5 Top Cyclical Stocks For Your Watchlist This Week

Cyclical stocks appear to be in fashion once again in the stock market today. For the most part, this would be thanks to a wide variety of factors in play. In essence, many companies continue to exceed Wall Street’s expectations. Adding to the current momentum would be the general trajectory of the economy now. Even as government stimulus and pandemic-era aid wanes, consumer markets remain strong. Seeing as we are well into the fourth quarter of the year, where general spending is higher, this is arguably, encouraging.

For example, we could take a look at the likes of Cleveland-Cliffs (NYSE: CLF) and American Express (NYSE: AXP) now. While both companies’ core businesses may differ, they both thrive amidst times of economic growth. Not to mention each company reported record figures in their respective third-quarter earnings calls. On one hand, Cleveland-Cliffs posted a record quarterly revenue of $6 billion and a record net income of $1.3 billion. On the other hand, Amex saw an earnings per share of $2.27 on record third-quarter revenue of $10.9 billion. It smashed earnings estimates of $1.80 a share. As cyclical stocks appear to be kicking into high gear, I could understand if investors are keen on the sector. Could that make one of these cyclical players top picks in the stock market now?

Top Cyclical Stocks To Watch Today

- Urban Outfitters (NASDAQ: URBN)

- Robinhood Markets Inc. (NASDAQ: HOOD)

- Target Corporation (NYSE: TGT)

- Walmart Inc. (NYSE: WMT)

- Mattel Inc. (NASDAQ: MAT)

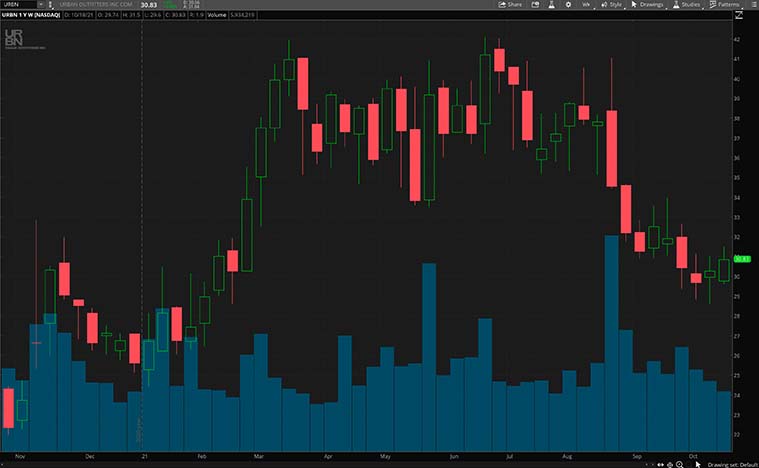

Urban Outfitters

Urban Outfitters is a cyclical company that focuses on lifestyle retail. It has stores all over the world with its portfolio of global consumer brands. This would include Urban Outfitters, Anthropologie, and Free People, among others. It mainly targets young adults with a mix of women’s and men’s fashion apparel, footwear, and wellness products. URBN stock is up by over 20% in the past year alone.

This past week, the company received an upgrade from Citi to a buy rating. Citi analysts cite a more favorable risk-reward profile, following a 25% slump in the stock since its last quarterly earnings in August. Ahead of its third-quarter financials in November, the company has had a record second quarter. Diving in, it reported record net sales of $1.16 billion. This was driven by strong double-digit growth in digital channel sales. Net income for the quarter was $127 million or a diluted earnings per share of $1.28. All things considered, will you add URBN stock to your portfolio?

[Read More] 3 Top Real Estate Stocks To Watch In October 2021

Robinhood Markets Inc.

Following that, we have Robinhood Markets, a financial services company that is known for its commission-free online brokerage. It has over 21 active monthly users and has over $100 billion assets under its custody. Its user-friendly products have given rise to retail traders that can start investing at their own pace and terms. The company has also made strides into cryptocurrency trading recently.

