. The Covid-19 outbreak is unlike anything we have seen in our lifetimes. Most industries shut down and people starting making and spending less money.

There’s also a worry about a second wave of the coronavirus affecting financial stocks. So the market is still a very volatile place. Financial stocks are reliant on the economy reopening to see their share price start to rise back up. Financial stocks tend to trend upwards when there is good news related to reopening businesses once again. As the pandemic continues on, we have seen more and more businesses opening. Even places like gyms and hair salons are open in most places once again. This is being accomplished with social distancing guidelines and safety precautions put in place.

Just like when good news is released, financial stocks have seen big declines after bad news is released. This bad news can be anything from reopening delays to job reports. If a second wave of the coronavirus arrives, the economy will be in even bigger trouble. One example of an issue that will hurt financial stocks is another increase in loan defaults. While being a speculative market, there is still money to be made in this sector. Now it’s time to have a look at some financial stocks to watch as the market continues to progress.

Read More

- Square Versus PayPal: Which Fintech Stock Is A Better Buy

- What Are The Best Tech Stocks Today? 2 Names To Know

Top Financial Stock To Buy [or Sell] During The COVID-19 Pandemic: Goldman Sachs

The first financial stock to watch is The Goldman Sachs Group Inc. (GS Stock Report). Goldman Sachs is one of the most valuable corporations. Goldman Sachs is an investment bank with a focus on all types of financial services. GS stock has been a very interesting financial stock to watch during the pandemic crisis. GS stock price generally trends with other financial stocks in its sector.

Shares of GS stock have been rising and falling a lot in the market recently. Before the coronavirus began, shares of GS stock were doing well. GS stock price was at the highest it had been in over a year back in January 2020. In that month shares of GS stock reached a high of $249.46. In February, the pandemic took over and caused a huge plummet in GS stock price and other financial stocks. Shares of GS stock fell as low as $134.97 in March 2020. In April, GS stock price saw an uptick to an average of $175 a share.

As the economy further recovered in May, shares of GS stock rose once again. In May the average of GS stock price was $200 a share. In June GS stock rose to around $220 a share before dropping down once again to $198 a share on June 12th. News has come out that has affected GS stock price. The news was, by the end of June 2020 Goldman Sachs expects to have most of its employees return to office. Goldman Sachs also felt the impact of partnering with Amazon on a small business credit line program. It’s interesting to see how GS stock price changes and where GS stock will sit in the coming weeks.

[Read More] Are These 2 Top Retail Stocks Set To Rebound Post COVID-19?

Top Financial Stock To Buy [or Sell] During The COVID-19 Pandemic: JPMorgan Chase & Co.

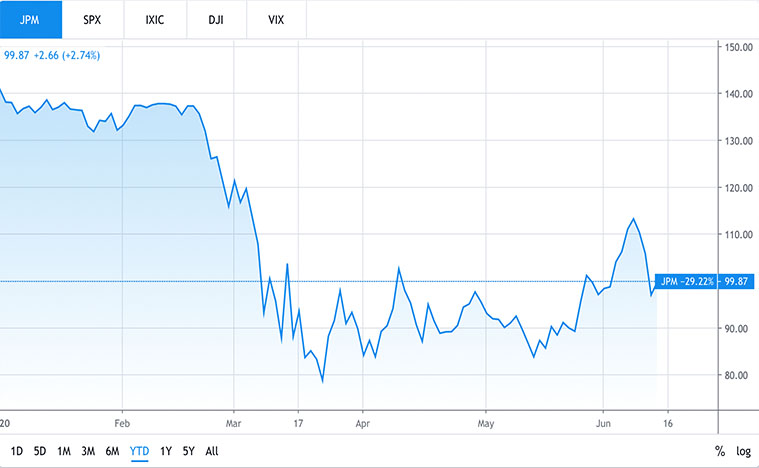

Another financial stock to watch is JPMorgan Chase & Co. (JPM stock report). By market capitalization, JPMorgan Chase is the most valuable bank in the world. JPMorgan Chase is an investment bank with a focus on all types of financial services, just like Goldman Sachs. JPM stock price is affected similarly like other financial stocks. JPMorgan Chase is another financial stock also largely affected by the ongoing pandemic.

Pre pandemic shares of JPM stock traded at a $135 average a share. On June 12th, JPM stock price was averaging at $99 a share. At some points JPM stock price dropped below $80 in March 2020. Financial stocks have been falling due to a statement released from the Federal Reserve Chairman Jerome Powell on June 11th. He stated, “We’re not even thinking about thinking about raising (interest) rates.” This caused a selloff in the market, with companies like JPM stock.

JPM stock price was affected by this, but not largely. On the trading day of June 12th, JPM stock is starting to rise once again. Financial stocks are going to continue to be in a volatile spot until an economic recovery happens. This will hold true to GS stock as well since both banks are in the financial sector. The volatility and potential for good news in the financial sector make JPM stock and GS stock potential financial stocks to watch.