Do You Have These Top Cyber Security Stocks On Your Watchlist This Week?

During the current age of digital acceleration, cybersecurity stocks have become some of the best performers in the stock market. This is because of the ongoing pandemic keeping most of the general population stuck at home. The way we carry out work has fundamentally changed as working-from-home becomes the new normal. Aside from work, even our leisure activities have evolved towards the digital space. All this has and continues to contribute to the insane growth of the cybersecurity industry over the past year. Experienced investors are taking notice of this and have been flocking to the top cybersecurity stocks accordingly. Take Palo Alto Networks, Inc. (NYSE: PANW) for instance, PANW stock is experiencing gains of 149.71% in the past year. The cloud security company continues to step up to meet rising demands in the sector.

Let’s not forget there is also an ongoing investigation into a hack targeting U.S. government agencies in December. Cybersecurity company SolarWinds (NYSE: SWI) was alerted to the breach in its systems by FireEye (NASDAQ: FEYE). In January, it was reported by the New York Times that the scale of the attack was much larger than initially thought. Some 250 federal agencies and businesses have been breached and the list is still growing. With top tech stocks like Microsoft (NASDAQ: MSFT) and Intel (NASDAQ: INTC) getting hacked, one thing is obvious. Cybercrime is rising and is constantly evolving. Likewise, cybersecurity companies have accelerated their efforts to bolster their services. Furthermore, Cybersecurity Ventures estimates that cybercrimes will be the cause of $6 trillion in annual losses in 2021.

It’s apparent, given the increase in demand for top cybersecurity companies, it sets up an interesting opportunity for investors. With all the recent cyber threats, companies would likely want to strengthen their online security. With all that in mind, are these the best cybersecurity stocks to buy right now?

Top Cybersecurity Stocks To Watch Now

- CrowdStrike Holdings Inc. (NASDAQ: CRWD)

- Zscaler Inc. (NASDAQ: ZS)

- Cloudflare Inc. (NYSE: NET)

- CACI International Inc. (NYSE: CACI)

CrowdStrike Holdings

First up on the list is CrowdStrike Holdings Inc. or CRWD. The company focuses on providing cloud-based endpoint and workload protection using its Falcon platform. Basically, CrowdStrike’s platform uses Artificial Intelligence to help defend customers against various cyber attacks. We live in an age, where now more than ever CRWD’s services are experiencing an increase in demand. CRWD stock was one of the hottest growth stories on Wall Street last year. Given the recent advancements in technology and digital, it’s no surprise that investors are turning their attention to a top cybersecurity stock to buy like CrowdStrike.

In just the last year alone, shares of CRWD stock have surged over 500% closing Friday’s trading session at $199.00 a share. Though, recently amid the recent market pullback that also caused shares of CRWD stock to retreat roughly 15% from February’s highs. Despite the stock still not being “cheap” it may not be as expensive as you think. The need to protect information is at an all-time high for businesses and consumers. CRWD stock is well-positioned to capitalize on the industry’s optimistic growth outlook. In fact, the company’s management anticipates the cloud cybersecurity market will grow to $38.7 billion by 2023.

Furthermore, the company recently announced the closing of a $400 million dollar acquisition of Humio. Humio is a leading provider in high-performance cloud log management and observability technology. CEO and Co-founder George Kurtz stated, “We are excited to welcome the Humio team to CrowdStrike as we join forces to stop breaches, advance our Security Cloud, and extend our ability to address non-security use cases,” he continued with, “Humio will enhance CrowdStrike’s ability to solve real-world customer problems with its cloud-native platform by adding index-free data ingestion and analysis capabilities for both first- and third-party data.” Given the industry outlook, and the recent developments, would you consider adding CRWD stock to your watchlist this week?

Read More

- Best Stocks To Buy This Week? 4 Health Care Stocks To Watch

- Should Investors Buy These Top Tech Stocks In March? 4 Names In Focus

Zscaler Inc.

Next on the list of top cybersecurity stocks to watch is Zscaler Inc. (ZS). Zscaler is a cloud security company that has been trending in the market this year. ZS stock is another top growth stock that has been on investors’ radars as of late. Over the last year shares of ZS stock have gained an impressive 341.44%, currently trading at $184.61 as of Friday’s close. Similar to CrowdStrike, ZS stock has pulled back a modest 5.85% year-to-date, which we can tie into the recent decrease in the broader markets. Despite the recent pullback, the rise in demand for cloud security comes into play. Let’s take a deeper dive into how Zscaler performed during the recent quarter.

