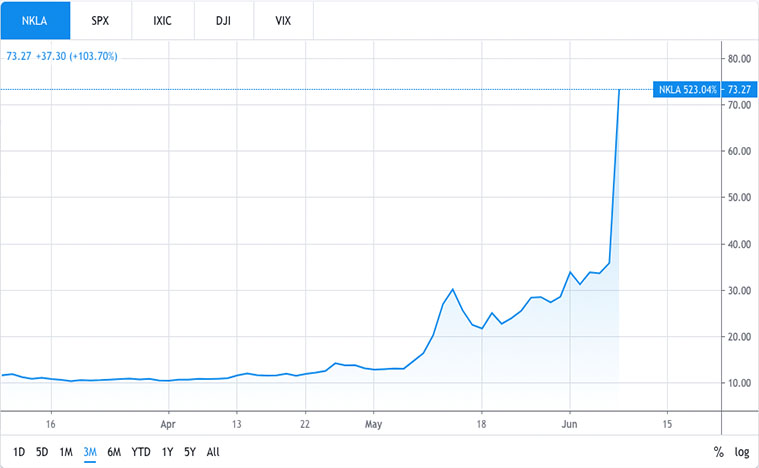

Is Nikola Stock Still A Buy After The Hot Rally?

Nikola Corporation (NKLA Stock Report), the maker of hydrogen and battery-powered semis skyrocketed as much as 104% on Monday. Yes, you heard that right. The truck maker’s stock more than doubled on Monday, gaining $37.3 a share. This came after the company set a June 29 reservation date for its new electric truck, the Badger. Some analysts said Nikola wants to be the Tesla (TSLA Stock Report) of Trucking. The company plans to disrupt the pickup trucks just like how Tesla has been upending the car business.

The company went public last week through a reverse merger with VectoIQ Acquisition (VTIQ Stock Report). Since announcing its planned reverse merger with VectoIQ on March 3, shares are up as much as 612%. Just to clear some confusion, if you were holding VTIQ shares as of last week, you are now holding NKLA stock.

Can Nikola Deliver in 2020?

Now, as everyone knows, the company said it will begin taking reservations for their new electric pickup truck, the Badger in late June. For investors and consumers alike, it’s reasonable to assume that the Badger is a product that the company is going to present to us in the near future. What we didn’t know is that it is a ‘soon to be’ product only waiting to be manufactured. This is an exciting development that somehow managed to stay under the radar.

And now it is taking investors by storm. The Badger will have both a battery pack and a hydrogen fuel cell, which together will allow the truck to go up to a range of 600 miles. The truck will draw its energy like the existing hybrid model we have, drawing power from both the hydrogen fuel cell and the battery pack, or from the batteries alone.

All these while, Nikola has focused on a series of all-electric Class 8 (tractor-trailer) trucks that have gained some considerable interests from the trucking industry as well as investors. One reason that draws investors’ attention is the powertrain that powers the truck. For consumers, there will be a choice between a proprietary high-energy density battery or hydrogen fuel cells.

Read More

What Does The Future Hold For Nikola?

Nikola expects to begin construction of a factory in Arizona soon and to have the battery-powered trucks in production by the end of 2021. More importantly, the company claimed it has over 14,000 pre-order bookings for the trucks. This is a huge deal for the company as it represents more than $10 billion in potential sales for Nikola Corporation, making it one of the best automotive stocks to buy right now.

Like Tesla, Nikola must also raise a significant amount of money to fund operations and capital expenses from investors willing to stomach years of losses. It worked for Tesla. Just look at the prices of TSLA stock today. The company has never earned an annual profit, its growth rate is slowing and the novel coronavirus has pushed the global economy into deep recession. Yet, Tesla investors remain so optimistic and TSLA stock is trading above $900 now.

But the question here is, can NKLA stock reach the achievement of its rival? If you are an investor in NKLA stock, you would certainly be hoping for a similar outcome. As for now, Nikola has yet to sell a single truck. Even though Nikola claims “orders” for 14,000 semi trucks, the filings make clear that those are more like expressions of interests. They are cancelable, and no deposit is required. Oh, bummer.

Nikola Stock To Be Volatile In The Near Term

There is going to be a lot of interest in NKLA stock. It seems to me like it is going to be a hot topic among the investing community, where investors and consumers will treat it as a potential complement to Tesla. However, there is going to be a mixed response from investors.

As investors, it is in our nature to question the viability of a new business or idea. But we also need to remember that there will always be skeptics around when there’s a new technology. Look at Tesla. First, people wondered if there is actually a market for electric vehicles. They questioned the battery technology. They expressed reservations about the capital expenditure needed to build a network of charging stations. And what about the economics of manufacturing mass-market electric cars?

Final Thoughts Before Buying Nikola Stock

Weaning the trucks off diesel and on to clean renewable energy is a noble initiative. The proposed hydrogen fuel cell electric vehicle (FCEV) business seems to be revolutionary. But the company has yet to prove the cost-effectiveness of its truck leasing plans.

On the other hand, at least, the Badger is a promising product. Granted, it may not steal significant market shares from conventional pickup truck giants just yet. But it may prove to be a strong competitor to Tesla’s much-hyped Cybertruck. The reality is, trucks eventually need a solution that does not emit diesel fumes. As such, can we expect Nikola Corporation to be the panacea to these problems?