Are These The Top Fintech Stocks To Buy Now?

With the rise of financial technology, there is now a broad selection of fintech stocks in the stock market today. The opportunities within the industry are massive. It now ranges from payment services, banking, investing, insurance, and even cryptocurrencies. With that being said, some of the top names in the industry have gone through significant corrections over the past year. Now, some investors may argue that the bearish sentiment could be slightly overblown. As such, it would not be surprising if fintech stocks eventually rebound when the stock market regains its footing.

For example, sentiment around artificial intelligence lending platform Upstart Holdings (NASDAQ: UPST) could be changing over the past few days. This came after the company attempted to address some concerns at a recent fintech conference. UPST stock climbed more than 24% this week. Separately, the fintech industry continues to innovate despite the unprecedented adoption over the past few years. We saw Mastercard (NYSE: MA) announcing that it has begun trials for a biometric payment system for brick-and-mortar stores. Consumers can potentially use facial recognition to make payments in the future. In summary, it would be a safe assumption that financial technology will evolve over time and play a growing role in our daily lives. Hence, here are four top fintech stocks in the stock market today worth taking a look at.

Fintech Stocks To Watch Today

- Block Inc (NYSE: SQ)

- American Express Company (NYSE: AXP)

- Affirm Holdings Inc (NASDAQ: AFRM)

- JPMorgan Chase & Co (NYSE: JPM)

Block

Firstly, let us have a look at the fintech giant, Block. Put simply, the company creates tools that enable businesses, sellers, and individuals to participate in the economy. It does so by helping sellers run and grow their businesses with its integrated ecosystem for commerce, business software, and banking services. With its Cash App, it is building an ecosystem of financial products and services that helps individuals manage their money by making it relatable, instantly available, and universally accessible. As a result, fintech investors would often have an eye on SQ stock.

Earlier this week, the company’s Square launched its latest hardware offering, Square Register, in Ireland. This is a fully integrated countertop point-of-sale solution (POS) that would give Irish businesses with complex needs the versatility they need to manage sophisticated operations. Aside from that, Square Register also runs the company’s vertical POS software, Square for Retail and Square for Restaurants. All in all, the company continues to address the need for omnichannel selling in the modern world. With the emphasis on simplicity for staff and security for customers, the product could help streamline business operations. With that said, would you consider SQ stock as a top fintech stock to watch?

[Read More] Stock Market Today: Dow Jones, S&P 500 Sinks On Powell Comments; Target Stock Tumbles On Missed Earnings

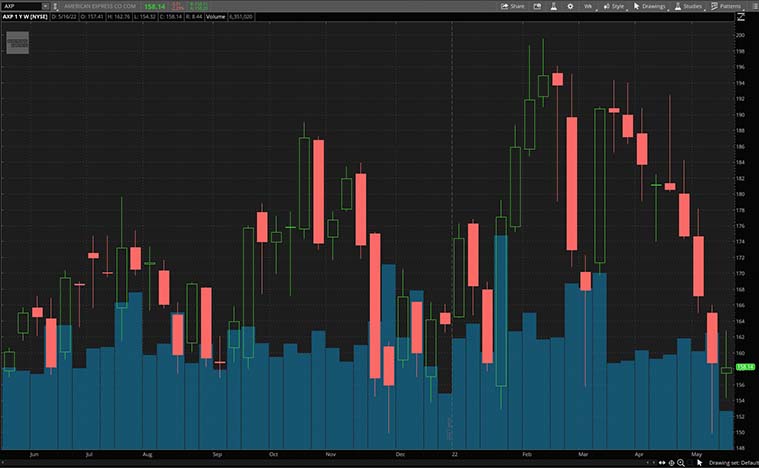

American Express

Following that, we have the integrated payments company, American Express. In detail, the company provides its customers with access to insights, experiences, and products that build a business. Besides that, American Express also provides credit and charge cards to consumers and corporations around the globe. Investors should also note that the company recently declared a regular quarterly dividend of $0.52 per common share. However, AXP stock has been trading sideways since the start of the year.

Last week, the company along with Versapay announced a new agreement to provide suppliers who utilize the functionality of American Express virtual cards with access to Versapay’s world-class collaborative accounts receivable (AR) network of buyers and suppliers. This will help suppliers to increase efficiency, and accelerate cash flow while improving customer experiences in the invoice to cash cycle. Ultimately, the collaboration will help American Express offer a fully automated acceptance experience and this is important as the financial industry continues to evolve. Considering these factors, would you be adding AXP stock to your watchlist?

Affirm

Affirm is a company that is notable for its ‘buy now, pay later’ (BNPL) services. Through its technology-driven payments network and partnership with an originating bank, it enables consumers to pay for a purchase over time. Financially, Affirm has also been firing on all cylinders. Last week, the company reported its fiscal third-quarter results. Diving in, quarterly revenue grew to $354.8 million, up 54% year-over-year. Meanwhile, its Gross Merchandise Volume climbed to $3.9 billion, representing an increase of 73% year over year.

Another important metric to note is the number of active merchants and active consumers on the company’s platform. The number of active merchants grew from 12,000 to 207,000 just within the past year. In a similar trajectory, its active consumers more than doubled to 12.7 million. Not to mention, Affirm also recently announced a multi-year extension of its partnership in the U.S. with Shopify (NYSE: SHOP). This confirms Affirm as the exclusive pay-over-time provider for Shop Pay Installments in the country. Overall, there seem to be plenty of positives going about for Affirm right now. So, would you bank on the future of AFRM stock in the stock market today?

[Read More] Best Stocks To Buy Now In 2022? 4 Dividend Stocks For Your Watchlist

JPMorgan

To sum up the list, we have one of the largest financial holding companies in the world, JPMorgan. Among its banking industry peers, the firm is a leader in the investment banking industry. The firm manages trillions in assets worldwide and provides a vast array of financial services. This ranges from serving consumers, and businesses of varying sizes to commercial banking alongside financial transaction processing and asset management. In fact, the Board of Directors of the company just announced a quarterly dividend of $1.00 per share on its common stock.

Furthermore, JPMorgan announced last week the launch of “Fusion by J.P. Morgan”. This is a data platform that delivers end-to-end data management and reporting solutions for institutional investors. The platform will allow clients to combine and seamlessly integrate data from multiple sources into a single data model. Thus, delivering the benefits of scale and reduced costs. Moreover, the platform will also combine high-quality data with a governance framework that can be leveraged consistently across the investment lifecycle. Given these exciting developments, should investors be keeping a closer tab on JPM stock?

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!