Just last month, ZS reported its second-quarter fiscal 2021 financial results. Notably, the company announced a 55% year-over-year (YoY) increase to $157.0 million. Also, Zscaler reported a 71% YoY increase in calculated billings to $232.0 million, as well as notching in a 60% YoY jump in deferred revenue to $446.8 million.

Furthermore, the company highlighted that it has passed a new milestone by surpassing 5,000 customers during the quarter, with 500 of those being Global 2000 companies. With all that being said, is now the best time to buy ZS stock on the dip? That’s for you to decide.

[Read More] Making A List Of The Top Fintech Stocks To Buy? 4 To Know

Cloudflare Inc.

Third, we have Cloudflare (NET). The company specializes in providing content delivery network services, DDoS mitigation, and internet security to name a few. Also, the company claims that approximately 16% of Fortune 1,000 are paying Cloudflare customers. If you’re an avid reader of StockMarket.com, you’ve likely seen us cover NET stock as one of the top growth stocks to watch in 2021. Shares of NET stock are up an impressive 379.27% in the last year of trading. The momentum seems to be carrying over into this year for Cloudflare as the company recently announced its fourth-quarter and fiscal year 2020 financial results. Let’s see how they did, read on.

Cloudflare reported quarterly revenues of $125.9 million, representing a 50% increase year-over-year. This brought fiscal year 2020 revenues to $431 million, also signifying a 50% increase from the same time in the previous year. It’s also important to note, the company notched in an increase of 1,280 basis points to its 2020 GAAP operating margin of 24.8%. “We had a remarkable end to a year we’ll never forget, delivering a record fourth quarter and full year 2020. Our paid customer count grew to more than 111,000, with our largest customers continuing to be our strongest growth area,” commented Matthew Prince, co-founder, and CEO of Cloudflare.

On top of the strong growth in financials, Cloudflare recently announced they have recognized by Forrester Research, Inc., as a Leader in The Forrester Wave™: DDoS Mitigation Solutions, Q1 2021 report. As the company continues its growth story, is now the time to get on the for the ride with NET stock? You tell me.

[Read More] Best Stocks To Invest In Right Now? 4 Consumer Stocks To Watch

CACI International Inc.

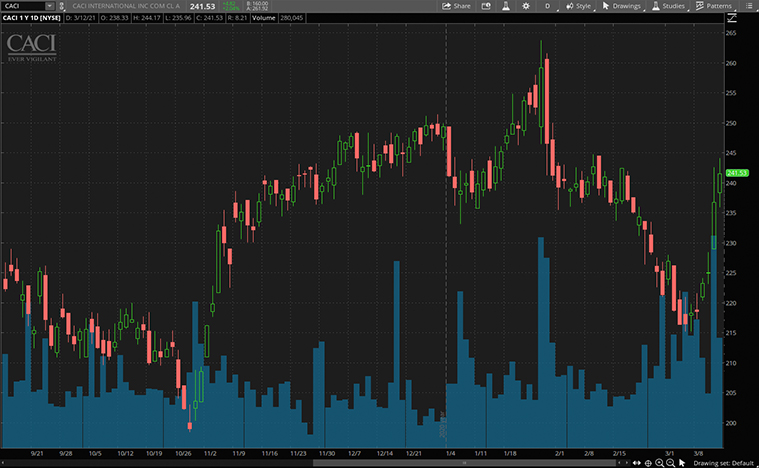

Last but not least, let’s turn our attention to CACI International, stock symbol CACI. In the last year of trading, shares of CACI have surged 27.89%, and it currently trades at $241.53 a share. CACI International is a multinational software giant and is based out of Virginia. The IT company has often been compared to top software stocks like Palantir (NYSE: PLTR). This is because CACI provides services to a variety of branches of the U.S. federal government. This past trading week, CACI stock notched in an increase of 10.17%. This recent rally comes after the company announced a new $500M share repurchase authorization.

Continuing on, this repurchase agreement is equal to approximately 2.1 million shares, at the closing price on March 11, 2021, representing nearly 8% of CACI’s outstanding common stock. You may be asking, “Why is this a bullish news release?“. Well, when a public company makes the decision to repurchase shares, they are buying shares in the open market and retiring the outstanding shares. Investors usually see this as a bullish sign because, after the share buyback, the investor will own a bigger piece of the company. In short, it improves shareholder value and usually increases the share price of the company.

John Mengucci, CACI’s President and CEO, commented, “This accelerated share repurchase transaction is the next step in a more opportunistic and flexible capital deployment strategy and demonstrates our confidence in CACI’s strategy and future growth prospects. It also reflects our commitment to deliver value to our shareholders.” With all that being said, would you consider adding CACI to your portfolio this month?