Top Fintech Stocks To Watch In The Stock Market Today

Given the convenience and pandemic-driven necessity of digital payment solutions, fintech stocks continue to be attractive options in the stock market. There’s no question that fintech players have taken the financial industry by storm in recent years. Not to mention, they have threatened to disrupt the stranglehold that traditional financial institutions have had over decades.

Of course, many traditional banks are not resting on their laurels. For instance, Goldman Sachs (NYSE: GS) recently announced the acquisition of buy now, pay later (BNPL) fintech GreenSky (NASDAQ: GSKY) for $2.24 billion. The acquisition, which is still subject to regulatory approval, is expected to close in the fourth quarter of 2021 or the first quarter of 2022.

With the acquisition of GreenSky, Goldman hopes to bolster its consumer business and offer new ways to attract consumers to its Marcus funnel. For those unfamiliar, Marcus is a consumer-focused brand that was launched to compete with a growing set of fintech startups. The company believes that aligning GreenSky’s unique capabilities with the expanding products of Marcus would position them for significant growth. With so much happening in the space, here are five fintech stocks to watch in the stock market today.

Top Fintech Stocks To Buy [Or Sell] Right Now

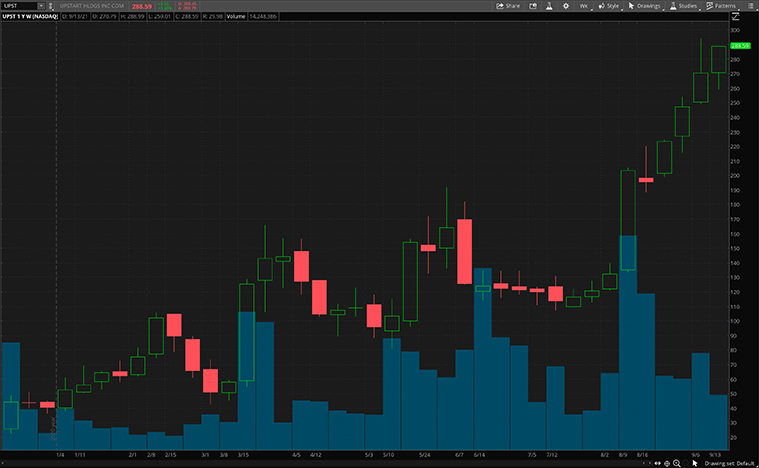

- Upstart Holdings Inc. (NASDAQ: UPST)

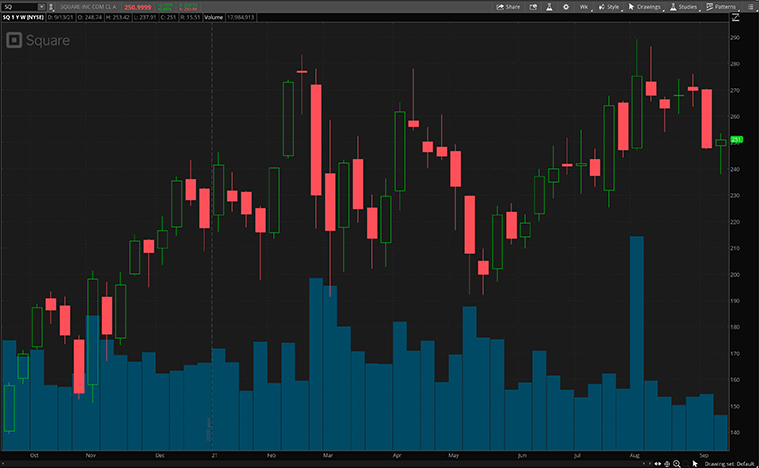

- Square Inc. (NYSE: SQ)

- Paysafe Ltd. (NYSE: PSFE)

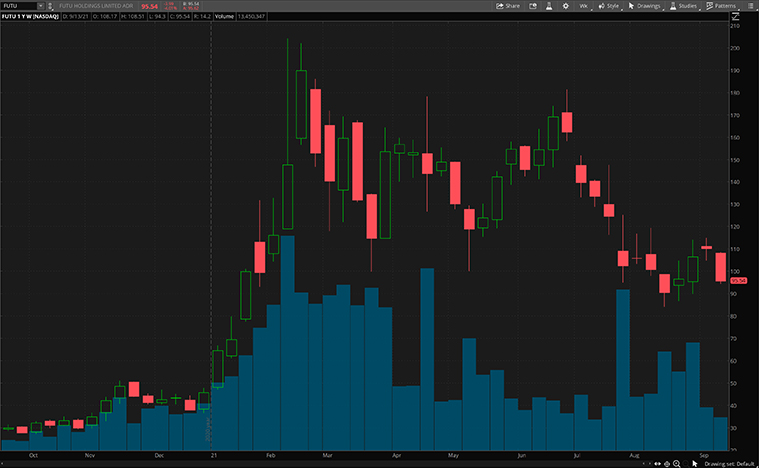

- Futu Holdings Ltd. (NASDAQ: FUTU)

