Do You Have These Communication Stocks On Your February 2022 Watchlist?

As investors continue to look for the top stocks to buy in the stock market today, communication stocks could be worth a look. Today, the communication sector includes everything from century-old legacy media companies to social media companies. And, it continues to grow as technology pushes the boundaries to give us more options for communication. With the role of communication services in our daily lives, this segment of the stock market would often be in focus.

Furthermore, the increasing 5G adoption would likely benefit some of the top names in the industry. This can be seen through Verizon’s (NYSE: VZ) recent fourth-quarter financial report that was announced yesterday. The company reported more-than-expected wireless subscribers that pay a monthly bill and expects a strong year ahead fueled by increasing 5G adoption.

On another hand, AT&T (NYSE: T) also surpassed its fourth-quarter estimates on strong streaming and wireless demand. The company’s WarnerMedia segment raked in revenues of $9.9 billion for the quarter, an increase of 15.4% year-over-year. This is a testament to its popular HBO Max streaming service that continues to edge to the top of the streaming industry. With all said and done, it is easy to understand why investors are paying more attention to communication stocks now. So, here is a list of some of the top names to watch out for in the stock market today.

5 Communication Stocks To Watch Before February 2022

- T-Mobile US Inc (NASDAQ: TMUS)

- Comcast Corporation (NASDAQ: CMCSA)

- Charter Communications Inc (NASDAQ: CHTR)

- News Corp (NASDAQ: NWS)

- Vodafone Group Plc (NASDAQ: VOD)

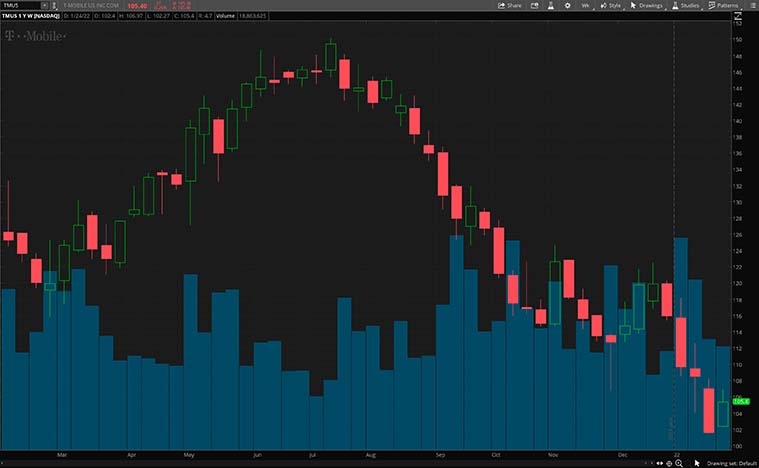

T-Mobile

T-Mobile is a telecommunication company that prides itself on putting its customers first. Essentially, it provides wireless services to postpaid, prepaid, and wholesale customers. Besides that, the company also provides devices and accessories across its flagship brands such as T-Mobile, Metro by T-Mobile, and Sprint. With the company’s fourth-quarter earnings report around the corner, keen investors are keeping a close tab on TMUS stock right now.

The company started the year with an announcement regarding the acquisition of Octopus Interactive. This marks the next step for the company’s Marketing Solutions in expanding its advertising offerings for marketers. Octopus Interactive would help the company to reach audiences through video ads presented on screens inside rideshare vehicles such as Uber (NYSE: UBER) and Lyft (NASDAQ: LYFT). As a result, it would be a new way to reach consumers and likely contribute to the company’s growth. Keeping this in mind, would TMUS stock be a viable investment long-term?

[Read More] Best Lithium Battery Stocks To Buy Now? 4 To Know

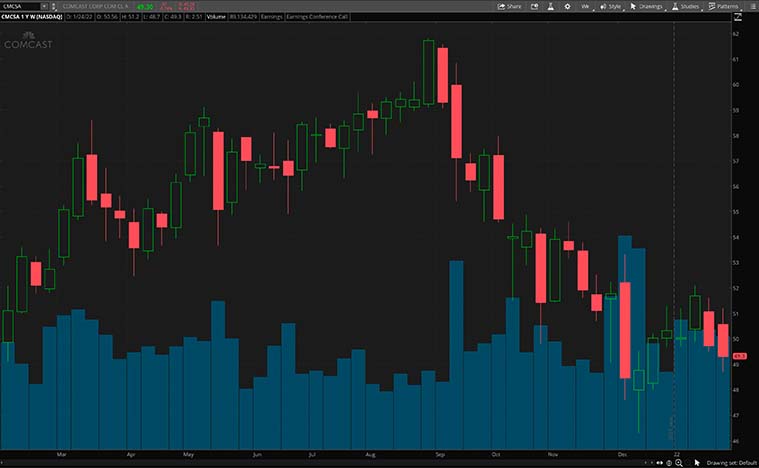

Comcast

Another leading name in the industry today is Comcast. In detail, the company primarily operates through three businesses, Comcast Cable, NBCUniversal, and Sky. Its Comcast Cable provides Internet, video, wireless, and automation services under the XFINITY brand. Not to mention, it also has a portfolio of national cable networks. In this period of uncertainty in the stock market, Comcast’s history of consistent dividend payout would offer a sense of security among investors. In fact, it has been increasing for the past four years.

