Are These Top Biopharmaceutical Stocks In Your September 2021 Watchlist?

As stocks continue to sell off this September, biopharmaceutical stocks continue to gain traction in the stock market today. Aside from investor fears over broad-based selling, new economic data from China is also weighing in on the stock market now. Namely, China’s retail sales, industrial production, and fixed-asset investment growth all slowed down significantly in August. This would, to some extent, affect the overall outlook regarding global economic recovery now. Additionally, there is also the factor of the more infectious Delta variant of the coronavirus persisting across the globe.

For the most part, all of these factors could highlight the biopharmaceutical industry now. As concerns rise over the global reopening trade, investors would turn towards more defensive stocks. The likes of which would include biopharma giants such as AstraZeneca (NASDAQ: AZN) and Sanofi (NASDAQ: SNY). Notably, both companies are also hard at work expanding their operations now. On one hand, AstraZeneca is now working to support general health care research in Saudi Arabia. On the other hand, Sanofi completed its acquisition of Translate Bio, a biotech company that specializes in mRNA gene therapy. With all this activity in the biopharmaceutical space now, here are 5 biopharmaceutical stocks to watch this week.

Top Biopharmaceutical Stocks To Watch Right Now

- Adagio Therapeutics Inc. (NASDAQ: ADGI)

- Pfizer Inc. (NYSE: PFE)

- Vera Therapeutics Inc. (NASDAQ: VERA)

- Eli Lilly and Company (NYSE: LLY)

- AbbVie Inc. (NYSE: ABBV)

Adagio Therapeutics Inc.

Adagio Therapeutics is a clinical-stage biopharmaceutical company that develops and commercializes antibody-based solutions for infectious diseases with pandemic potential. Notably, its lead product candidate is ADG20, which is designed to be a potent, long-acting, and broadly neutralizing antibody for both the treatment and prevention of the virus.

Last week, it announced that the independent data monitoring committee (IDMC) for the EVADE Phase 2/3 trial of ADG20 has provided a recommendation to expand the company’s Phase 3 trial enrolment. Given the urgent need for additional treatment and preventative options for the pandemic, the company hopes this inclusion of adolescents and pregnant or nursing women in the next phase of the study will help pave a way for more people to have access to the treatment.

Furthermore, the company says that this antibody treatment has the potential to become the preferred prophylactic option for the virus as these groups are currently limited or have no options available. With that being said, is ADGI stock worth watching right now?

Read More

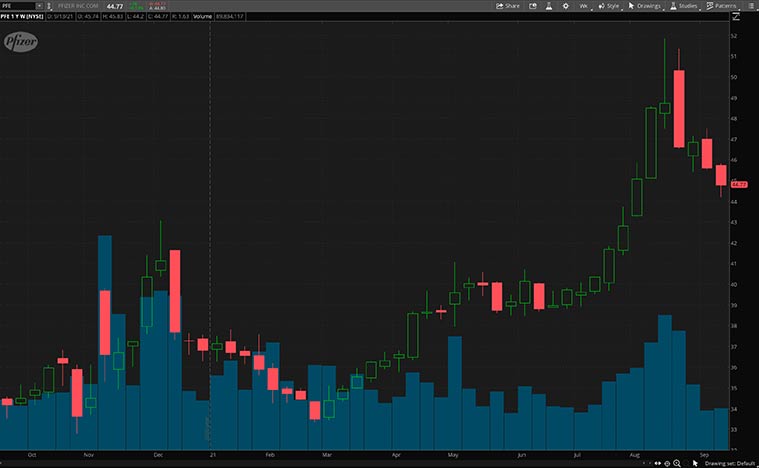

Pfizer Inc.

Next up, we have Pfizer, a multinational pharmaceutical company with headquarters in New York. The company’s portfolio of treatments and drugs has impacted the lives of millions over the world and provided significantly improved quality of life. With over 170 years in the industry, the company is certainly a biopharmaceutical titan. Recently, it announced the FDA acceptance for review of a supplemental New Drug Application for Myfembree. Myfembree is used for the management of moderate to severe pain associated with endometriosis.

Last month, the company also announced that it has entered into a definitive agreement to acquire Trillium, a clinical-stage immune-oncology company that develops innovative therapies to treat cancer. Also, under the terms of the agreement, Pfizer will acquire all outstanding shares of Trillium for an implied equity value of $2.26 billion or $18.50 per share in cash.

The acquisition of Trillium will build on Pfizer’s strong track record in oncology. It will also enhance its hematology portfolio as the company strives to improve the outcome for people living with blood cancers around the globe. For these reasons, will you consider investing in PFE stock?

[Read More] Top Stocks To Buy Now? 4 Renewable Energy Stocks For Your Watchlist

Vera Therapeutics Inc.

Vera Therapeutics is a clinical-stage biotech company that develops transformative treatments for patients with serious immunological diseases. For instance, its lead program is atacicept, a fusion protein that is in development for IgA nephropathy, a disease with high unmet medical needs and no approved therapies. VERA stock has been up by over 140% in the past year alone.

On August 16, 2021, the company reported its second-quarter financials and provided a corporate update. Vera therapeutics says that it achieved key clinical and financial milestones in the first half of the year.

Marshall Fordyuce, founder and CEO of Vera Therapeutics had this to say, “In the second quarter, we initiated on schedule our Phase 2b clinical trial of atacicept in patients with IgA nephropathy (IgAN). Known as ‘ORIGIN,’ this trial will potentially demonstrate atacicept as the first disease-modifying therapy for patients with IgAN. ORIGIN is a randomized controlled trial powered to determine whether atacicept’s proven ability to substantially reduce Gd-IgA1 translates into improvements in renal function, as measured by proteinuria. We look forward to providing additional clinical updates planned for the remainder of 2021 and into 2022.” With that being said, will you consider adding VERA stock to your portfolio right now?

Eli Lilly and Company

Another name to consider in the biopharma industry today would be Eli Lilly and Company (LLY). In brief, LLY is a pharmaceutical goliath with operations spanning across the globe. For a sense of scale, the company has offices in 18 countries while its products are solid in approximately 125 countries. The company’s portfolio currently consists of treatments for a wide array of diseases. This includes but is not limited to, diabetes, cancer, endocrine-related illnesses, and COVID-19.

Now, LLY stock is up by over 40% year-to-date. Adding to all of this, LLY seems keen on keeping up its current momentum. Earlier today, the company revealed that it will be supplying an additional 388,000 doses of its COVID-19 treatment, etesevimab, to the U.S. government. After considering all this, will you be adding LLY stock to your watchlist?

AbbVie Inc.

AbbVie is a biopharmaceutical company that develops advanced medicines with strong clinical performance in areas of great need. Its key therapeutic areas include immunology, oncology, neuroscience, virology, and eye care. Shares of ABBV stock have increased by over 18% in the past year. On Monday, the company announced a partnership with Regenxbio (NASDAQ: RGNX) for an eye care collaboration.

In detail, the two companies will develop and commercialize RGX-314, potential one-time gene therapy for the treatment of wet age-related macular degeneration, diabetic retinopathy, and other chronic retinal diseases. Regenxbio will complete its ongoing trials while Abbvie will share costs on additional trials of RGX-314. By leveraging AbbVie’s global developmental and commercial infrastructure within the field of eye care, this collaboration could prove fruitful for the company in the years to come. Will you consider keeping an eye on ABBV stock with this piece of news?