Are These The Best Entertainment Stocks To Buy Right Now?

Entertainment stocks have been hit hard by the effects of the COVID-19 pandemic in 2020. There are many different types of entertainment stocks that have been trending the stock market this year. Entertainment companies like AMC Entertainment Holdings (AMC Stock Report) and Live Nation (LYV Stock Report) have been affected negatively by the pandemic. This is mainly because all in-person entertainment has been closed for the better half of this year.

On the other hand, entertainment companies that are digitally focused have delivered huge gains for investors in 2020. For example, with more people staying home streaming stocks have been big winners for investors in the stock market in 2020. Companies like Apple (AAPL Stock Report) and Spotify (SPOT Stock Report) have delivered handsome gains to investors this year. With that being said let’s take a closer look at three top entertainment stocks to watch this week after Moderna (MRNA Stock Report) just announced their COVID-19 vaccine is 94.5% effective.

Read More

- Should Investors Buy These Top Epicenter Stocks After Moderna’s Vaccine Success?

- Are These The Best Biotech Stocks To Buy Right Now Amid Moderna’s Positive Vaccine Results?

Top Entertainment Stocks To Watch This Week: Roku

The first entertainment stock on the list is Roku, Inc. (ROKU Stock Report). Roku has been a big beneficiary of the increased demand for streaming services resulting from the COVID-19 Pandemic. Currently, the average household is more likely to have more than one subscription to a streaming service. Roku is the answer to managing multiple services on a single user interface. This is why Roku has made this list of entertainment stocks to buy in the stock market today.

Its wide selection of content and 40 million active accounts have been the driving force for the company’s advertising revenue. InQ2 of this year Roku rolled out its New Shopper Data program with Kroger (KR Stock Report) as its first partner for the program. Roku will be able to leverage the retailer’s shopper data giving them a more effective way to advertise to their viewers. This will attract more advertisers to Roku. It will also make Roku a preferred choice for brands that want to reach their potential customers.

ROKU Stock: What To Watch

The company recently reported its third-quarter earnings, and they were impressive. Roku reported a 43% year-over-year active account growth rate. They also reported their total net revenue gained 73%year-over-year to $452 million, and a 81% YoY increase in platform revenue to $319 million. ROKU stock is up over 58% from August, and it’s up 293%from March’s lows.

“Coming out of Q3, we are pleased with the resilience of our business and cautiously optimistic about the holiday season. However, we are also aware of the potential for COVID-19 or economic-related disruptions, as well as the potential impact to historical consumer spending levels or shopping patterns as we enter the holiday season,” stated Founder and CEO Anthony Woods.

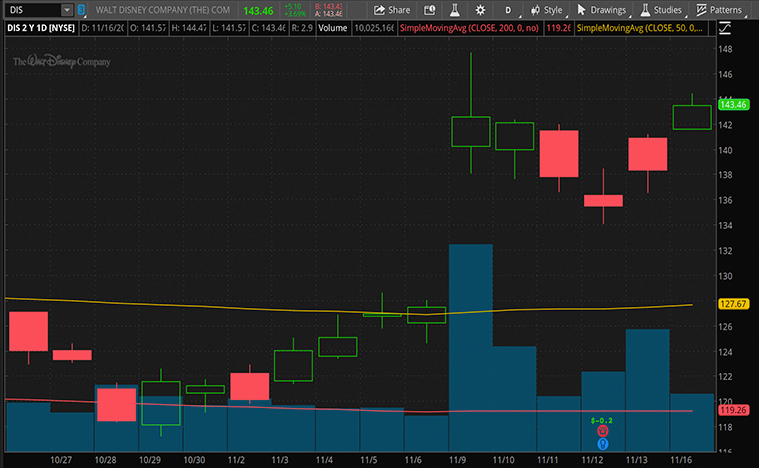

Top Entertainment Stocks To Watch This Week: The Walt Disney Company

Next up on the list is entertainment powerhouse Walt Disney, Inc. (DIS Stock Report). Disney has been one of the best entertainment stocks to buy in the stock market with a solid track record. The company is well diversified between its theme parks, movie theaters, and streaming services. Despite COVID-19 making Disney temporarily shutting down their theme parks, DIS stock is currently trading near pre-COVID levels and has seen steady growth this year so far. The stock has rallied 50.75% from March lows in the $93 dollar a share range to opening today’s trading session at $141.57 a share. We accredit this growth to the company successfully transitioning its priorities to its streaming business during the COVID-19 pandemic.

