Check Out These Dividend Stocks Amid A Volatile Stock Market

Dividend stocks are increasingly sought after in the stock market now. That’s especially the case when the Fed has signaled that it will soon begin tapering the asset purchase program. While there isn’t any immediate impact felt at this moment, it makes sense why some are eyeing the less risky areas of the stock market.

You see, most of us would love extra income, but few of us are willing to put in the effort on a side gig. Thankfully, there are other ways to get extra income. And one of them is through investing in some high dividend stocks. Now, you may think that investing in top dividend stocks are for retirees who need income to live off of. But it is also worth pointing out that this section of the stock market can offer lower volatility.

What’s more, some investors are speculating that a stock market crash is imminent. The allure of investing in dividend stocks would be increasingly in focus. After all, companies that pay out regular dividends are often profitable and time-tested, which makes them perfectly suited to help you navigate short-term market downside. That said, you may not want to grab the biggest yields along your way. In addition to a high dividend yield, you should also find companies that are high quality and growing. With all that in mind, here are five dividend stocks for your watchlist in the stock market today.

Top Dividend Stocks To Watch Right Now

- AGNC Investment Corporation (NASDAQ: AGNC)

- Costco Wholesale Corporation (NASDAQ: COST)

- Realty Income Corporation (NYSE: O)

- Chevron Corporation (NYSE: CVX)

- Apple Inc. (NASDAQ: AAPL)

AGNC Investment

AGNC Investment is the largest mortgage real estate investment trust (REIT) by market cap. The mREIT has made a strong comeback after an underwhelming 2020. In brief, the company uses its in-house subsidiaries to help package, buy, and sell government-backed mortgages secured by residential real estate. While mortgage REITs may not be a favorite on Wall Street, there’s no question about AGNC’s consistent dividend yield. The REIT has an annualized dividend yield of about 9%.

What’s more, AGNC almost exclusively invests in agency securities. For those unfamiliar, these assets are backed by the federal government in the event of default. If you’re an investor in the stock market today, you probably know a thing or two about rising interest rates. And that is among the reasons why stocks were down. While it may be bad for stocks in general, a rising interest rate can actually benefit AGNC. For this reason, some may see AGNC stock as a defensive play. With that in mind, would you add AGNC stock to your watchlist?

[Read More] Best Lithium Battery Stocks To Buy Now? 4 To Know

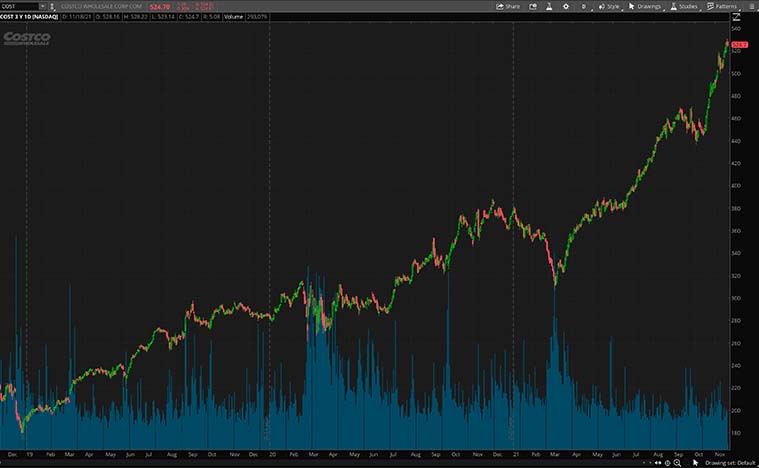

Costco Wholesale

Costco may not be on your list of highest dividend stocks to buy. But it surely checks those boxes for reliable dividends and having a sustainable business model. The pandemic may have caused many retail businesses to shut, but Costco has shown its value as an essential business. In fact, the company’s resilience during the pandemic has made it one of the best defensive stocks to buy. Even at a time of uncertainty, the retail giant continues to post impressive financial results and growth metrics.

For all of 2020, Costco’s total sales grew 7.7% from a year earlier. Part of the company’s growth is coming from its e-commerce channel. What’s more, the company’s membership renewal rate is also the envy of the retailing world at 89% globally. As a result, investors are jumping on COST stock, driving it up nearly 70% year to date. Based on its strong moat in the retail industry, do you have COST stock on your watchlist in the stock market today?

[Read More] 4 Artificial Intelligence Stocks To Watch Right Now

Realty Income

If you’re looking for a monthly dividend stock to buy, look no further than Realty Income. The REIT is a bellwether in one of the most resilient niches of the commercial real estate industry. The company owns more than 6,700 properties, most of which are occupied by retail tenants. That makes up 80% of the portfolio holding. While several REITs pay monthly dividends, this company’s monthly payout is a crucial part of its identity. In fact, the company actually trademarked “The Monthly Dividend Company” as its official nickname. For these reasons, it is no surprise why many dividend investors gravitate toward the stock.

