Are These The Top Entertainment Stocks To Buy Now?

When it comes to answering the question of what stocks to buy today investors may want to consider entertainment stocks. For the most part, the stock market now is going through some uncertain times. On one hand, the economy continues to show signs of a recovery with weekly jobless claims hitting a pandemic-era low. On the other hand, coronavirus daily cases and deaths are creeping closer towards January 2021 levels. Regardless of which way you see things going, some would argue that entertainment stocks remain viable bets.

To elaborate, the entertainment industry continues to cater to the needs of the general public across the board. For instance, companies like Dave & Busters (NASDAQ: PLAY) that offer in-person entertainment continue to gain in the stock market now. Thanks to a rise in fully vaccinated consumers nationwide, the restaurant-video arcade operator posted record figures in its latest fiscal quarter report earlier today. In detail, the company reported quarterly earnings per share of $1.07, crushing Wall Streets’ estimates of $0.58. As a result, PLAY stock is currently up by over 10% as of today’s opening bell.

Alternatively, we could also take a look at stay-at-home entertainment names such as Spotify (NYSE: SPOT). As of yesterday, the company is now rolling out a new feature for its premium users, Enhance. In short, Enhance allows users to easily add personalized recommendations to their music playlists. This essentially creates a curated listening experience for users, all with one push of a button. Not to mention, analysts over at KeyBanc recently hit SPOT stock with an Overweight rating and a price target of $340. All in all, would you say now is a good time to keep an eye on these top entertainment stocks?

Best Entertainment Stocks To Buy [Or Sell] This Month

- Walt Disney Company (NYSE: DIS)

- FuboTV Inc. (NYSE: FUBO)

- Roblox Corporation (NYSE: RBLX)

Walt Disney Company

First, on this list, we have Disney, a leading diversified international family entertainment and media enterprise company that includes Disney Parks, Experience and Products; Disney Media & Entertainment Distribution. It also owns some of the most prominent film production companies like Pixar, Marvel Studios, and Lucasfilm. The company produces high-quality cinematic storytelling for both theatrical and streaming releases and has certainly captured millions of audiences around the world. DIS stock currently trades at $185.97 as of 1:38 p.m. ET and is up by over 35% in the past year alone.

On August 12, 2021, the company reported its third-quarter earnings for fiscal 2021. Firstly, revenue for the quarter was $17.02 billion, a 45% increase year-over-year. Its direct-to-consumer business is performing very well, with a total of nearly 174 million subscriptions across Disney+, ESPN+, and Hulu, and has a host of new content coming to its platforms. Secondly, the company posted diluted earnings per share of $0.50 compared to a loss of $2.61 in the prior-year quarter.

Recently, the company had just launched its Star+ streaming service in Latin America. Star+ is Disney’s stand-alone streaming service and the company hopes to reach 300 million to 350 million streaming subscribers by 2024. Disney had gained control of Star as a result of its $71.3 billion acquisition of most of 21st Century Fox. Given this exciting piece of news, will you consider DIS stock a top entertainment stock to buy right now?

Read More

FuboTV Inc.

FuboTV is a sports-first TV streaming service that provides premium content, integrated wagering, and interactivity. Through its proprietary data and technology platform, the company encourages its viewers to become active participants in a new category of interactive television. FUBO stock currently trades at $30.35 as of 1:38 p.m. ET and is up by over 200% in the past year alone.

On Thursday, VIZIO (NYSE: VZIO) announced that Fubo’s platform will now be available on VIZIO SmartCast. With a subscription to Fubo, SmartCast users can enjoy more than 100 channels streaming tens of thousands of live sporting events annually. They will also be able to enjoy leading news and entertainment content. “94% of fuboTV subscribers enjoy watching their favorite sports, news, and entertainment on the big screen,” said Len Landi, Senior Vice President, Business Development, fuboTV. “With today’s launch on VIZIO SmartCast TVs, we’re bringing fuboTV’s premium viewing experience to VIZIO SmartCast, one of the most popular smart TV platforms on the market. It’s a perfect marriage as we gear up for the fall sports season.”

Last month, it reported that it had delivered record revenue of $130.9 million in its second quarter. It also ended the quarter with 681,721 total subscribers, including over 90,000 net subscriber additions in this quarter. Engagement also reached an all-time high with Fubo customers streaming 245 million hours of content during the quarter, increasing by 148% year-over-year. With these impressive financials, will you consider investing in FUBO stock?

[Read More] 4 Artificial Intelligence Stocks To Watch Right Now

Roblox Corporation

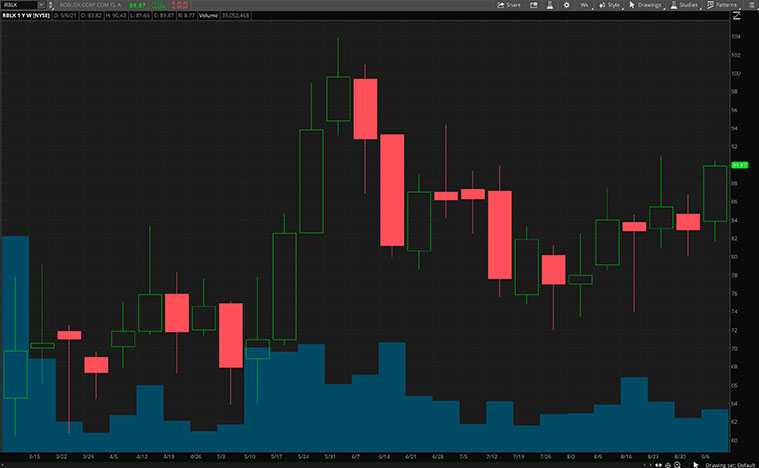

Last but not least, we have Roblox, an online game platform and game creation system. It is a global platform that brings millions of people together as they explore immersive 3D experiences that are in turn built by a global community of developers. It boasts over 2 million developers who produce their own immersive multiplayer experiences each month using the company’s Roblox Studio, an intuitive desktop design tool. Today, RBLX stock trades at $89.88 as of 1:39 p.m. ET. and is up by over 20% year-to-date.

While all that is great, the company does not seem to be slowing down on the operational front anytime soon. As of last week, the company is currently partnering up with skate apparel brand, Vans. Through this partnership, Roblox players now have access to “Vans World”, a novel skatepark experience in-game. Overall, this is a win-win situation for both Roblox and Vans. While Vans gets exposure, Roblox can offer its players a much more robust experience all around.

On top of that, Roblox continues to perform on the financial front as well. In its second-quarter report, the company posted solid figures. Namely, it raked in total revenue of $454.1 million for the quarter, marking a major 127% year-over-year leap. Additionally, Roblox also saw its average daily active users grow to a whopping 43.2 million throughout the quarter. This would indicate a sizable 29% year-over-year increase. As gamers increasingly turn to Roblox amidst the current pandemic, will you be keeping an eye on RBLX stock?