The defense industry is a critical sector of the economy. Mainly because it produces goods and services primarily for military and national security purposes. The industry encompasses a wide range of products and services. This includes military aircraft, missiles, ships, ground vehicles, and electronic systems, among others. Given the importance of national security, the demand for defense products and services is expected to remain steady. This makes it a relatively stable sector for investors looking for long-term growth opportunities.

Defense stocks are companies that operate in the defense industry and manufacture defense-related products or provide related services to the government or military. These stocks are often viewed as a safe haven for investors. This is due to the steady demand for defense products and services, which is largely driven by government spending.

Additionally, the contracts for defense products and services are typically long-term and offer a high degree of visibility. As a result, this can provide investors with potential stability in their returns. However, the defense industry is also heavily regulated and subject to changes in government policies. Which can impact the demand for products and services and the profitability of defense companies. That being noted, here are three defense stocks to watch in the stock market today.

Defense Stocks To Buy [Or Avoid] Today

- The Boeing Company (NYSE: BA)

- Lockheed Martin Corporation (NYSE: LMT)

- Raytheon Technologies Corporation (NYSE: RTX)

The Boeing Company (BA Stock)

First, The Boeing Company (BA) is a multinational aerospace company that designs, manufactures, and sells commercial airplanes, military aircraft, and space equipment. Additionally, the company’s diverse portfolio includes products and services related to commercial airlines, military aircraft, and space technology.

At the beginning of the month, Boeing reported the date and time it will release its first quarter 2023 financial results. Specifically, the company is set to announce its 1st quarter 2023 results on Wednesday, April 26, 2023. To briefly recap, in Q4 2022, BA announced a loss of $1.75 per share and revenue of $20.0 billion.

Over the last month, Boeing stock has gained by 1.92%. Meanwhile, during Monday’s mid-morning trading session, shares of BA stock are trading higher on the day by 1.53% at $204.90 a share.

[Read More] Top Stocks To Buy Now? 2 Dividend Stocks To Watch

Lockheed Martin (LMT Stock)

Next, Lockheed Martin Corporation (LMT) is a global security and aerospace company that specializes in the design, manufacture, and sale of advanced technology systems, products, and services. The company operates in four business segments: Aeronautics, Missiles and Fire Control, Rotary, Mission Systems, and Space.

Last week, Lockheed Martin announced it will webcast its first quarter 2023 earnings results conference call on Tuesday, April 18, 2023, at 11 a.m. ET. During the call, James Taiclet, chairman, president, and CEO; Jay Malave, CFO; and Maria Ricciardone Lee, VP of investor relations, will discuss first quarter 2023 results, provide updates on key topics, and answer questions. First quarter 2023 results will be published prior to the market opening on April 18.

In the last month of trading, shares of LMT stock have advanced by 5.47%. While, during Monday morning’s trading session, LMT stock is trading slightly higher by 0.69% at $491.34 a share.

[Read More] Best Bank Stocks To Buy Now? 3 For Your Watchlist

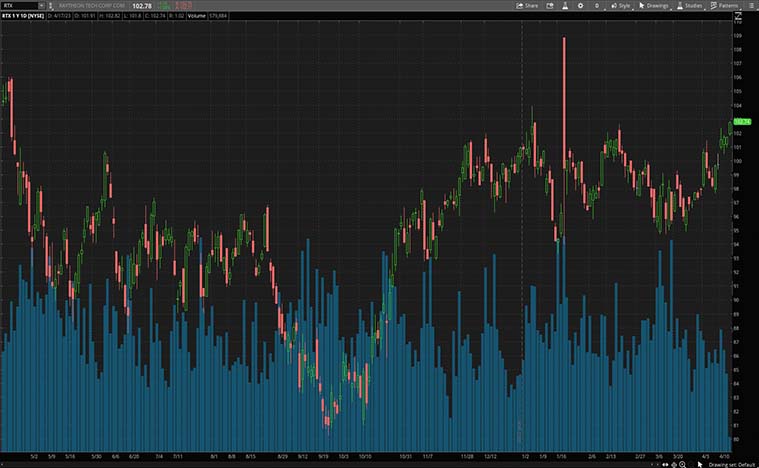

Raytheon Technologies (RTX Stock)

Finally, Raytheon Technologies Corporation (RTX) is a leading aerospace and defense company that specializes in developing advanced technology solutions for commercial, defense, and government customers worldwide.

Last week, Raytheon announced that its subsidiary Blue Canyon Technologies, which is a subsidiary of Raytheon Technologies, has been awarded a contract to design and produce three microsatellites for NASA’s Investigation of Convective Updrafts (INCUS) mission. The INCUS project, led by NASA’s Jet Propulsion Laboratory, aims to improve the understanding of the intricate dynamics of thunderstorms and their impact on Earth’s climate and weather models.

Looking at the last month of trading activity, shares of RTX stock have increased by 7.32%. Moreover, on Monday, RTX stock is trading higher on the day so far by 1.08% at $102.80 a share.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!