Are Investors Bullish On These Video Streaming Stocks?

There’s no question that the coronavirus pandemic has been benefiting video streaming stocks immensely. The coronavirus has all but shut down in-person forms of entertainment. This caused most consumers to switch toward streaming services, which they can enjoy in the comfort of their own home. In fact, the red hot rally among video streaming stocks has seen some challenges recently. The tech sell-off which started last Thursday dragged most tech stocks down, and streaming stocks are not spared. But if you see the coronavirus pandemic as a catalyst for meaningful long term investment in video streaming stocks, read on.

The year 2020 is a year where many new video streaming providers launched new services. All of this new competition may have some investors wondering if the streaming space is getting a little bit too crowded. And most importantly, whether investors can benefit from such intense competition at all. These companies are looking to win over viewers globally. The winners of this battle will be sure to enjoy the fruits of their labor, rewarding shareholders along the way. With that in mind, are these streaming stocks on your watchlist for the remainder of 2020?

Read More

- Are These The Top Tech Stocks To Buy Amid The Tech Rebound?

- Top 3 Consumer Staples Stocks To Watch In September 2020

Top Streaming Stocks To Buy [Or Avoid]: Netflix

Video streaming giant Netflix (NFLX Stock Report) comes to mind immediately among the list of streaming stocks to buy. Shares of NFLX have been under pressure in recent weeks along with the broader tech sector. Shortly after the broader market sell-off, the “Cancel Netflix” hashtag is putting another pressure as the streaming giant faces heavy flak for its controversial film Cuties, which made its debut on the service this week. The French film was a Sundance favorite in 2019 but has drawn heavy criticism from those saying it sexualizes young girls. While it should come as no surprise that Netflix capitalized hard during the pandemic, investors should prepare for volatility in the next few trading sessions.

Given its vast content and affordable pricing, Netflix should remain sticky for customers. It is only natural that with limited outdoor entertainment options, most consumers will turn to Netflix. If you have been eyeing this stock, would this be the perfect moment to jump in after the recent dip?

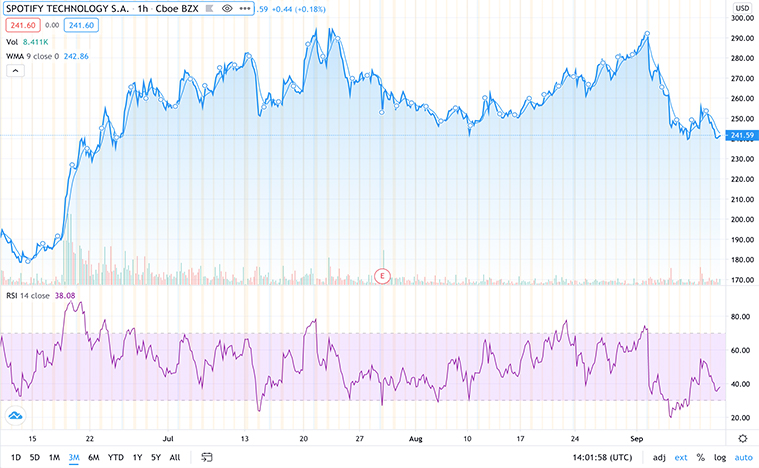

Top Streaming Stocks To Buy [Or Avoid]: Spotify Technology

Shares of Spotify Technology (SPOT Stock Report) were rebounding after Credit Suisse analysts upgraded it from “Neutral” to “Outperform” on Thursday morning. This couldn’t come at a better time as the share price has been showing some weakness in recent weeks. Further gains here would serve as an impetus to drive investors’ interest.

The main growth driver of Spotify seems to be its singular focus on music streaming. But the addition of podcasts will increase their offerings to stay at the leading spot. Of course, the new offering is unlikely to bring huge profits to the company anytime soon. We know podcasts could be big, but many think that it will be huge in the long run. This means this is a streaming stock worth watching from the medium to the long term.

[Read More] Are These Top Cloud Stocks A Buy Right Now?

Top Streaming Stocks To Buy [Or Avoid]: Roku

Shares of Roku (ROKU Stock Report) have been making big moves in recent weeks. The breakout occurred after two analysts issued bullish reports about the video streaming platform, noting increased demand as people shelter at home during the novel coronavirus pandemic and watch more videos.

The company has the highest consumer satisfaction rate when it comes to quality, with 54% of respondents rating their Roku device as six or higher on a 10-point scale. This outpaced Amazon Fire TV, with 53% satisfaction rate, and Apple TV at 38%. There is plenty of room for growth as more than two-thirds of consumers do not have a television that can connect directly to the Internet. That means they need a device like those that Roku offers. While ROKU stock has shown respectable gains this year, it is somewhat under the radar in comparison with other players in the market.