Accordingly, last week, the company announced that its new cryptocurrency wallet feature has more than 1 million customers on its waitlist, demonstrating that cryptocurrencies are becoming increasingly important for the company. “We’re very proud of our cryptocurrency platform and giving people more utility with the coins they have,” Robinhood CEO Vlad Tenev said during CNBC’s Disruptor 50 summit on Thursday. “We rolled out our wallets waitlist. A lot of people have been asking for the ability to send and receive cryptocurrencies, transfer them to hardware wallets, transfer them onto the platform to consolidate and the crypto wallets waitlist is well over a million people now.” With that being said, will you invest in HOOD stock?

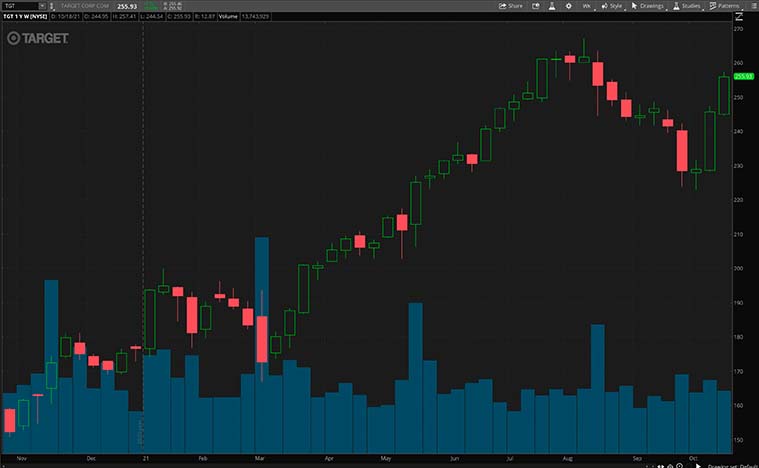

Target Corporation

Moving on, we have Target Corporation, one of the largest retailers in the U.S. with a presence in all 50 U.S. states. With over 300,000 associates and over 1,900 stores, the company is a titan in the retail industry. Also, its retail formats include the discount store Target and the hypermarket SuperTarget. TGT stock has enjoyed gains of over 60% in the past year.

On October 12, 2021, the company provided an insight into its supply chain strategy. In detail, as unprecedented supply chain challenges continue to impact retailers and industries across the globe, the company has made big investments into its operations and stores-as-fulfillment hubs model to serve its guests even faster and more efficiently. Thanks to the amazing work of teams across the company, its supply chain continues to move as efficiently as possible in time for the holidays. In light of this, should you consider adding TGT stock to your watchlist?

[Read More] Top Reddit Stocks To Buy Right Now? 5 For Your Late 2021 Watchlist

Walmart Inc.

Next up, we have Walmart. As the largest retailer in the world, the company would be a viable cyclical player to know now. Through its massive network of hypermarkets, discount department stores, and grocery stores, Walmart has and continues to cater to consumers worldwide. Not to mention, its stores offer shoppers a wide array of products ranging from consumer staples to home electronics. Thanks to its focus on catering to consumers, WMT stock is once again in focus in the stock market now.

For the most part, this is thanks to the company reportedly launching Bitcoin ATMs at select locations. Through a partnership with Coinstar, a coin-cashing machine firm, Walmart shoppers can now buy Bitcoin using ATMs in-store. According to Walmart, there are currently 200 Coinstar kiosks in its stores across the U.S.

[Read More] 5 Financial Stocks To Watch In A Rising Interest Rate Environment

Mattel Inc.

Last but not least is Mattel. In brief, the California-based company is a titan in the global toy manufacturing industry now. Most would be familiar with the company’s flagship brands such as Barbie, Hot Wheels, and UNO among other childhood favorites. For a sense of scale, the company’s products are readily available in over 150 countries worldwide. As it stands, MAT stock has increased by over 60% in the past year.

Thanks to the company’s latest financial report, some could argue that MAT stock has more room to grow. In detail, Mattel posted an earnings per share of $0.84 on net sales of over $1.7 billion for the quarter. In terms of earnings per share, the company exceeded analyst estimates of $0.74. Additionally, Mattel CEO Ynon Kreiz believes that the company is “on a clear path” towards improved profitability and accelerated top-line growth. All this is despite the ongoing global supply chain issues. By and large, it seems that Mattel is heading into the upcoming holiday season strong. Given all of this, will you be keeping an eye on MAT stock?