Ford (F) Stock Soars On New EV & Battery Plants

Despite optimism for a Biden infrastructure bill to boost clean energy, many electric vehicle (EV) stocks have seen their stock prices struggle as of late. Unlike last year, investing in the EV industry in the stock market today can often be a challenging task. Gone were the days when an investment in any EV stocks could give a boost to your portfolio. Admittedly, the EV space appears to be getting more crowded as days go by. Therefore, looking for the best EV stocks to buy requires more research and hard work.

With Ford Motors’ (NYSE: F) recent investment in three new battery plants and a pick-up factory, it’s not surprising why F stocks are surging right now. Together with SK Innovation, Ford is investing $11.4 billion in new U.S. facilities that will create nearly 11,000 jobs to produce EV and batteries. These initiatives are the latest of Ford’s efforts to increase the development and production of electric vehicles, including batteries. The new investments come on top of the $30 billion the company previously said would go to EVs through 2025.

Certainly, the climate crisis has helped to speed up the adoption of EVs globally. Nevertheless, governments around the world are aiming for more. And as a result, some investors are choosing to invest in high-quality EV companies that are poised to grow and put their plans into action. Of course, it depends greatly on your risk appetite and what your investing goals are. However, whichever type of investor you are, there may be some electric vehicle stocks that could be worth buying. So, with all of that in mind, let’s take a look at some of the top EV stocks that investors are watching in the stock market right now.

Top EV Stocks To Watch Right Now

- Lucid Group Inc. (NASDAQ: LCID)

- Fisker Inc. (NYSE: FSR)

- Nio Inc. (NYSE: NIO)

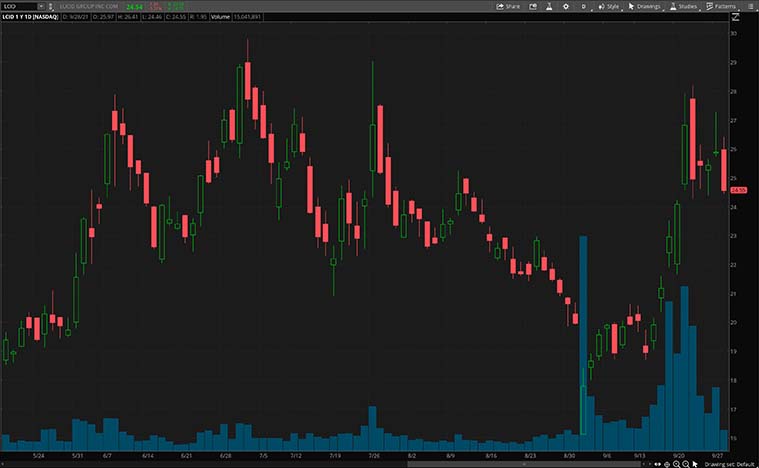

Lucid Group

A lot is brewing at Lucid Group even as rival Polestar plans to go public through a merger with a blank-check company. Just yesterday, Lucid hosted its highly anticipated production preview week in Arizona, for the first time. EV enthusiasts will get the chance to tour the factory and see Lucid’s technology first-hand. What’s more, they will also be able to test-drive its much-awaited luxury sedan, Lucid Air.

For those unfamiliar, Lucid Air is a state-of-the-art luxury sedan with a design underpinned by race-proven technology. With up to 1,080 horsepower and a range of over 500 miles per charge, the company’s flagship model will be able to accelerate from 0 to 60 mph in 2.5 seconds. And that’s not all, the company also announced that its limited-run Lucid Air Dream Edition will be produced in two distinct versions.

On one hand, we have the Dream Edition performance whereby it will feature a powertrain optimized for speed and acceleration. On the other hand, we have Dream Edition Range where it will focus on maximizing range. Considering all these, will LCID stock make your list of top EV stocks to buy after the production preview week hosted on Monday?

[Read More] Best Lithium Battery Stocks To Buy Now? 4 To Know

Fisker

Fisker is a design-forward, digitally focused EV company that is designing a next-generation EV. A lot of investors believe that Fisker’s asset-light, the direct-to-consumer operating model could be a strong competitor to Tesla (NASDAQ: TSLA). The company is on track to launch its first model, Fisker Ocean. Similar to many EV start-ups, Fisker has yet to generate any revenue and has also not managed to build a solid vehicle either.

At a glance, Fisker stock seems like a risky bet until manufacturing begins. However, the bulls seem to think otherwise. The company has been making news with strong partnerships and high growth prospects. And that makes it an appealing investment for investors who can stomach higher risks. Not to mention, the current chip shortage that affects the entire EV industry could also slow things down for Fisker.

Even though many are bearish on EV stocks that have yet to manufacture a single-vehicle, Wall Street analysts are more optimistic on FSR stock. Jeoffrey Lambujon, an analyst at Tudor Pickering, initiated coverage on FSR stock with a “buy”. Meanwhile, BofA analyst John Murphy downgraded the stock from “buy” to “neutral” with a price target of $18. The new price target still represents a potential upside of 20% despite Monday’s surge. Given all this, would you invest in FSR stock or stay away until it starts production?

[Read More] Top Stocks To Buy Now? 4 Renewable Energy Stocks For Your Watchlist

Nio

2021 has not been kind to Chinese stocks. This includes Nio, a leading Chinese electric vehicle maker that saw its stock down more than 30%. The company relies on a manufacturing partnership with a state-owned Chinese company. In the wake of China’s crackdown on a number of prominent Chinese companies, investors have been very cautious with NIO stock. Following this reason, Nio’s prospects may have been heavily discounted. But NIO stock has been working its way back up. This comes as the company nears the launch of sales in Norway, its first international market outside China.

As Nio stocks continue to recover from the general weakness in Chinese stocks, more aggressive investors are taking the recent downturn as an opportunity to buy on dips. After all, Nio’s fundamentals remain unchanged despite Beijing’s crackdown on other industries or the Evergrande fallout. Put simply, it appears to me that NIO stock is being punished for no concrete reason.

If you are bullish on the potential of this EV company, it’s worth noting that Nio is making steady progress into the European market. The company also recently said it plans to launch its new ET7 luxury electric sedan in Germany by the end of next year. But the bigger catalyst for the company could be its all-new 75 kWh standard-range, hybrid-cell battery pack. The new battery will extend the vehicle’s range in cold weather but will cost the same as the previous 70 kWh model. With all that being said, is NIO stock a buy amid its recent weakness?