Energy Is Changing Quickly, And These Solar Stocks Are Poised To Benefit In The Long Term

The energy industry has gone through massive change over the past decade. Due to environmental reasons, coal has become less important and oil has become less profitable than it was decades ago. Oil prices may be in the dumps, but solar stocks are still posting gains. That may sound surprising. If oil is cheap, why bother with solar? But we have got to think for the long term. Solar stocks are a big deal in 2020. Climate change is adding new urgency to the effort to move to green power. That’s great news for alternative energy stocks. And if you are looking to cruise along with the accelerating shift to renewable energy, now may be a good time to take a closer look at solar stocks.

Solar energy has come a long way in a decade. Back in 2010, the global market was small and highly dependent on government subsidies. This year, there will be more than 115 gigawatts (GW) of solar power installed across the world. That alone is more than all other generation technologies put together. Despite the huge adoption, many companies, if not all, are still struggling to achieve profitability. The two biggest players in the residential solar market in the US agreed to merge late Monday. The merger between the two could bring the industry to profitability. As solar energy becomes even cheaper to obtain as technology improves, there’s a greater chance for solar companies to be profitable. With all that in mind, would investing in solar stocks be profitable in the longer term? Let’s find out.

Read More

- Should You Invest In Logistics Stocks?

- Top 5 Things To Know In The Stock Market This Week

- Is Nikola The Next Tesla, Or Better?

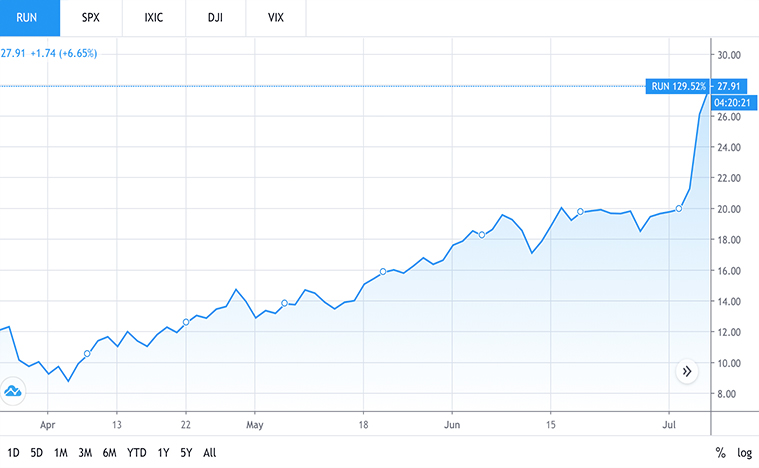

Top Solar Stocks To Buy [Or Sell]: Sunrun Inc.

Tesla’s (TSLA Stock Report) acquisition of SolarCity in 2014 turned the electric vehicle (EV) manufacturer into the undisputed largest player in residential solar. But that’s about to change as Sunrun (RUN Stock Report) came roaring with more aggressive plans. The company will be merging with the residential solar installation company Vivint Solar (VSLR Stock Report) to create the biggest solar player in the market. Through this merger, the combined entity aims to scale up its business and improve cost efficiency in the space. Following the announcement, shares of Sunrun and Vivint Solar were up 23% and 38% respectively.

The combined companies will save roughly $90 million per year thanks to operational efficiencies. And the economies of scale will give the companies even more leverage when they contract with utilities on feeding power into the electric grid. The deal looks set to close in the fourth quarter, pending shareholder and regulatory approval. If this deal goes through as planned, the largest home solar and energy services provider would be in a good position to play a leading role in the industry’s long term expansion.

[Read More] Are Investors Hungry For These 2 Restaurant Stocks?

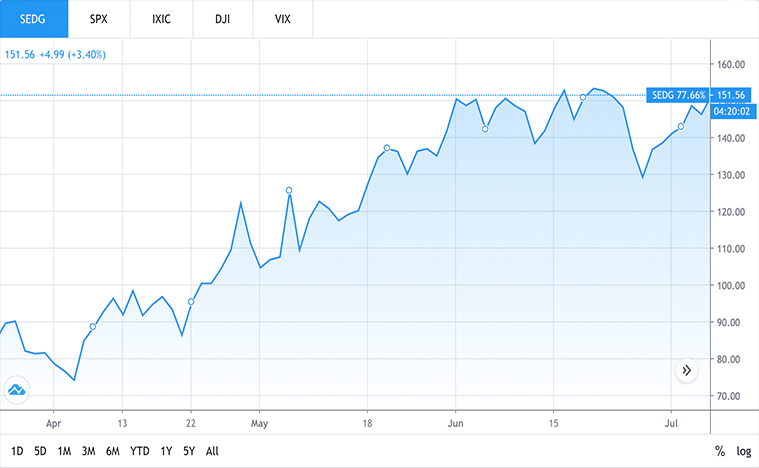

Top Solar Stocks To Buy [Or Sell]: SolarEdge Technologies

Another company that stands to benefit from the rise of solar energy is SolarEdge Technologies (SEDG Stock Report). The company designs and sells direct current optimized inverter systems for solar photovoltaic (PV) installations worldwide. It has deployed more than 1.3 million monitored solar systems in 130 countries.

The company started with power optimizers, which are add-on “smart” modules installed on solar panels to improve the efficiency of DC power delivered to an inverter. Power optimizers can also shut down solar panels as a safety feature. Earlier this year SEDG announced that it received certification from Japan Electrical Safety and Environment Technology Laboratory for its award-winning single phase inverter with HD-Wave technology.

Obviously, SolarEdge is a dominant player in the power optimizer market. The installation of its components in a typical solar panel gives it access to valuable data about the system’s efficiency and status. This shows us that the company not only can monetize their power optimizer products but also have another stream of revenue from monitoring solutions. In the past year, SEDG stock has gone up 134%, and it is 43% higher year to date.

[Read More] Are These The Best EV Stocks To Watch For July 2020?

Bottom Line

Climate change is making renewable energy sources more important than ever before. That said, solar power is one of the most promising technologies in this regard. The market for solar energy is going to be huge in the long run. That’s because despite years of growth, residential solar only represents about 3% of the electricity generated in the US. In my opinion, the solar energy space is akin to a technology company in its nascent stage, with tremendous room for growth. Given that solar is not terribly difficult to install, not to mention modular, it should mean that solar installations could enjoy strong growth in this coming decade. For this reason, solar stocks are well positioned to benefit from the shift to alternative energy space.