Last week, Comcast announced a partnership with Nokia (NYSE: NOK) to extend its enterprise connectivity portfolio. In essence, it would deliver 5G private wireless networks using Nokia DAC (Digital Automation Cloud) industrial-grade private wireless solution and digitalization enabler platform. On top of that, the collaboration also supports Comcast’s vision of aiding emerging connected ecosystems by delivering connected solutions at scale. All things considered, would CMCSA stock be a top communication stock to watch for you?

[Read More] Best Monthly Dividend Stocks To Buy Now? 5 For Your List

Charter Communications

Following that, we will be looking at broadband company Charter Communications. Through its Spectrum brand, the company serves approximately 31 million customers in 41 states throughout the country. In addition, Charter also distributes news coverage, sports, and original programming to its customers through Spectrum Networks and Spectrum Originals. As some of you may be aware, Charter will be announcing its fourth-quarter earnings report at the end of the week on Friday, January 28.

Coming off an impressive third quarter, CHTR stock would naturally be on the watchlist of many investors. The company delivered earnings of $6.69 per share, an increase of 66.8% year-over-year. Also, its revenue was $13.1 billion, increasing by a respectable 9.2% year-over-year. Overall, Charter appears to be firing on all cylinders and trending in the right direction. With that in mind, would you consider adding CHTR stock to your watchlist ahead of its earnings report?

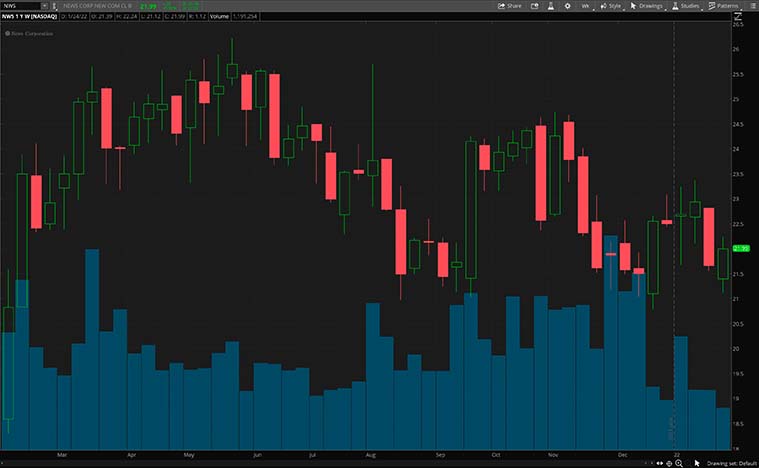

News Corp

In today’s communication industry, the media continues to play a massive role. And that brings us to News Corp, a media and information services company that specializes in authoritative and engaging content. It also has brands such as The Wall Street Journal, Barron’s, Dow Jones, The Sun, and many more.

Last month, News Corp announced that it has agreed to acquire the Base Chemicals business from S&P Global and IHS Markit. It will then be part of Dow Jones’s Professional Information Business alongside OPIS, the energy and renewables data, and information business. Basically, Base Chemicals will provide pricing data, insights, and forecasting capabilities for the world’s most important base chemicals. With a strong track record of growth and revenue base, it would be a positive addition to the company. Therefore, do you think NWS stock will have more room to grow?

[Read More] Best Artificial Intelligence Stocks To Buy Right Now? 5 To Watch

Vodafone

Similar to T-Mobile, Vodafone is a company that specializes in telecommunication services. Put simply, it provides a range of mobile services, enabling customers to reliably call, text, and access data. In addition, Vodafone also has an African payment platform known as M-Pesa. It offers money transfer services and a range of other financial services. Despite an underwhelming 2021 for the stock, VOD stock has risen nearly 10% this year.

Recently, there are reports that Vodafone and Iliad are in talks to strike a deal in Italy that would form a business partnership. The collaboration aims to end cut-throat competition in the eurozone’s third-biggest economy. For those unaware, Iliad had just made its wireline broadband debut yesterday and is working with investment bank Lazard on its strategic plans in Italy. Should this deal between Vodafone and Iliad be successful, it may well create a telecoms powerhouse with a mobile market penetration of about 36% and combined revenue of nearly $6.77 billion. Given such an exciting development, would you be watching VOD stock?

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!