Top Financial Stocks To Buy [Or Avoid] In November 2020

At the end of 2019, you would not have expected the finance industry to be flipped over in the stock market. Cue the COVID-19 pandemic, some of the biggest names in the financial sector are now on the brink of bankruptcy. With financial stocks being battered hard since the stock market crash in March 2020, things may seem bleak. Amidst the chaos and uncertainty, however, are financial stocks worth investing in today? Would this be an opportunity for investors to buy financial stocks given that they are at their lowest in the last 2 years?

Bank of America (BAC Stock Report) and Goldman Sachs (GS Stock Report) are some financial stocks that have lost a sizable chunk of their market cap. Despite the downtrend, these companies have taken steps to adapt to this new world brought upon by the pandemic. By shifting to online banking and digital consumer banks, finance companies who do so are able to weather through the pandemic.

Financial services without a doubt are here to stay. It is an essential service that billions all over the world depend on after all. From keeping our money safe in banks to insurance brokerage and accounting services, financial services and fintech are crucial to us. These services will help us manage our money and give us a higher quality of life. The S&P 500 Financials has climbed steadily in recent months, up by 42% since the March lows. This is a clear indication that the finance industry is making a comeback. With that said, here are 3 top financial stocks to watch in the stock market today.

Read More

- Are These The Best Stocks To Buy Ahead Of Ant Group’s Upcoming IPO?

- What Are The Best Tech Stocks To Watch This Week? 1 Reporting Earnings Today

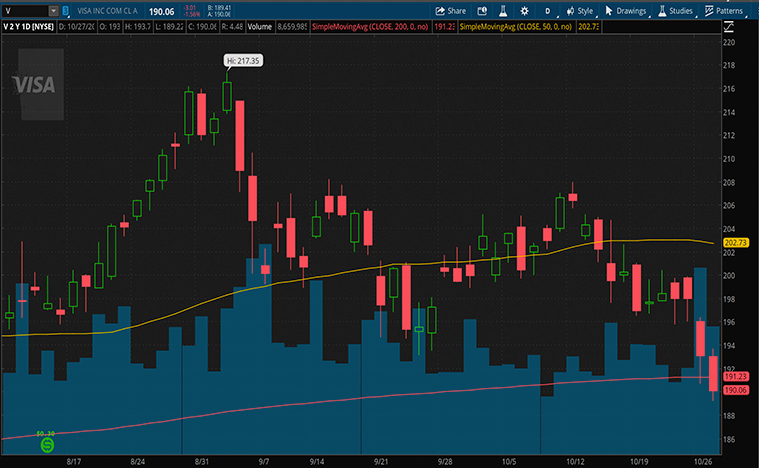

Top Financial Stocks To Buy In November 2020: Visa Inc

The world pre-COVID had already been shifting towards e-commerce and mobile payments. With the pandemic being the catalyst, more people are adopting the idea of a cashless society. At the forefront of the industry, Visa (V Stock Report) provides a fast and safe transfer of funds from customers to merchants. The company has enjoyed a 42% increase in stock price since March and is currently valued at $193.07 per share.

In its third-quarter fiscal posted in July 2020, the company reported a decrease of 17% in revenue at $4.8 billion. The silver lining is that there have been improved payment volumes each month throughout the quarter. Even with the decrease in revenue, Visa is still one of the largest payment processing companies in the world. The company has also reported earnings per share of $1.07 and has paid a hefty $1.6 billion in dividends and repurchases of shares.

Visa has recently announced that it will be offering mobile payment solutions. This allows the company to compete with fintech companies like Square (SQ Stock Report). Its Tap to Phone feature transforms current generation Android smartphones into contactless payment systems without any additional hardware. With contactless payments booming in the COVID-19 era, this cost-effective tool helps businesses. It allows users to access the digital economy, prevents lost sales, and improves cash flow. With that in mind, would you consider adding V stocks to your portfolio?

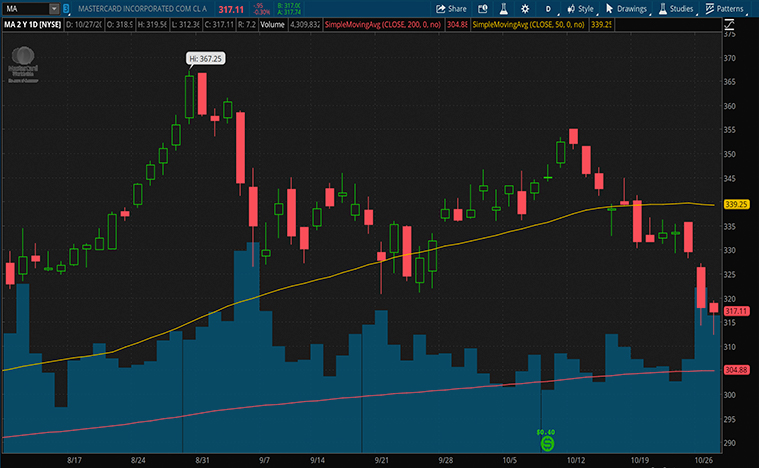

Top Financial Stocks To Buy In November 2020: Mastercard

Holding a duopoly with Visa, Mastercard (MA Stock Report) has also had a bumpy ride in the stock market. The two companies share a similar fate where a decline in payment volume was observed. With more people staying at home at the beginning of the pandemic, this was a given. Despite being affected by the pandemic, the company has enjoyed a 56% increase in share price since March.

The company has invested heavily into cashless payments and have almost doubled their fees on card payments over the past two years. As the COVID-19 pandemic speeds the transition to cashless payment solutions, the company expects to earn higher revenue from this increase in fees. With analysts expecting most Asian and European countries to go cashless by 2030, Mastercard seems to be in the right position. The company has also seen significant year-on-year growth in contactless in-person transactions. Be it card, mobile device, or wearables, contactless payment now represents 63% of in-store transactions across Europe.

Fortunately, Mastercard has a broad range of market-leading services, from insights and analytics to cybersecurity tools. This allows the company to support its partners’ evolving needs in a rapidly changing world. Mastercard had also acquired Finicity in June 2020. Finicity offers better financial data for customers to make better credit decisions. By incorporating this into Mastercard’s operations, the company expects to further enhance and grow its banking reach and capabilities. With such exciting developments surrounding Mastercard, does this make MA stocks a top financial stock to buy?

[Read More] Top Video Game Stocks To Watch In November 2020; 3 Names To Watch

Top Financial Stocks To Buy In November 2020: PayPal Holdings

One of the few financial stocks to have enjoyed 2020, PayPal (PYPL Stock Report) has been in the limelight recently. Despite falling 7% in the last three trading days, the online payments giant has enjoyed a share price increase of 77% year-to-date. PayPal has emerged a winner in this pandemic as more people than ever are turning to their services.

In the company’s latest fiscal posting, it had reported the strongest quarter in PayPal’s history. The company had reported revenue growth of 25% at $5.26 billion. In addition to the revenue growth, the company had witnessed a 37% increase in daily active accounts year-over-year. These impressive feats are only achievable by PayPal. The reason being that as borders close all around the world, PayPal offers better rates for transferring money across countries than conventional banks.

The company had also noted that there were 346 million active consumer accounts across all its businesses. PayPal’s digital wallet app Venmo allows for digital payments and peer-to-peer payments. Venmo payments volume was reported to have increased by a staggering 52% to approximately $37 billion in the second quarter. PayPal had also acquired Honey last year. Honey is a browser extension that automatically finds and applies coupons codes at checkout. You can see that PayPal has been setting itself up in the online payment services in the last few years. This does position PYPL stock as one of the top financial stocks to watch in 2020.