Could Easing Lockdown Hurt Tech Stocks?

Some of the larger tech stocks are benefiting from the new normal whereby consumers are spending more time at home. But, shares of almost all companies that previously benefited from the stay-at-home order were sliding on Wednesday. That could be due to the possibility that the economy may be opening sooner than we have expected. This in effect prompts some investors to change their investing strategy. They may be reconsolidating their investments into travel-related stocks and offloading some of their positions in the stay-at-home tech stocks. After all, momentum and timing are the key ingredients when it comes to day trading.

Many shift their attention to companies that will benefit as states and national governments lift stay-at-home restrictions. As people begin to travel again, we are seeing upticks in most travel and leisure stocks. The question here is, how long could this momentum last? My concern, though, is the over-optimistic sentiments with these stocks. Why? Because we are still in the midst of a global recession, with nearly 40 million people currently being unemployed in the US. Could the rally in these leisure and travel stocks be short-lived? In my opinion, that depends on the development of an effective vaccine and improvements in the unemployment figure. Otherwise, we might not see a complete recovery in these stocks.

Read More

- 2 Consumer Stocks To Watch This Upcoming Week Ahead Of Earnings

- Are These The Best Tech Stocks To Buy In May?

Tech Stocks To Thrive With Or Without A Pandemic

What if you are not a day trader, but just an investor who prefers to hold stocks for the long term and let them make their own magic. If so, tech stocks might be a better choice, with or without Covid-19. The sharp pull back in some tech stocks are making investors very anxious about the market right now. We must bear in mind that tech stocks are usually a very volatile bunch. They could give you a massive breakout in a short span of time. But they could also go south on a similar scale. When it comes to investing in blue-chip tech stocks, the fundamentals and scalability of the business are the things I pay attention to. With the current dip in tech stocks, are these the best tech stocks to buy now?

Best Tech Stocks To Buy [Or Avoid] # Shopify

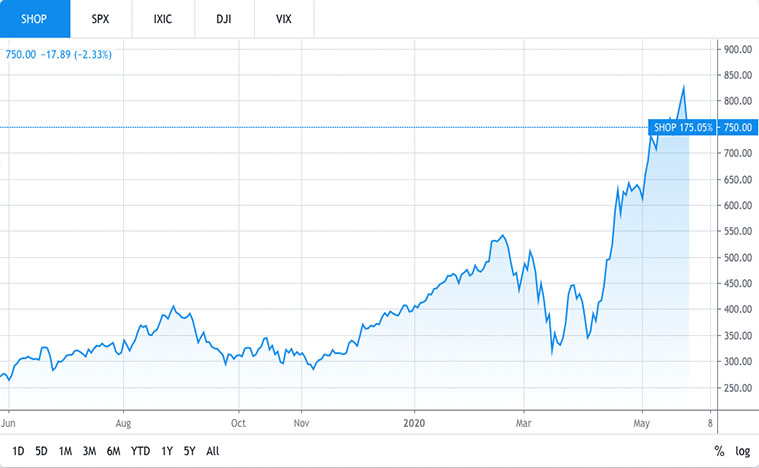

First, Shopify (SHOP Stock Report) recently became the largest company in Canada by market capitalization. The ecommerce company can attribute its meteoric rise to the skyrocketing daily traffic on its platform. This came as the stay-at-home order came into effect to contain the coronavirus. When the company reported their quarter results earlier this month, it did not just beat analysts expectations. Its revenue growth of 47% year-over-year was simply magnificent.

The massive growth with Shopify was pretty unexpected. You only had to blink a few times to miss the ride. Just last month, the company’s chief technology officer Jean-Michel Lemieux tweeted that the platform was handling Black Friday level traffic every day. Shopify has released Shop, a new app to make it easier for customers to speed through checkout, track their order and shipment details. Such measures could help merchants during these trying times. Most recently, the partnership with Facebook and Instagram allows users to shop directly from merchants on those platforms, powered by Shopify. As a result of recent developments, Shopify stock has gone parabolic since the market crash in March, rising from $322.29 to $825.17 (+156%). The stock slid to $686.01 yesterday before bouncing back to $750.00. If there’s a pull back again in the coming days, would SHOP stock be a good buy?

Best Tech Stocks To Buy [Or Avoid] # Netflix

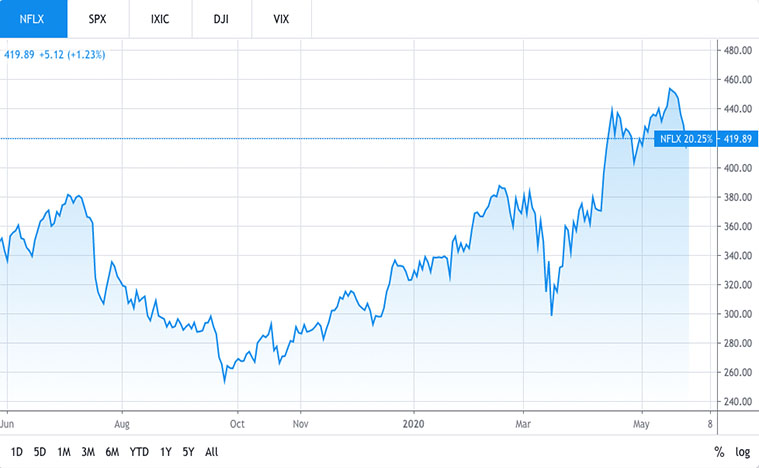

Shares of Netflix (NFLX Stock Report) pulled an intraday U-turn to close higher on Wednesday. The stock slid shortly after the opening bell, likely due to a few reasons. Some analysts said it’s due to the recent launch of HBO Max service while some said it’s the optimism over the easing of lockdown measures. Either way, it may not matter that much at least in the near term. It’s fair to assume that these factors wouldn’t stop the streaming giant from getting bigger. Why?

When it comes to streaming, content is king. With the coronavirus pandemic forcing everyone to stay home, we need to have some form of entertainment to keep our spirits up. If you’re like me, Netflix is a go-to-choice when there’s time to kill. Whether I’m binge-watching the new season of Money Heist or Ozark, I never have trouble finding something entertaining to watch. Also, some would argue that the reopening of cinemas may pose some threats to the streaming giant’s subscription base. To me, this threat is not imminent. Even if cinemas reopen completely, 1) consumers might not flock to the cinemas because the fear of the virus is still there, and 2) many movie producers have delayed their screenings until next year. With these factors in mind, could NFLX stock be testing new highs in the coming weeks?