Simply put, undervalued stocks are stocks that investors believe are worth more than their current market price. This can happen for a variety of reasons, such as a temporary downturn in the industry, a misunderstanding of the company’s financial health, or a lack of awareness about the company’s potential growth. Investors who believe a stock is undervalued may see it as a good opportunity to buy the stock at a discounted price with the hope that the stock will eventually rise in value and bring a profit.

To determine if a stock is undervalued, investors may use various financial metrics. Some of these include the price-to-earnings ratio, the price-to-book ratio, and the dividend yield. These ratios compare the stock’s price to various measures of the company’s financial performance, such as earnings per share or the value of the company’s assets. By comparing these ratios to the industry average or to the company’s historical performance, investors can determine if a stock is undervalued relative to its peers or to its own past performance.

It’s important to note that just because a stock is undervalued doesn’t necessarily mean it’s a good investment. It’s important to carefully consider the company’s financial health, management, and industry conditions before making any investment decisions. With that being said, here are three potential undervalued stocks to watch in the stock market ahead of the new year.

Undervalued Stocks To Watch Now

- Bank Of America Corporation (NYSE: BAC)

- Cloudflare, Inc. (NYSE: NET)

- Zscaler, Inc. (NASDAQ: ZS)

Bank Of America (BAC Stock)

Starting off, Bank of America Corporation (BAC) is a multinational investment bank and financial services company based in the United States. The bank serves individuals, small businesses, and large corporations with a range of financial products and services, including checking and savings accounts, credit cards, mortgages, investment products, and business lending. It also provides wealth management, insurance, and asset management services.

Back in October, BAC reported its third-quarter 2022 financial results. Diving in, the company announced earnings of $0.81 per share and revenue of $30.4 billion. This is versus analysts’ consensus earnings estimates of $0.79 per share, and revenue estimates of $23.5 billion. Additionally, Bank of America reported a revenue increase of 26.4% compared to the same quarter, the year prior.

So far in 2022, shares of BAC stock have fallen by 30.73% year-to-date (YTD). In addition, on Thursday afternoon, BAC stock is trading down by 2.20% on the day by $31.96 a share.

[Read More] Recession-Proof Stocks To Invest In Now? 3 To Watch

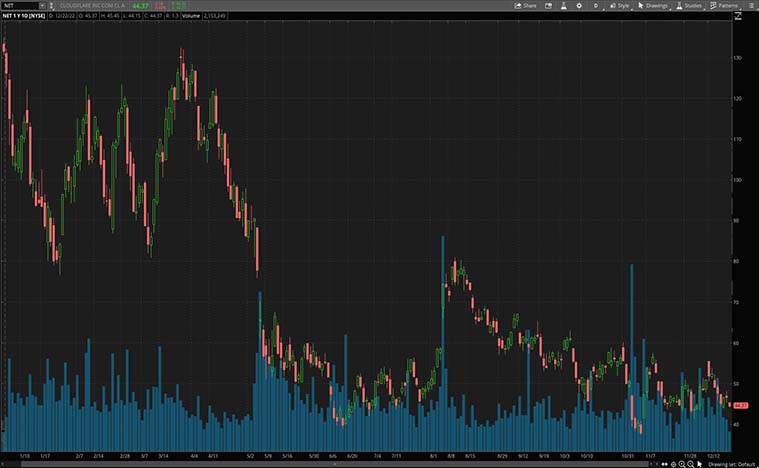

Cloudflare (NET Stock)

Next, Cloudflare, Inc. (NET) is a technology company that provides a range of internet services, including content delivery network (CDN), distributed denial-of-service (DDoS) protection, and domain name system (DNS) services.

Last month, Cloudflare announced its third-quarter 2022 financial results. Diving in, the company reported earnings of $0.02 per share, along with revenue of $253.9 million for Q3 2022. Moreover, they also reported a 47.3% increase in revenue compared to the same period, in 2021. Additionally, Cloudflare said it estimates Q4 2022 non-GAAP earnings of $0.04 to $0.05 per share and revenue estimates between $273.5 million to $274.5 million.

Year-to-date Cloudflare stock has dropped by 64.88% in 2022 so far. Meanwhile, on Thursday afternoon, shares of NET stock are trading at $44.33 a share.

[Read More] Cheap Stocks To Buy Now? 2 Tech Stocks To Watch In 2022

Zscaler (ZS Stock)

Topping off the list is Zscaler Inc. (ZS). For starters, Zscaler is a technology company that provides cloud-based internet security and network performance solutions. Zscaler’s services focus on helping organizations secure their networks and protect their employees from internet-based threats, such as malware, phishing attacks, and unsecured websites.

In recent news, Zscaler reported better-than-expected Q1 2023 financial results. Specifically, the company reported 1st quarter 2023 earnings of $0.30 per share and revenue of $355.5 million. This is versus Wall Street’s consensus estimates for the quarter which were earnings of $0.26 per share and revenue estimates of $344.0 million. These revenue figures represent a 54.2% increase in revenue versus the same period, a year prior.

Moving along, year-to-date, Zscaler stock has fallen by 64.10%. As of Thursday afternoon shares of ZS stock are trading at $108.36 a share.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!