Are These The Best Work From Home Tech Stocks To Buy Right Now?

The market for tech stocks has been rather strong in 2020. That was until September 2nd came around, and the stock market began to fall. As of September 4th, the Dow has dropped nearly 600 points and the Nasdaq has dropped 2%. Data from the Labor Department recently showed that the economy regained 1.4 million jobs in August against a 1.2 million prediction. There is still a slow economic recovery though.

With that being said, could this be the right time to buy work from home tech stocks? Tech stocks have been one of the largest growing sectors of the market in 2020. In fact, US tech stocks are now worth more than the entire European stock market. When the market itself recovers again, these tech stocks could go back up. So there are many tech stocks to watch during this time. Let’s talk about 3 potential companies for your list of tech stocks.

Read More

- Should Investors Buy These Electric Vehicle Stocks As Tesla Extends Its Pullback?

- Are These The Best Retail Stocks To Buy Right Now? 3 Names To Watch

Work From Home Tech Stocks To Buy [Or Sell] In September: DocuSign Inc.

The first tech stock we must discuss is DocuSign Inc. (DOCU Stock Report). DocuSign is a tech company that allows people to create electronic agreements. DocuSign will allow you to sign a contract digitally with ease. The company decided to IPO back in April 2018. Since many businesses are dealing with closure due to COVID-19, people are turning to DocuSign for important agreements.

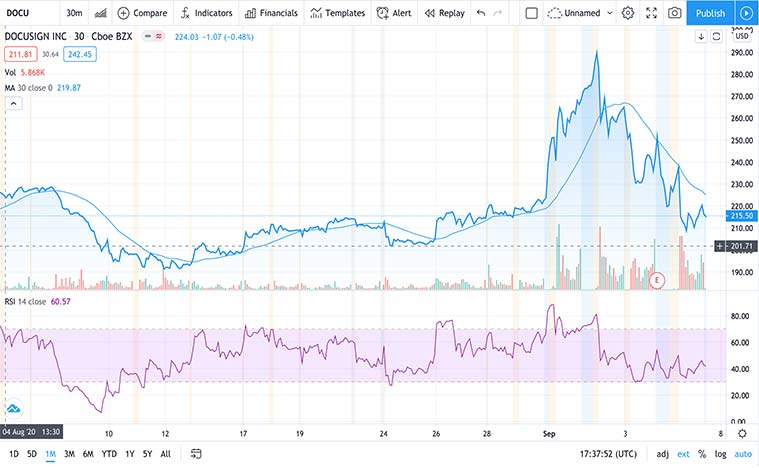

This recent fall of the market has affected DocuSign as well. DOCU stock is down 22.5% from September 2nd as of the 4th. DOCU stock was at $279 a share and is now at $216 a share. This is a similar issue that most tech stocks are dealing with this week. We’ve seen even Tesla Inc. (TSLA Stock Report) fall 18.3% in the last couple of days as well. Other than this downfall DOCU stock is performing well this year. When 2020 started, DOCU stock price was at $75 a share, making $279 a share its new record high.

Work From Home Tech Stocks To Buy [Or Sell] In September: Zoom Video Communications

This next tech stock, Zoom Video Communications Inc. (ZM Stock Report), has become quite popular in 2020. Zoom has been making headlines with its video communication software. Zoom is being used for personal, business, and school purposes. Even the Queen of England has used Zoom in 2020. ZM stock went public on April 30th, 2019. People have needed to stay connected during the pandemic and Zoom provided the perfect platform for people to do so. That is what has made ZM stock such a gainer in 2020.

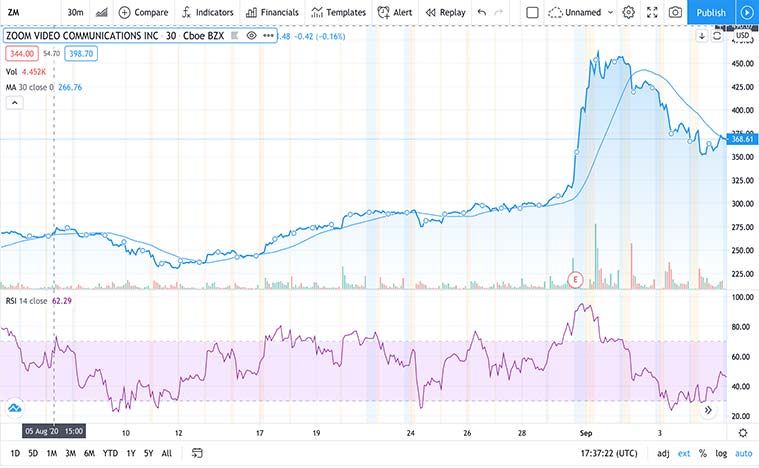

Zoom released positive financial results on August 31st. This caused ZM stock price to go from $325 a share to $462 a share the next day. But with the market falling, ZM stock has gone back down to $363 a share. This is still far above its $325 a share price from before the financial results were released though. That is what makes ZM stock a tech stock to watch. If the company can keep its momentum going in a positive direction it could continue to strive.

[Read More] Top Bank Stocks To Buy According To These Analysts

Work From Home Tech Stocks To Buy [Or Sell] In September: Oracle

This last tech stock, Oracle Corporation (ORCL Stock Report) has been trending for a few reasons. Oracle is a tech company that sells software, cloud services, and more. As of 2019, it is the second-largest software company in the world by revenue. It is also the second-largest software company by market cap. Oracle has been able to reach new heights due to its positive drive throughout 2020. Oracle has also been public about its offer to buy TikTok. That has been driving ORCL stock upwards as well.

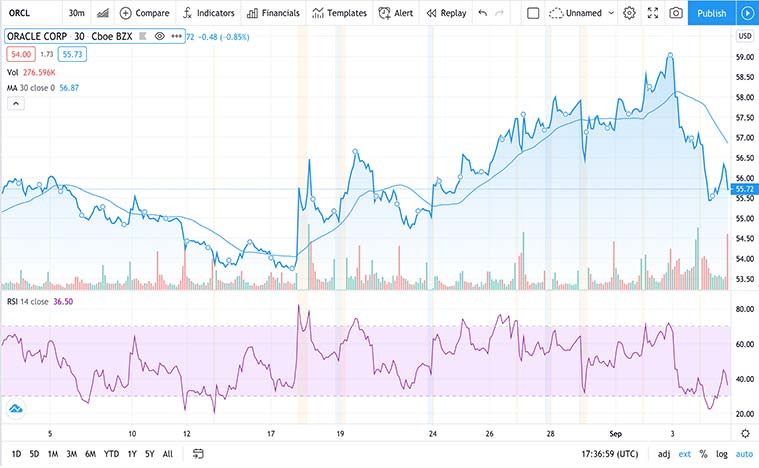

At the start of 2020, ORCL stock price was at $53 a share on average. When the pandemic arrived, ORCL stock fell to $39 a share at one point in March. Since then, ORCL stock has fully recovered as its at $55 a share on September 4th. On September 2nd, ORCL stock price was at $59 a share but it has fell to $55 a share due to the market falling. Do you think ORCL stock will go back up when the market ends this downwards trend?

What Now

Tech stocks have been a valuable part of the market in 2020. That is why some investors see this dip as the perfect time to buy. It is unsure when the market will recover from this drop regardless. That is why these are all tech stocks to watch in case of recovery.