The defense sector is a crucial part of the global economy. In detail, it refers to companies that engage in activities related to national security and military operations. Think of it like this: it’s the group of companies that makes all the tools and technologies a country’s military might need. This includes a wide range of products and services, such as military aircraft, ships, tanks, weapons, and even cybersecurity systems.

Investing in defense stocks can be similar to placing your bet on a sports team that always has a game scheduled. This is because there is a constant demand for defense products and services. Governments usually have budgets set aside for defense spending, meaning that these companies often have a steady stream of income. But remember, the performance of these stocks can be influenced by geopolitical events, changes in government budgets, and advancements in technology.

Like in any other sector, investing in defense stocks comes with its own set of challenges and opportunities. It requires understanding the market dynamics, being aware of political situations, and closely watching government spending trends. But given the consistent demand and the sector’s resilience during economic downturns, these stocks can be a part of a well-diversified investment portfolio. With this in mind, here are three defense stocks to check out in the stock market today.

Defense Stocks To Buy [Or Avoid] Now

- Lockheed Martin Corporation (NYSE: LMT)

- Northrop Grumman Corporation (NYSE: NOC)

- Raytheon Technologies Corporation (NYSE: RTX)

Lockheed Martin

To start, Lockheed Martin (LMT) is a global security and aerospace company. The company focuses on the research, design, development, manufacture, integration, and sustainment of advanced technology systems, products, and services.

In late April, Lockheed Martin announced its second quarter of 2023 dividend. Diving in, the company reported that its Board of Directors have approved a Q2 2023 dividend of $3.00 per share. Moreover, the dividend is payable on June 23, 2023, to shareholders of record on June 1, 2023. As a result, LMT currently has an annual dividend yield of 2.68%.

Meanwhile, during Tuesday morning’s trading session, shares of LMT stock are trading modestly lower off the open by 0.20% at $447.57 per share.

[Read More] Top Stocks To Buy Now? 3 Tech Stocks To Know

Northrop Grumman

Second, Northrop Grumman (NOC) is a global security company. Specifically, providing innovative systems, products, and solutions in autonomous systems, cyber, C4ISR, space, strike, and logistics.

Meanwhile, earlier this month, Northrop Grumman announced its most recent quarterly dividend. In the press release, the company reported that it has declared a quarterly dividend of $1.87 per share on common stock. This dividend is payable on June 14, 2023, to shareholders of record on May 30, 2023. This dividend represents an 8% increase, signifying the company’s 20th straight year of annual increases.

Moving along, on Tuesday morning, shares of NOC opened higher by 0.37% so far, trading at $439.92 a share.

[Read More] 3 Cyclical Stocks To Watch In May 2023

Raytheon Technologies

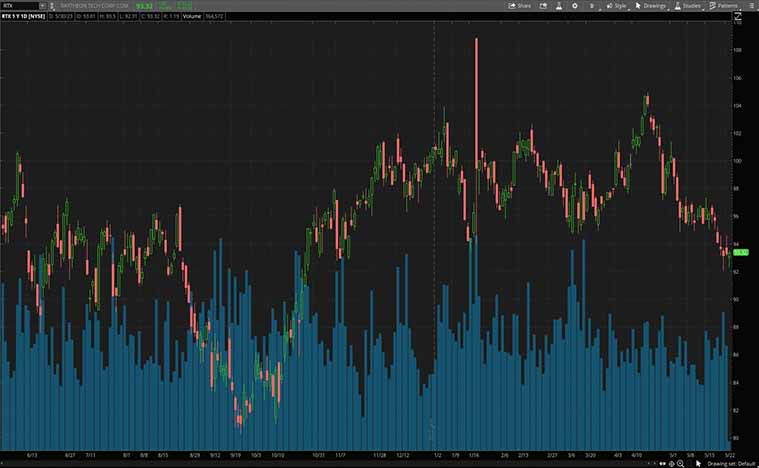

Finally, Raytheon Technologies (RTX) is a defense company that specializes in defense, civil government, and cybersecurity solutions. It’s known for its missile defense systems and military sensors.

Today, Tuesday, Raytheon Technologies announced when it will host its 2023 Investor Meeting. In detail, the company said it will host its annual investor meeting on June 18, 2023. On the call, key executives from RTX will talk about the company’s long-term outlook and growth strategy.

Moreover, on Tuesday morning, RTX stock is trading slightly lower by 0.33% at $92.98 per share.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!