Top Cybersecurity Stocks To Watch In The Remainder Of 2020

As the coronavirus pandemic continues to ravage the world, people are stuck at home. This has fundamentally changed the way we live and the way we work. Most companies are now employing digital workspaces in place of physical ones. In light of this, cybersecurity stocks are currently in the limelight. In fact, having the means to operate remotely is important but being able to do so safely is even more crucial. According to Cybersecurity Ventures, cybercrimes will likely account for the loss of $6 trillion annually by 2021.

Cybercrime is a constantly evolving and invisible threat. It is no wonder that the global cybersecurity industry is surging at the moment. Consequently, while people rush to guard their digital wealth, could a portfolio of top cybersecurity stocks help with your material wealth? Cloudflare Inc (NET Stock Report) has seen a meteoric rise in the share price. The content shielding cybersecurity stock has seen a year-to-date increase of 211%. Another example would be Check Point Software Technologies (CHKP Stock Report). The company has made a tremendous recovery from the March stock market slide with a 44% increase.

Cybercrime ranges from damage and destruction of data, stolen money, and theft of intellectual property to embezzlement and even reputational harm. As mentioned, the losses could be massive. How much are companies willing to pay to prevent this? Here is a list of top cybersecurity stocks that could provide the services they need.

Read More

- Are These The Top Renewable Energy Stocks To Watch Amidst The Uncertainty Of The U.S. Elections?

- 3 Top Gold Stocks To Watch In November 2020

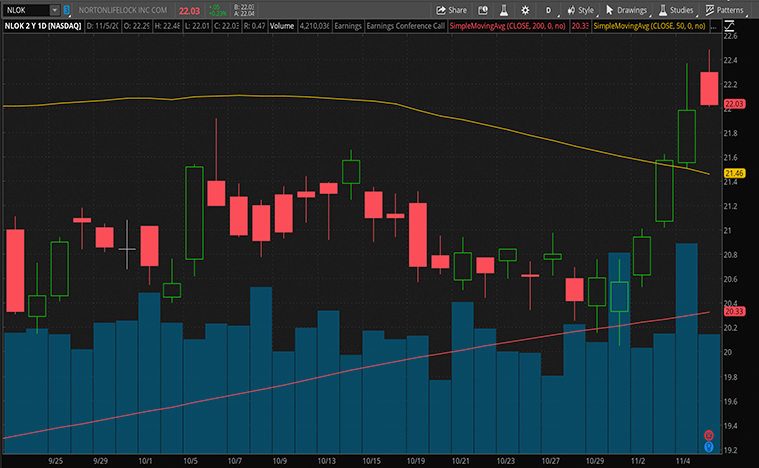

Top Cybersecurity Stocks To Watch Now: NortonLifeLock Inc

The first stock on this list is NortonLifeLock Inc (NLOK Stock Report). NortonLifeLock is a consumer cybersecurity company. The company is based in the U.S. and was founded in 1982. It is well known for providing a wide variety of digital protection services. This includes services for devices, online privacy, home networks, and personal information. In Q2 2020, the company saw a 48% increase in its earnings per share (EPS) year-over-year. Furthermore, it gained 416,000 new clients in the same period. The company has enjoyed a 30% increase in its share price upon recovering from the March stock market slide.

NortonLifeLock appears to have somewhat recovered from its two slides in the stock market this year. In recent news, NortonLifeLock unveiled its Privacy Monitor Assistant (PMA) on November 2. The PMA is a white-glove service created to help consumers “fight back against data brokers” who are looking to sell personal information. As consumers are spending more time online now, many of them have become weary of their personal data while doing so. The PMA could be just the solution to this fear of the general public.

CEO Vincent Pilette summed it up perfectly saying, “With our privacy offerings, Norton Secure VPN, PC SafeCam, and now, Privacy Monitor Assistant, we continue to arm consumers with the tools they need to reclaim control of their online privacy.”

Despite a rocky start in 2020, NortonLifeLock looks keen on regaining momentum. The company’s growing list of personal information protection services will likely attract customers and investors in the long run. With that in mind, could NLOK stock be a cybersecurity stock worth watching?

Top Cybersecurity Stocks To Watch Now: CACI International Inc

The next stock on this list would be CACI International (CACI Stock Report). CACI is an American multinational professional service and information technology company. It is based in Arlington, Virginia, and was founded in 1962. The company is no newcomer to the cybersecurity industry. In fact, it provides services to many branches of the US federal government including defense, homeland security, intelligence, and healthcare. These services include information assurance and security as well as systems integration, reengineering, and electronic commerce.

The company’s share prices saw a surge of almost 10% in the last week. This was likely because the company released its positive Q3 2020 financials. In it, CACI reported a 37.8% year-over-year increase in net income. Additionally, there was a 34% increase in operating income and a 38% increase in diluted EPS. Considering the volatility of CACI at the beginning of the year, the company has regained its foundation.

The company has also given out contract awards totaling up to $1.8 billion. Most notably this includes a five-year $450 million contract to provide enterprise technology in support of Desktop Support Services to the Department of Homeland Security (DHS). Other key contracts involve the Department of Veteran Affairs and the Office of Under Secretary of Defense.

The company appears to be making major moves and has no plans on slowing down. With robust cash flow from operations and bountiful contract awards, could CACI stock be a cybersecurity stock to have in your portfolio?

[Read More] Top Tech Stocks To Watch Before Friday; 3 Names To Know

Top Cybersecurity Stocks To Watch Now: CrowdStrike Holdings Inc

Lastly, we have CrowdStrike Holdings Inc (CRWD Stock Report). CrowdStrike is an American cybersecurity technology company based in California. The company is most well-known for its cloud-based platform, Falcon. It is a collection of services including endpoint security, threat detection, and cyber attack response. This key product is aimed at large organizations. The company is well-known amongst the Fortune 100 companies as it serves almost half of them. For example, Home Depot (HD Stock Report) and Verizon (VZ Stock Report) are amongst CrowdStrike’s list of clients.

Crowdstrike has seen an impressive 72% gain in share price in the last six months. It also reported an 84% year-over-year increase in total revenue in Q2 2020. Furthermore, its adjusted subscription gross margin grew, and it posted a non-GAAP net profit of $12.5 million. This is likely because of the recent surge in subscribers it has received. The company reported a 91% year-over-year increase in subscribers with more than half using four or more of its cloud modules.

Recently, Malwarebytes announced that it will be integrating its services with CrowdStrike. Malwarebytes is a leading provider of advanced endpoint protection and remediation solutions. This deal includes a custom offering in the form of Malwarebytes Remediation.

In short, the deal would integrate this with CrowdStrike’s cybersecurity services. This provides a comprehensive solution for preventing a compromised device from becoming a full-scale breach. Malwarebytes CEO Marcin Klecynski also mentioned that the integration “minimizes business downtime during an attack by automating remediation and neutralizing attacks promptly.” This would be an extremely useful asset for CrowdStrikes larger clients and likely incentivize long-term subscriptions. With all these in mind, the company does not appear to be slowing down in Q4 2020. Could CRWD stocks be a cybersecurity stock to watch in 2020?