Are These The Best Biotech Stocks To Watch This Week?

Finding the best biotech stocks to buy can be tricky as volatility often haunts the space. Clinical plans don’t always come to fruition even though they might show highly promising results in the beginning. But when they do, investors are sure to reap great benefits from the huge upside.

The top biotech stocks to watch are usually those that have a strong streak of earnings growth. In other words, invest in those biotech stocks that are currently profitable. That way, there’s only upside moving forward since these biotech stocks are also excellent dividend stocks if they have a strong pipeline of drugs under their belt. Well, some more risk-averse investors would prefer to invest in large-cap biotech stocks. But what if you are just looking for a quick flip?

Then we might want to take a closer look at smaller cap biotech stocks. As you may or may not know, these biotech stocks are the ultimate risk-reward play for day traders. They are also famous for their notorious breakouts overnight. If you could stomach a higher risk when the stock moves both ways on an epic scale, then the smaller cap biotech stocks are for you. Either way, with strong research and due diligence, both small and large-cap biotech stocks could prove to be very rewarding. With all that in mind, there are a few biotech companies making big moves this week on positive news regarding their clinical trials. Are these biotech stocks on your watchlist?

Read More

- 2 Top Coronavirus Stocks To Buy Amid Latest Vaccine Deals?

- 2 Top Tech Stocks To Buy In July 2020

- Is Nikola The Next Tesla, Or Better?

Top Biotech Stocks To Buy [Or Sell]: Pfizer Inc.

Pfizer (PFE Stock Report) and partner BioNTech’s (BNTX Stock Report) experimental coronavirus vaccines received ‘fast track’ designation from the Food & Drug Administration, speeding up the regulatory review process. From the announcement, both stocks jump 4% and 11% respectively. This highly positive news also sent spillover effects to other coronavirus stocks in the stock market.

The main attraction of investing in Pfizer is the cash flow and getting that four and a half percent dividend yield. The healthcare company was lacking some recipes to spice things up. That was until Pfizer grabbed headlines again with its work on mRNA against the virus that caused Covid-19. Pfizer and BioNTech expect to launch a phase 2b/3 vaccine trial later this month, enrolling up to 30,000 subjects. Shall the study be successful, it could lead to approval of the vaccine. The companies said they expect to manufacture up to 100 million doses by the end of this year and more than 1.2 billion doses by the end of 2021.

[Read More] Netflix Stock In Focus This Week Upon Earnings Announcement

Top Biotech Stocks To Buy [Or Sell]: Equillium Inc.

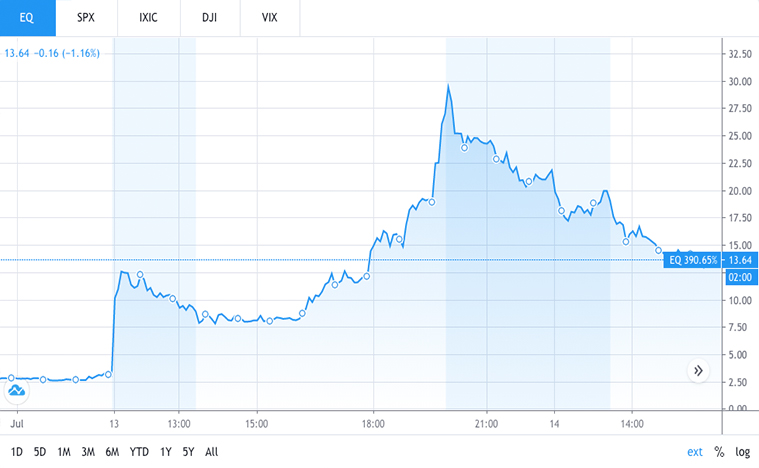

Shares of Equillium Inc. (EQ Stock Report) exploded more than 731% on Monday. This is a classic example of a massive breakout demonstrated by smaller-cap biotech stocks. This came after the company announced that a clinical trial conducted in India by its partner Biocon demonstrated that the drug candidate significantly reduced mortality in patients hospitalized with Covid-19. Prior to the announcement, EQ stocks barely traded in the market.

Everything seemed normal going into the weekend with 48k shares changing hands per day. But by the end of Monday, EQ stock had jumped to $26.5 per share during the closing bell with more than 90 million shares traded. Yes, an 731% move in one single day.

[Read More] Top 2 Battery Stocks That Could Be Making Big Moves In 2020

Top Biotech Stocks To Buy [Or Sell]: Moderna Inc.

Shares of Moderna (MRNA Stock Report) climbed higher on Monday. This came after bullish analyst coverage and news that the biotech company would be added to the Nasdaq-100 index. As of Monday’s closing bell, MRNA stock was up more than 14%. This came after Jefferies analyst Michael Yee said the experimental Covid-19 vaccine could produce annual sales of more than $5 billion, should it prove both safe and effective.

Of course, being added to a stock index has no material impact on the fundamental value of the business. But funds that track the Nasdaq-100 will soon need to purchase shares of Moderna. Investors know this, and typically they tend to purchase MRNA stocks ahead of the large purchases. This could be the reason for more shares to change hands during the bullish rally on Monday. Perhaps more interesting is the analyst’s assertion that Moderna will receive “at least” an emergency use authorization for its vaccine candidate by early 2021. “We think billions in sales would be reasonable and there would be high demand over the first one to two years.” Would this be a good enough reason to draw investors’ attention to MRNA stock?