3 Top Enterprise Software Stocks To Watch After Salesforce Earnings Topped Estimates

Love it or hate it, the enterprise software industry continues to grow by the day. Right now, one of the biggest factors that could have an impact on the stock market is Covid. With cases rising in the U.S. and globally, many investors are looking for stocks to invest in that could continue to thrive under this environment. Correspondingly, with the current shift towards digital workspaces, it’s inevitable that enterprise software stocks are gaining traction in the stock market today.

These stocks are also in focus today as Salesforce.com (NYSE: CRM) reported stellar second-quarter earnings and forward guidance that topped Wall Street’s estimates. Following the strategic acquisition of Slack Technologies, the company remains confident that it would improve its operating margin and is on the path to generating significant returns to its shareholders. Meanwhile, Microsoft (NASDAQ: MSFT) announced on Wednesday that it will invest $20 billion over the next 5 years in cybersecurity. This will hopefully help in reducing cyberattacks in an increasingly digitized world.

Of course, there are no guarantees when it comes to investing in the stock market. However, with the growth of enterprise software we are seeing today, it is almost a sure bet one can make for the upcoming decade. One only needs to look at the rapid adoption of cloud-based services among enterprises today. With a lot of business activities being carried out remotely now, I can understand if investors are keen to jump on this bandwagon. Should you be one of them, here are three enterprise software to consider in the stock market today.

Best Enterprise Software Stocks To Buy [Or Avoid] In The Stock Market Today

- Snowflake Inc. (NYSE: SNOW)

- Amazon.com Inc. (NASDAQ: AMZN)

- Splunk Inc. (NASDAQ: SPLK)

Snowflake

Snowflake is a cloud-based data-warehousing company that is based in California. The company was one of the most exciting IPOs in recent years. Since peaking at $429 per share towards the end of last year, the stock has given back most of its gains since its public debut. For investors who have been waiting for the company to trade at a reasonable valuation, could now be a good time to look at SNOW stock?

If you are unfamiliar with its business, Snowflake’s platform enables customers to consolidate data into a single source to drive business insights and build data-driven applications. Today, thousands of customers around the world mobilize their data with Snowflake’s cloud data platform. Customers flock to Snowflake as users can securely share data inside and outside of their organizations easily.

From its quarterly report announced yesterday, revenue came in 104% higher year-over-year to $272.2 million. The company now has 4,990 total customers and 116 customers with trailing 12-month product revenue greater than $1 million. What’s more, it also raised full-year product revenue guidance to between $1.06 billion and $1.07 billion. That would represent year-over-year growth of 91% to 93%. With the company on track to see further growth, is SNOW stock a top enterprise software stock to invest in now that it is trading at a more reasonable valuation than where it was earlier this year?

Read More

- 4 Artificial Intelligence Stocks To Watch Right Now

- Best Lithium Battery Stocks To Buy Now? 4 To Know

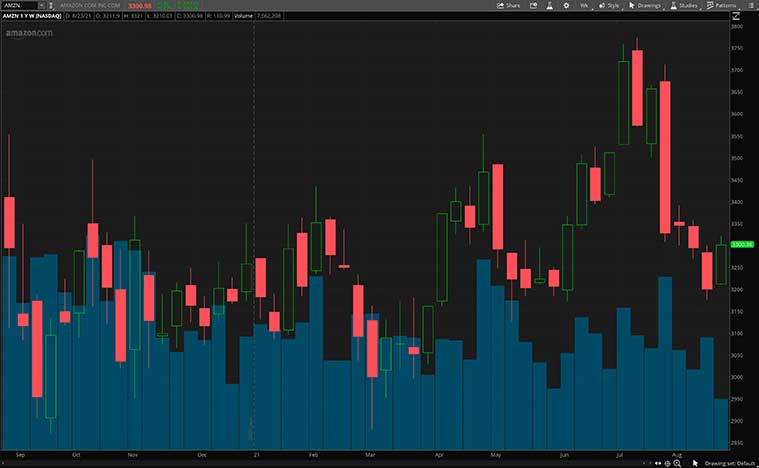

Amazon.com

Amazon is a growth company that has one of the largest online marketplaces in the world. The company also has a cloud computing and artificial intelligence business. While Amazon is mostly known as the top e-commerce marketplace in the world, its cloud computing segment is actually the segment that generates a higher profit margin. The company had a multi-year head-start with its Amazon Web Services (AWS). And now, it is the world’s largest and most comprehensive cloud infrastructure platform.

According to Barron’s writers, Eric Savitz and Max Cherney, Amazon’s current market capitalization could arguably be justified by the value of AWS alone. They argue that growth at AWS is accelerating, and revenue from the segment could hit an annualized $100 billion by 2023. Despite posting a third $100 billion quarter in a row, Amazon said it expects growth would decelerate from pandemic highs. The guidance echoes similar warnings from Facebook (NASDAQ: FB) and Apple (NASDAQ: AAPL).

In Amazon’s second quarter, revenue came in 27% higher year-over-year to $113.08 billion. However, its revenue from the AWS unit came in 37% higher, faster than 32% growth in the previous quarter. Amazon said its operating profit in the third quarter will be in a broad range of $2.5 billion and $6 billion. Despite its size, AMZN stock could still be a stock that has a lot to offer in the long run.

[Read More] 4 Robotics Stocks To Watch Amid Rising Shifts To Automation

Splunk

Splunk is another software company focusing on big-data analytics. In brief, the company produces software for searching, monitoring, and analyzing machine-generated big data. Splunk does all this via its Data-to-Everything platform. For the most part, the company helps organizations gain actionable insights from their data regardless of scale. In the age of information, this would serve as a vital service for businesses looking to refine their business strategies. Accordingly, this would position Splunk to continue benefiting from the pandemic-fueled exposure it gained over the past year. Seeing as Splunk posted stellar figures in its quarterly report after yesterday’s closing bell, investors could be watching SPLK stock.

Diving right into it, the company posted revenue of $606 million, ahead of the range of $550 million to $570 million it had predicted. Also, Splunk said annual recurring revenue (ARR) was $2.63 billion, up 37%. That was also slightly above the $2.59 billion to $2.61 billion it had forecast. CEO Doug Merritt added, “Our second quarter execution was broad-based with each of our major geographic regions exceeding our own expectations as more and more customers around the world rely on Splunk and our market-leading data platform and cloud-based capabilities.”

Besides, Splunk recently attracted Silver Lake to invest $1 billion in Splunk, in the form of convertible notes. It goes without saying the private equity firm hopes to make a big return on its investment. Therefore, some would see the investment as a vote of confidence in Splunk stock. Considering all these, will you be keeping SPLK stock in your sights?