Railroads have been a crucial part of transportation and logistics infrastructure for centuries. Connecting people and goods across vast distances, and playing a critical role in economic development. Today, railroads continue to play a vital role in the movement of goods and people. With that said, investing in railroad stocks can be an attractive option for investors seeking long-term, stable growth.

For the uninitiated, railroad stocks refer to shares of companies that own and operate railroads. This can include freight and passenger transportation services. As well as related businesses such as railway equipment manufacturing and maintenance. Railroad companies are often regarded as blue-chip stocks due to their long histories, high barriers to entry, and established market positions.

Investing in railroad stocks can provide investors with a variety of benefits. Additionally, railroad companies have a reputation for being resilient in economic downturns. This comes as they are often able to adapt to changing market conditions. Also, they are typically less affected by disruptions in global trade compared to other industries. However, it is important to note that investing in railroad stocks also carries risks. Such as exposure to volatile energy markets and regulatory risks. All in all, here are three railroad stocks to watch in the stock market now.

Railroad Stocks To Buy [Or Avoid] Now

- CSX Corporation (NASDAQ: CSX)

- Union Pacific Corporation (NYSE: UNP)

- Trinity Industries Inc. (NYSE: TRN)

CSX Corporation (CSX Stock)

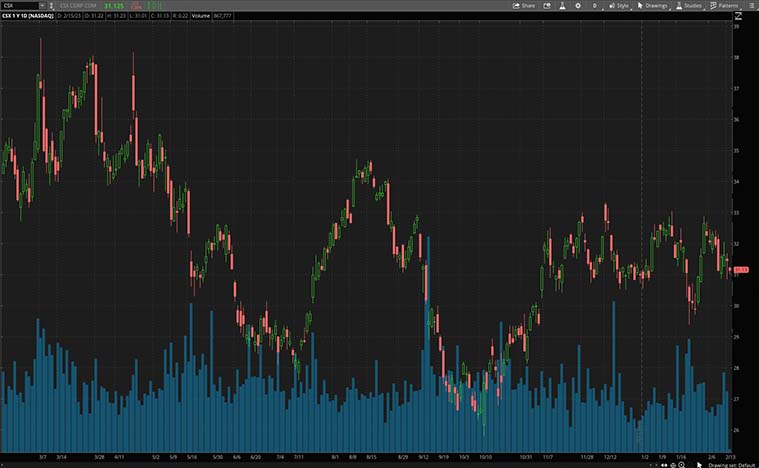

First up, CSX Corporation (CSX) is a freight transportation company that operates a network of railroads, intermodal terminals, and other transportation infrastructure in the eastern United States. CSX’s operations are primarily focused on transporting coal, chemicals, and intermodal freight.

Just today, Wednesday, CSX Corporation announced an increase in its quarterly dividend. In detail, the company’s Board of Directors has declared an increase in its quarterly dividend by 10% from $0.10 to $0.11 per share. The new dividend amount will be payable on March 15, 2023, to shareholders who hold the stock on record at the close of business on February 28, 2023. This results in an annual dividend yield of 1.28%.

So far year-to-date, shares of CSX stock have increased slightly by 1.23%. Meanwhile, on Wednesday morning, CSX stock fell off the open by 0.52% and is currently trading at $31.28 a share.

Union Pacific Corporation (UNP Stock)

Second, Union Pacific Corporation (UNP) is one of the largest freight transportation companies in North America. The company operates a network of railroads that spans the western United States. Union Pacific’s operations focus on transporting a range of goods, including agricultural products, chemicals, and energy products.

This month, Union Pacific Corporation has declared a quarterly dividend of $1.30 per share on its common stock. The dividend will be payable on March 31, 2023, to shareholders of record as of February 28, 2023. Union Pacific has a long history of providing dividends to its shareholders, having paid them for 124 consecutive years. Currently, UNP offers its shareholders an annual dividend yield of 2.59%.

Moving along, shares of UNP stock have dropped by 3.27% so far year-to-date. Additionally, during Wednesday morning’s trading action, UNP stock is trading lower off the open by 1.63% at $200.67 a share.

[Read More] 3 Copper Mining Stocks To Watch In February 2023

Trinity Industries (TRN Stock)

Last but not least, Trinity Industries Inc. (TRN) is a diversified industrial company that operates in several different industries, including rail transportation, railcar leasing, and energy equipment manufacturing. Trinity’s rail transportation division produces railcars, railcar components, and other related products and services for customers in North America and other markets.

In January, Trinity Industries reported that it will be acquiring Holden America. In detail, Holden America is a manufacturer of multi-level vehicle securement and protection systems, gravity-outlet gates, and gate accessories for freight rail in North America. The acquisition includes an initial purchase price of $70 million with an additional minimum of $5 million per year for the next two years. This strategic acquisition strengthens Trinity’s position in the autoracks market, providing them with a market-leading bi-level chock system to complement their existing tri-level chock system.

Next, since the start of 2023, shares of TRN have dipped by 8.83% YTD. Meanwhile, on Wednesday morning, TRN stock is trading modestly lower off the open by 0.95% at $27.14 a share.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!