Are These The Best Industrial Stocks To Buy In July?

Industrial stocks are once again in focus this week thanks to the recent infrastructure bill from the White House. For the most part, this would add to the overall tailwinds seen by the industrial sector in the stock market now. This would be the case with companies in the industrial space playing crucial roles in the current economic recovery. For the uninitiated, industrial stocks consist of companies that manufacture and distribute capital goods and provide related services. The likes of which are generally used in construction and manufacturing, highly relevant processes in Biden’s infrastructure plan.

Now, when it comes to the industrial sector, investors appear to be spoilt for choices. To begin with, we could look at the mining and metals industry. Companies such as Alcoa (NYSE: AA) and Vale (NYSE: VALE) provide the precious raw materials needed by most manufacturing operations today. In fact, Morgan Stanley (NYSE: MS) analyst Carlos De Alba recently hit AA stock with an Outperform rating, naming it a top pick. At the same time, industrial companies such as Boeing (NYSE: BA) in the aerospace area are also kicking into high gear. Earlier this week, the company received a massive 270 aircraft order from United Airlines (NASDAQ: UAL).

By and large, top industrial stocks are looking at major tailwinds across the board now. On one hand, there is the current trajectory of the economy, which the sector often follows closely. On the other hand, $579 billion worth of investments would serve to accelerate growth in the industrial market as well. All in all, I could see industrials being among the most active stocks in the stock market today. With that said, here are three names to know now.

Best Industrial Stocks To Buy [Or Sell] Today

- General Electric Company (NYSE: GE)

- Caterpillar Inc. (NYSE: CAT)

- Applied Materials Inc. (NASDAQ: AMAT)

General Electric Company

General Electric (GE) is a multinational industrial company that is headquartered in Boston. The company operates through many industries that are vital to economies all around the world. Notably, the company has been investing heavily in its renewable energy and healthcare segments. GE Renewable Energy is a $15.7 billion business that combines one of the broadest portfolios in the renewable energy industry to provide end-to-end solutions for its customers. GE stock currently trades at $13.44 as of 1:39 p.m. ET and has been up by over 25% year-to-date.

Today, the company announced that GE Renewable Energy has connected the last unit of the Wudongde (WDD) hydropower station to the grid for power generation. Under the contract that was signed in 2015, GE was responsible for the design, manufacturing, and commissioning of the 6 x 850 MW Francis turbines generator sets and related equipment for the WDD hydropower project. A single Francis turbine can generate enough power for approximately 1.8 million typical Chinese homes.

Not resting on its laurels, the company also announced today that GE Healthcare has a new partnership with the Ministry of Health of the Democratic Republic of Congo to deliver mobile X-ray units and ECG machines to help efforts to fight the pandemic. Last week, the company reported that GE Healthcare and Wayra have selected five health tech start-ups. The start-ups will focus on applying AI to augment medical imaging, improve oncology care, and improve the patient experience. Estimates suggest that over 400,000 European lives could be saved annually through the application of AI in healthcare. Given the excitement surrounding the company, is GE stock worth adding to your portfolio?

Read More

Caterpillar Inc.

Caterpillar is an industrial company that designs and sells machinery. In essence, the company is the world’s leading manufacturer of construction and mining equipment. It also manufactures diesel and natural gas engines, along with industrial gas turbines. CAT stock currently trades at $216.80 as of 1:40 p.m. ET and has been up by over 65% in the last year.

On June 9, 2021, the company’s board of directors voted to increase the quarterly cash dividend by 8% to $1.11 per share of common stock that will be payable on August 20, 2021. “Through the execution of our enterprise strategy for profitable growth, Caterpillar is generating higher free cash flow through the cycles,” said Caterpillar CEO Jim Umpleby. “Our strong balance sheet and liquidity position make it possible for us to continue our long history of increasing our dividend and returning value to shareholders.”

In late April, the company also recorded strong first-quarter 2021 financials. Diving in, sales and revenue increased by 12% year-over-year to $11.9 billion. This increase was due to higher sales volume driven by higher end-user demand and also from the impact of changes in dealer inventories. Its first-quarter earnings per share were $2.27 and it ended the quarter with $11.3 billion of enterprise cash on hand. With that in mind, is CAT stock worth buying right now?

[Read More] 4 Artificial Intelligence Stocks To Watch Right Now

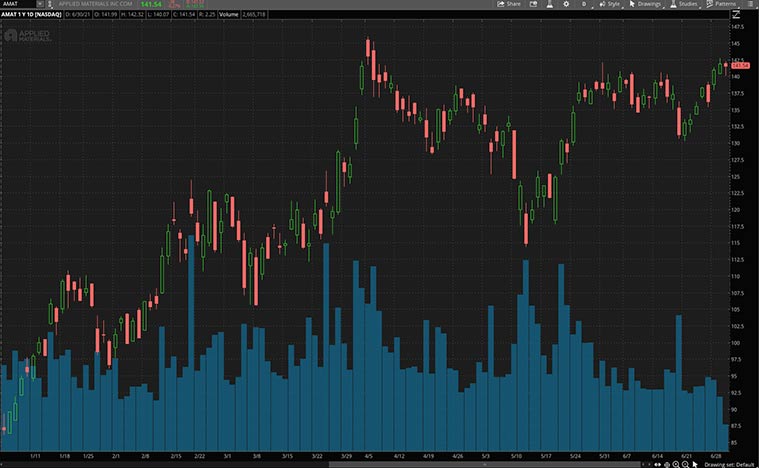

Applied Materials Inc.

Following that, we have Applied Materials Inc (AMAT). In brief, the California-based company is a leading name in terms of materials engineering solutions. Primarily, AMAT specializes in providing the necessary equipment, services, and software for the semiconductor manufacturing industry. Notably, the company achieves this via its expertise in modifying materials at atomic levels and on industrials scales. Given AMAT’s vital role in enabling the semiconductor industry, AMAT stock would be in the spotlight now. With the latest global chip shortage, manufacturers would be looking to ramp up production capacities. In theory, this could lead to AMAT seeing higher demand for its offerings.

Evidently, the company saw green across the board in its recent quarter fiscal posted in May. In it, AMAT raked in total revenue of $5.58 billion for the quarter, marking a sizable 41% year-over-year jump. On top of that, the company also saw solid year-over-year surges of 76% in net income and 74% in earnings per share. CEO Gary Dickerson cited broad-based strength across AMAT’s semiconductor business as a key factor for the company’s performance. According to Dickerson, AMAT is confident in its ability to outperform its markets thanks to existing secular trends.

On the operational front, the company continues to break new ground as well. Earlier this month, AMAT revealed a new way to engineer the wiring of advanced logic chips. The main highlight of this breakthrough is that AMAT can scale said chips to nodes as small as 3 nanometers. In terms of application, Senior VP Prabu Raja explained, “This unique, integrated solution is designed to accelerate the performance, power, and area-cost roadmaps of our customers.” With AMAT seemingly firing on all cylinders now, would you consider AMAT stock a top buy now?