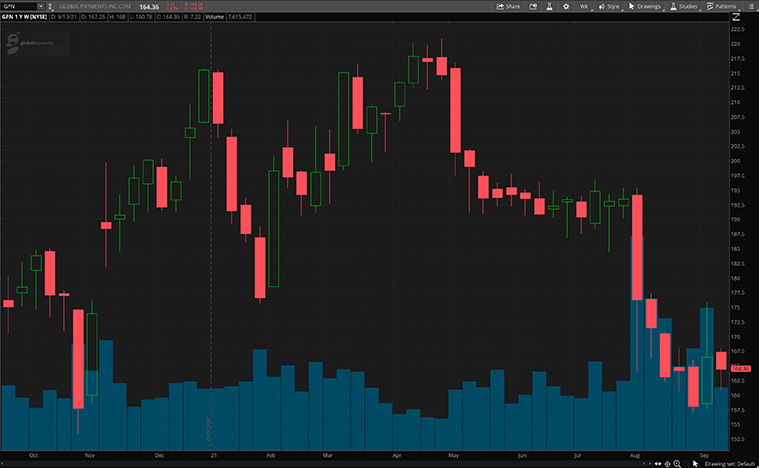

- Global Payments Inc. (NYSE: GPN)

Upstart

Starting us off is one of the most successful IPO stocks from late 2020, Upstart. The company has seen significant interest in its core offering. In brief, the company uses artificial intelligence (AI) in its cloud-based lending platform. Its platform enables banks to provide personal loans with more accurate credit scores for lenders. By utilizing the proprietary AI algorithm, it helps to automate the lending process and help lenders grow their loan books efficiently. Recently, Atlantic Equities initiated coverage for UPST stock with an overweight rating and a $290 price target.

Upstart’s platform can potentially offer higher approval rates and lower loss rates. Therefore, it may be able to allow more borrowers to access credit. If in doubt, investors just need to look at the company’s recent fiscal quarter. The company reported revenue growth of more than 1,000%. What’s more, Upstart is also profitable, an uncommon feat among such high-growth stocks. With the company’s current position of strength, I’m not surprised if UPST stock investors are keeping their foot on the gas.

Read More

Square

Square is a company that specializes in digital payments. Square’s product line includes Cash App, which allows users to send and receive money for free through a mobile application. Square is no stranger to frequently launching new services and upgrading its business to keep up with the times. In early August, Square announced the acquisition of BNPL company Afterpay (OTCMKTS: AFTPF) for an implied value of $29 billion. The deal is expected to be closed in the first quarter of 2022.

With Afterpay now on board, the company will have access to its pioneering global BNPL platform. This would accelerate Square’s strategic priorities for its Seller and Cash App ecosystems. At the same time, this will also support Square’s consumers with flexible payment options. The company’s second-quarter report was also impressive across the board. Considering all these, would SQ stock be on your watchlist this month?

[Read more] Best Stocks To Invest In 2021? 3 Cyclical Stocks To Watch

Paysafe

Next up, we have Paysafe, a multinational online payments company. From online to in-store payments and merchant acquiring to payment gateways, the company offers businesses a one-stop solution to digitalize. Not only that, but a good portion of the optimism also stems from Paysafe’s continuing expansion plans. Just in August alone, PaySafe has announced three acquisitions to tap into the alternative payment space in both Latin America and Germany. If anything, the company’s aggressive string of recent acquisitions will be crucial in driving the company’s growth moving forward.

From its second quarter, Paysafe processed over $32 billion worth of transactions globally. The company now has over 12.1 million customers under its eCash segment. In particular, this segment saw a 48% growth in revenue in the second quarter, thanks to the expansion in the iGaming space. With the company’s growth runway ahead, would you invest in PSFE stock?

Futu

Another top fintech name to watch would be Futu. The company engages in offering online brokerage services primarily in China. It also offers margin financing services. Most of the company’s services can be accessed through its digital brokerage platform under the name Futu NiuNiu. More impressively, the company has strong backing from notable shareholders like Tencent (OTCMKTS: TCEHY), Matrix Holdings, and Sequoia Capital. With the backing of a company like Tencent, coupled with retail investing tailwinds, the potential for Futu to cement itself as a leader in China’s mobile and online brokerage is bright indeed.

From the company’s second-quarter earnings, total revenue was 129.3% higher year-over-year at $203.1 million. In line with that, its net income also increased by 125.8% to $68.7 million. Despite facing challenges due to equities market performances, its total client assets increased to $64.6 billion, a growth of 253.5% year-over-year. All these reflect a strong international expansion by the company where Singapore contributed a significant portion of this growth. With that in mind, would FUTU stock be a top fintech stock to watch?

[Read More] Best Lithium Battery Stocks To Buy Now? 4 To Know

Global Payments

To sum up the list, Global Payments is a company that specializes in payment technology services. In detail, the company primarily provides payment solutions for credit cards, debit cards, electronic payments, and check-related services. Last week, the company announced the acquisition of MineralTree, a leading provider of accounts payable automation and business-to-business payments solutions. MineralTree’s cloud-native solutions substantially expand Global Payments’ target addressable markets and provide significant incremental avenues for growth.

Moreover, Global Payments also formed a strategic alliance with Virgin Money. Both companies are working to launch a new connected payment offering that creates frictionless experiences for Virgin Money’s consumers and merchants. Global Payments will serve as the exclusive provider of merchant services to Virgin Money. More importantly, this will enable the company to offer payment solutions in the UK. With these pieces of news, would you consider buying GPN stock?