Check Out These 5 Top Energy Stocks In The Stock Market Today

Some of the top energy stocks have been gaining significant traction in the stock market lately. Well, this is largely due to oil prices soaring to their highest since 2014. It appears that geopolitical tensions involving some of the major producers such as the United Arab Emirates and Russia may affect supply. Separately, some OPEC sources believe that a barrel of oil could cost $100 soon. Given these factors, is it surprising that some energy stocks are performing exceptionally well right now?

For instance, the likes of Marathon Oil (NYSE: MRO) and ConocoPhillip (NYSE: COP) have been nothing short of impressive. On one hand, MRO stock has more than doubled its value over the past year. On the other hand, COP stock has risen more than 90% during the same period. However, investors should also note that the energy sector also includes renewable energy stocks. While it may be true that the latter appears to be underperforming its oil and gas counterparts right now, some may argue that this is a buy on dip opportunity. After all, many believe that renewable energy sources would play an increasingly crucial role going forward. Keeping this in mind, do you have a list of the top energy stocks to watch in the stock market today?

Top Energy Stocks To Watch Right Now

- Enphase Energy Inc (NASDAQ: ENPH)

- Exxon Mobil Corp (NYSE: XOM)

- BP plc (NYSE: BP)

- Chevron Corporation (NYSE: CVX)

- Daqo New Energy Corp (NYSE: DQ)

Enphase Energy

First, on the list, we have Enphase Energy. For those unaware, it is a supplier of microinverter-based solar and battery systems. The company’s solutions would enable people to harness the sun to make, use, save, and sell their own power. Today, its microinverters work with virtually every solar panel made, and when paired with its smart battery technology, the company engineers one of the industry’s best-performing clean energy systems. For instance, the company’s Enphase Home Energy Solution with IQ platform provides integrated solar, storage, and energy management solutions.

Enphase started the year by announcing that it has completed the previously announced acquisition of ClipperCreek. Briefly, ClipperCreek offers electric vehicle (EV) charging solutions for residential and commercial customers in the U.S. So, how would this benefit Enphase? Well, it will provide the company distributors and installers globally with EV charging solutions that can be sold alongside solar and battery systems. Also, it will bring Enphase into the rapidly growing EV sector. So, it is understandable that investors are excited about the prospect of ENPH stock right now.

[Read More] Best Lithium Battery Stocks To Buy Now? 4 To Know

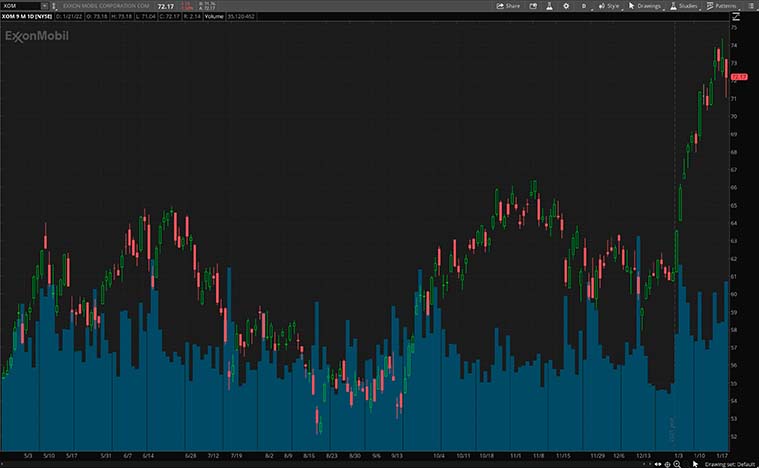

Exxon Mobil

Following that, we have energy giant Exxon Mobil. The company’s Upstream segment covers the exploration and production of crude oil and natural gas. Meanwhile, its Downstream segment manufactures, trades, and sells petroleum products. Impressively, the company stock has climbed approximately 50% over the past year. With oil prices trending higher right now, investors are likely keeping a close eye on the company.

Earlier this month, Exxon showed its interest in biofuels by acquiring a 49.9% stake in Biojet AS, a Norwegian biofuels company. Biojet plans to convert forestry and wood-based construction waste into lower-emissions biofuels and biofuel components. Thus, the company plans to develop up to five facilities to fuel this initiative. Exxon will then be able to purchase as much as 3 million barrels of the products per year. On top of that, the company also recently announced its ambition to achieve net-zero greenhouse gas emissions for operating assets by 2050. All things considered, would XOM stock be worth investing in now?

BP

Another top energy stock to note would be BP. This is a company that delivers heat, light, and mobility products and services to customers around the world. Similar to many energy companies, the company has both Upstream and Downstream segments. The Upstream segment is responsible for activities in oil and natural gas exploration and production. Meanwhile, the Downstream segment is in charge of global marketing and manufacturing operations. Now, BP stock is yet another energy stock riding on bullish momentum, rising more than 25% over the past month.

Last week, BP and the Ministry of Energy and Minerals in Oman announced a partnership to progress world-class scale renewable energy and green hydrogen development. Under the agreement, BP will capture and evaluate solar and wind data. Then, the evaluation will support the government in approving future developments of renewable energy hubs at suitable locations. Overall, the partnership is a significant evolution to BP’s business and aligns with its strategies that include rapidly growing its developed renewable generating capacity. With that in mind, should you be adding BP stock to your watchlist?

[Read More] Top Stocks To Buy Now? 4 Renewable Energy Stocks For Your Watchlist

Chevron

Chevron is a company that engages in integrated energy and chemicals operations. In fact, it is involved in every aspect of the oil and natural gas industries. This includes hydrocarbon exploration and production, refining, chemical manufacturing, and power generation. Only behind Exxon, the company is the second-largest oil company in the U.S. So, it should not come as a surprise that investors are focusing on CVX stock right now. It also helps that CVX stock is trending upward lately, climbing more than 30% over the past six months.

With that said, the company’s highly anticipated fourth-quarter earnings report will be released on January 28. After all, Chevron did just come off its best third-quarter earnings since 2013. During the quarter, the company reported earnings of $6.1 billion or $3.19 per diluted share, compared to a loss of $207 million or $0.12 per diluted share in the previous year’s quarter. Meanwhile, its sales and other operating revenues were $43 billion, an increase of 79.1% year-over-year. Thus, would you consider jumping on the CVX stock bandwagon ahead of its earnings report?

[Read More] Best Monthly Dividend Stocks To Buy Now? 5 For Your List

Daqo New Energy

To sum up the list, we have the polysilicon manufacturer, Daqo New Energy. Essentially, the company plays an important role in the alternative energy sector by providing polysilicon to photovoltaic product manufacturers. These are then processed into ingots, wafers, cells, and modules for solar power solutions. In addition, it also offers wafers through its downstream photovoltaic product manufacturing business. For a sense of scale, the company’s wafer manufacturing annual capacity is approximately 90 million pieces.

Earlier this year, Daqo announced that its subsidiary Xinjiang Daqo had obtained energy consumption approval for its polysilicon projects in Baotou, China. The project consists of a 100,000 MT polysilicon project for the solar industry and a 1,000 MT polysilicon project for the semiconductor industry. Safe to say, this new development will significantly increase the company’s production capacity. Moreover, it is an opportunity for Daqo to expand its business into the semiconductor industry. All in all, this is a positive development for the company that would excite investors. With that said, should you be keeping a close watch on DQ stock right now?

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!