Should You Be Investing In EV Stocks Despite Its Recent Weakness?

Electric vehicle (EV) stocks have been some of the hottest stocks in the stock market for the past years. Regardless of the performance of the stocks of the companies in the industry, EV stocks remain a hot topic among every investor. It is hard to ignore the sentiments in this industry when even the president is a strong advocate of EVs. Just last week, President Joe Biden made the case for his $174 billion EV proposal, urging automakers to manufacture their vehicles in the U.S. and secure a domestic EV supply chain. He also vowed to set a new pace for electric vehicles, in fears of falling behind China, which is selling more EVs as we speak.

The EV industry is often viewed as an investment opportunity and this is led by Tesla (NASDAQ: TSLA). Given that TSLA stock has been down for five consecutive weeks, it is understandable why the whole industry has not been bullish. However, this can present a buying opportunity. Many would agree that the future of the automotive industry is electric, so why not be ahead of the curve? With this in mind, let us look at some of the best EV stocks in the stock market today.

Best EV Stocks To Buy [Or Sell] This Week

- Fisker Inc (NYSE: FSR)

- Ford Motor Company (NYSE: F)

- General Motors Company (NYSE: GM)

- Xpeng Inc (NYSE: XPEV)

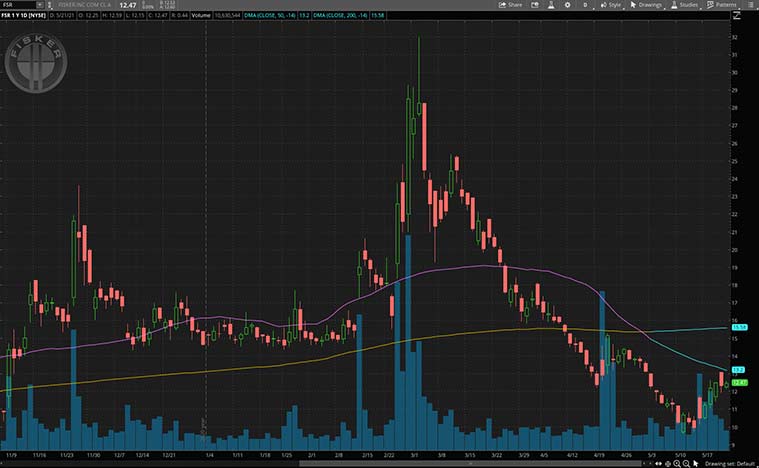

Fisker Inc

Firstly, we have the EV startup Fisker. To put it simply, it is a company that designs and manufactures electric vehicles. Its flagship Fisker Ocean is set for mass production in 2022. The company aims to become the No. 1 e-mobility service provider with the world’s most sustainable vehicles. Earlier this month, the company finally finalized the deal with Foxconn Technology Company to manufacture EVs in the U.S, starting in 2023. Four states are currently in consideration including Foxconn’s underutilized plant site in Wisconsin. The annual capacity for the plant will be at least 150,000 vehicles to start.

Furthermore, Fisker also announced last week that it has nominated Sharp Corporation to develop technologies to support its next-generation in-vehicle screens and interfaces. The agreement would include the co-creation of technologies and the subsequent manufacture of screens and components from Sharp to support the Fisker Ocean SUV, Project PEAR (Personal Electric Automotive Revolution), and potentially two additional Fisker vehicles.

For what it’s worth, the company claims it will be making the first all-electric popemobile on Thursday. It will be using a modified version of its forthcoming Ocean SUV. With that in mind, would you be investing in FSR stock now?

[Read More] 5 Tech Stocks To Watch This Week

Ford Motor Company

Next on the list is another automotive company that has been grabbing the headlines, Ford. This is an automotive company that designs, manufactures, markets, and services a full line of Ford trucks, cars, and Lincoln luxury vehicles. The company also holds ownership of Argo AI, a developer of autonomous driving systems, and Spin, a micro-mobility service provider. F stock has been on an upward trend since the start of the year, showing gains of over 55%. In fact, it has risen almost 130% over the past year.

Last week, the company officially debuted its latest electric pickup truck, the F-150 Lightning. This is the second mass-market EV from Ford, following the Mustang Mach-E. Also, it seems that the company has already received more than 44,500 reservations in less than 48 hours according to a tweet by CEO Jim Farley. This is a testament to greater things ahead as it is one of the most powerful F-150s ever made.

Within the same week, Ford also announced that it will be joining forces with SK Innovation as they seek to scale up battery cell deliveries for EVs. Both companies have signed a memorandum of understanding to form BlueOvalSK, a joint venture to develop battery cells and arrays in the U.S. With all these developments, would F stock not be an enticing investment now?

Read More

- Best Dividend Stocks To Buy Now? 4 Trending Now

- Good Stocks To Invest In Right Now? 4 Consumer Discretionary Stocks To Know

General Motors Company

General Motors Company is a multinational corporation headquartered in Detroit, Michigan. It designs, builds, and sells trucks, crossovers, cars, and automobile parts worldwide. The company also owns BrightDrop, which offers an ecosystem of electric first-to-last-mile products, software, and services to empower delivery and logistics companies to move goods more efficiently. Looking at GM stock, it has been nothing short of impressive for the past year. GM stock has more than doubled in value during this period.

Earlier this month, Ultium Cells LLC, a joint venture between General Motors and LG Energy Solutions, announced an agreement with Li-Cycle to recycle up to 100% of the scrap material from battery cell manufacturing. This new recycling process will enable the recycling of cobalt, nickel, lithium, graphite, copper, manganese, and aluminum. These materials can then be used for the production of new batteries. This is crucial as it serves as a sustainable alternative to mining. Considering all these, would you consider adding GM stock to your portfolio?

[Read More] Stocks To Watch This Week? 4 Entertainment Stocks To Know

Xpeng Inc

To finish off the list, we have a China-based EV company, Xpeng. Essentially, it is a company that designs, develops, and produces smart electric vehicles (Smart EVs). Not only that, the company also has aims of developing full-stack autonomous driving technology, in-car intelligent operating systems, and core vehicle systems.

Undoubtedly, this is one of the hottest EV stocks right now, especially with its remarkable first-quarter earnings report last week. Total vehicles delivered by the company jumped by 487% to 13,340 from 2,271 in the corresponding period of the prior year. Also, total revenue increased 616.1% year-on-year to $450.4 million. This can largely be attributed to its deliveries of the P7 model.

Now, what’s even more impressive is the expansion of the company’s gross margin to 11.2% from last quarter’s 7.4%. Xpeng had a negative gross margin of 4.8% in the same period last year. This strong financial quarter is nothing short of impressive. And the company is predicting another fruitful second quarter. Besides this, Xpeng’s charging network boasts 19,019 free charging and supercharging piles in 1,140 charging stations. This covers roads and highways across 164 Chinese cities. Xpeng claims it is the first Chinese EV maker to provide free lifetime charging services. Easy access to free charging facilities is extremely important and it also demonstrates the company’s commitment to popularizing smart EVs. Given the strong financial results of the company, would you say that XPEV stock is trading at a discount now?