What’s making Realty Income a compelling investment is its portfolio of strong clientele. After all, it has top tenants like Walmart (NYSE: WMT) and Dollar General (NYSE: DG). And these tenants should continue to do well and bring in a stable revenue stream for the company. Besides, the company recently completed the acquisition of peer VEREIT, bringing its number of properties to over the 10,000 mark. Given all of this, it seems to me that O stock is a great dividend stock that’s getting even better.

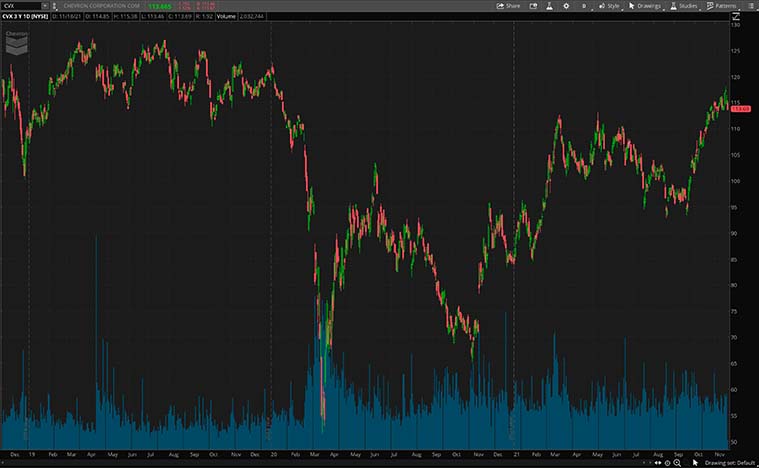

Chevron

Chevron might seem like an odd choice on this list. However, investing in the leading global energy company makes sense right now as a recovery play as we approach the tail end of the pandemic. Among its core offerings are crude oil, natural gas, transportation fuels, lubricants, petrochemicals, and additives. Of course, Wall Street is worried that clean energy will quickly displace fossil fuels within the broader energy landscape. While that’s certainly the bigger trend today, getting rid of oil and gas will likely take longer than what many have anticipated.

If anything, this simply means Chevron can still generate cash from its existing business. Despite higher oil and gas prices, Chevron has kept its spending in check. Instead of splashing its cash for another acquisition, the company chose to reap the benefits of last year’s acquisition of Noble Energy. It’s also worth noting that Warren Buffett has recently increased his stake in CVX stock. While some believe there’s limited upside with the stock, its dividend yield of 4.6% may still prove attractive.

[Read More] 5 Metaverse Stocks To Watch In November 2021

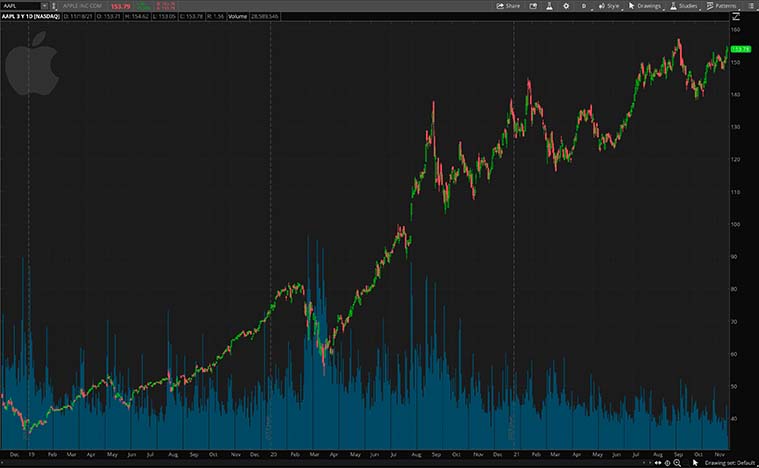

Apple

Many investors probably won’t think of tech giant Apple as a dividend stock. Even with the premium pricing on its devices, Apple continues to thrive amid the current pandemic. Not to mention, the company also offers a wide array of services and subscriptions that synergize well with its devices. All of these make up Apple’s holistic tech ecosystem. On top of all that, the company currently has a quarterly dividend of 22 cents per share.

Admittedly, Apple’s dividend might not seem particularly attractive today. But it’s worth pointing out that its latest quarter dividend is over 7% higher than what it was a year ago. In its most recent quarter, Apple recorded a revenue of $83.4 billion, up 29% year-over-year. Considering its strong growth, there’s much to look forward to. All things considered, would AAPL stock be a top dividend stock to buy right now?