DIS Stock: What To Watch

This month the company reported its fourth-quarter earnings. Even though Disney took a hit in certain aspects of its business like it’s Parks and studio entertainment segments, what’s encouraging was its ability to report a 41% increase in its direct-to-consumer & international business to $4.9 billion.

“Even with the disruption caused by COVID-19, we’ve been able to effectively manage our businesses while also taking bold, deliberate steps to position our company for greater long-term growth,” mentioned Bob Chapek, CEO at Disney. He also stated, “The real bright spot has been our direct-to-consumer business, which is key to the future of our company, and on this anniversary of the launch of Disney+ we’re pleased to report that, as of the end of the fourth quarter, the service had more than 73 million paid subscribers – far surpassing our expectations in just its first year.”

Within the world of streaming services, Disney+ looks like it may be posing the greatest threats to the major players in the industry. Disney+ may be a relatively new service, but it has already complied with over 60.5 million paying subscribers globally. After the pandemic is over, Disney should be able to get all of its key revenue generators back on track. Can we expect Disney to have a huge rally when that does happen? That’s why we have DIS stock on this list of streaming stocks to watch this week.

[Read More] Are These The Best 5G Stocks To Buy This Week? 1 Is Up 152% Since March

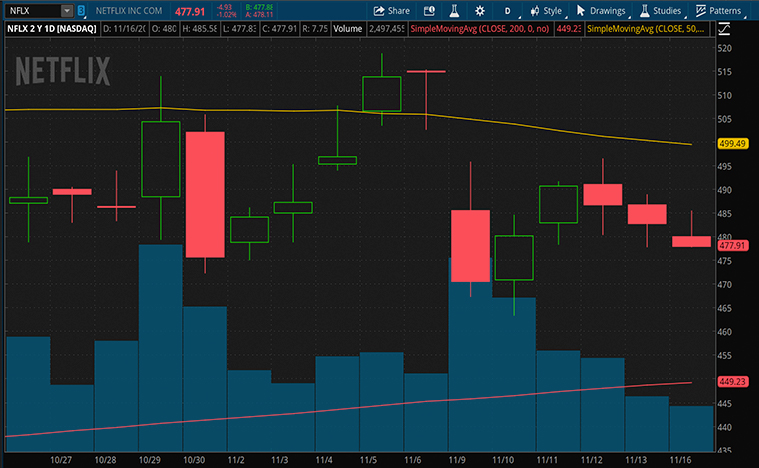

Top Entertainment Stocks To Watch This Week: Netflix

Last on the list of entertainment stocks to watch this week is Netflix (NFLX Stock Report). This sentiment remains. Netflix is the largest entertainment company by market capitalization coming in at a current market cap of $228 billion. The video streaming giant has seen its share price increase of 60.28% from March lows. NFLX stock is currently trading at $478 a share on average as of today, November 16th.

NFLX Stock: What To Watch

In the company’s most recent Q3 2020 earnings report the company announced its average streaming paid memberships increased by 25%. Adding 2.2 million net memberships in the third-quarter. They also reported their net cash generated by operating activities in Q3 was +$1.3 billion vs -$502 million during the previous period in 2019.

What’s really encouraging is their free cash flow was positive for the third straight quarter at $1.1 billion vs -$551 million in Q3 2019. The company currently has $8.4 billion in cash on its balance sheet. This gives them plenty of cash to be able to weather the COVID-19 pandemic. For those reasons that is why we have Netflix on the list of top entertainment stocks to watch this week.