Should You Be Watching These Top Streaming Stocks Next Week?

We all know that streaming stocks had an invigorating year on the stock market in 2020. With the coronavirus pandemic and rising cord-cutting trends, the industry continues to increase its market share. As expected, more people have been staying at home and the top streaming stocks to watch have been keeping them entertained. Adding to that, the Biden administration just unveiled a $1.9 trillion coronavirus stimulus package. In theory, the streaming industry is a prime place for consumers looking to spend their discretionary dollars. Given all of this, I’m not surprised that investors have turned their heads towards this section of the stock market over the last few months.

Take streaming company Roku (NASDAQ: ROKU) for example. Its share prices have more than tripled over the past year. Seeing as it provides both the hardware and digital content for consumers, this is no surprise. Another top player in the industry now would be Disney (NYSE: DIS) with its Disney+ streaming service. When the coronavirus pandemic initially hit, most were quick to label it as an “epicenter stock”. However, DIS stock has doubled since the stock market crash in March. This is where its streaming service comes into play. Disney managed to leverage its wide pool of content by bringing it directly to viewers in their homes. With the pandemic months or years away from ending, the industry still has potential for growth.

Evidently, investors and companies alike are aware of this. Many of the latter have shifted their attention towards bolstering existing streaming services. This is through acquisitions, collaborations, and deals throughout the entertainment industry. With so much going on in the space now, investors may be looking for viable entry points. If you are one of them, here is a list of the best streaming stocks to watch going into next week.

Read More

- 3 Top Software Stocks To Watch In January 2021

- Is Affirm (AFRM) Stock The Best Fintech Stock To Buy Other Than PayPal & Square?

Top Streaming Stocks To Watch Right Now

- ViacomCBS (NASDAQ: VIAC)

- Amazon.com (NASDAQ: AMZN)

- Netflix (NASDAQ: NFLX)

ViacomCBS

First up, Viacom is a cable TV company that has pivoted towards the streaming business. The multinational mass media conglomerate has been in the spotlight this week. For starters, VIAC stock is looking at gains of over 15% since this week’s opening bell. This could be thanks to news of a recent upgrade from Wells Fargo (NYSE: WFC) and the company’s latest project.

Earlier this week, Wells Fargo boosted its estimates for VIAC stock on account of stronger ad trends. The bank raised its price target from $30 to $43. Furthermore, the company delivered the first-ever addressable impressions within a live national broadcast yesterday. What that means is that different ads can now be shown to different viewers watching the same TV program. Viacom SVP of Advanced Advertising Mike Dean explained, “This breakthrough allows ViacomCBS to deliver the most powerful solution for our advertisers by combining the reach of national broadcast with the targeted relevance of household addressable.” This was undoable until now, marking a tremendous milestone for the industry as a whole. Overall, it seems that Viacom is looking to make the most of rising ad trends. Should it leverage its ad expertise with its streaming services, investors would have reason to watch VIAC stock.

In its third-quarter fiscal reported in November, the company posted stellar figures across the board. In detail, the company brought in $6.12 billion in total revenue for the quarter. For its streaming services, the company saw spikes of 72% in subscribers and 78% in revenue over the same period. All this coupled with the upcoming launch of its Paramount+ streaming service marks exciting times for VIAC stock ahead. Would you agree?

[Read More] Looking For The Best Tech Stocks To Buy This Month? 3 Names To Watch

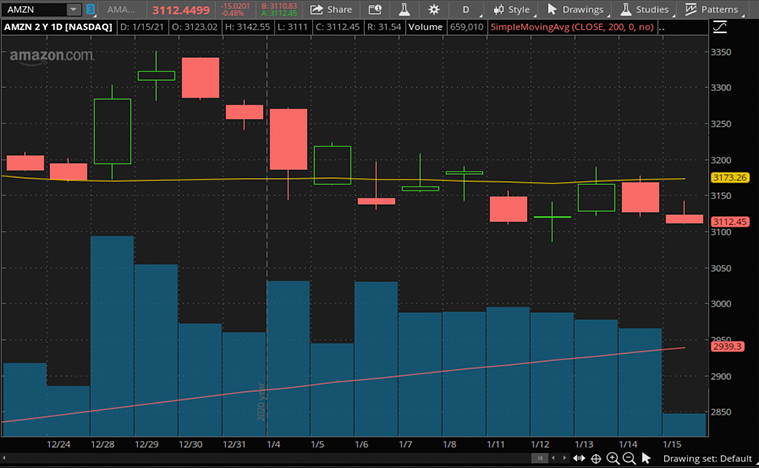

Amazon.com

Another top streaming stock to watch now would be Amazon. Primarily, we will be looking at its streaming service Amazon Prime Video (APV). APV is the company’s subscription-based video-on-demand streaming and rental service. Spectacularly, Amazon has included APV access as a perk along with its Amazon Prime subscription services. With this, the company can cater to rising streaming and e-commerce demands through its all-in-one subscription service. In relation to that, investors may be wondering if AMZN stock still has room to grow given its impressive gains over the past year.

Well, among other things, Amazon just made a very bold play towards the streaming market in India yesterday. The company launched a $1.20 mobile APV plan in India known as Prime Video Mobile Edition (PVME). The company has partnered with local telecom network Airtel in the process. In brief, PVME is a 28-day mobile-only plan which comes with 6GB of mobile data. With its affordable price in mind, Amazon seems to be keeping up with its rivals as it expands its affordable streaming service into new markets. Not forgetting, Amazon also announced plans of expanding APV services to Europe just last month. With such aggressive plays, investors’ list of reasons to watch AMZN stock appears to be growing longer.

Even with the growing competition for subscribers, APV does not seem to be backing down. Last year, the company reported having over 150 million APV subscribers. Taking into consideration the growing adoption of Amazon’s Prime subscription package, APV could hold its own against the competition. All in all, Amazon brings an affordable and convenient streaming service option to the table. With its global ambitions for APV, do you think AMZN stock will have another record year?

[Read More] 3 E-Commerce Stocks To Watch Ahead Of Biden’s $1.5 Trillion Stimulus

Netflix

Finally, we have streaming titan Netflix. The California-based production company has become a household name over the last few years. With its library boasting a plethora of self-produced and licensed series, it is a go-to streaming platform for many. Boosted by pandemic tailwinds, it has shown little signs of slowing down. In fact, NFLX stock had one of its best years on the stock market in 2020. Regardless, investors are likely curious to know if it can perform again this year.

Well, earlier this week the company showed investors that it is not resting on its laurels just yet. Namely, Netflix announced that it would be releasing a new self-produced movie every week in 2021. You read that right, there will be over 50 star-studded top-quality movies coming down the pipeline this year. I’d say Netflix has no plans to lose out to its competition this year. Aside from that, the company also has solid justifications for its recent increase in subscription fees. With such a strong start to 2021, NFLX stock is definitely in the limelight now.

In terms of financials, Netflix reported solid figures across the board in its recent quarter fiscal. Impressively, the company raked in $6.44 billion in total revenue. It also ended the quarter with $8.39 billion in cash on hand which marked an 89% year-over-year jump. Netflix also reported 28.1 million total new subscribers for the first nine months of 2020. Looking forward, the company forecasted this number to rise by another 6 million by the end of its fourth quarter. With Netflix slated to release its fourth-quarter fiscal next Tuesday, will you be adding NFLX stock to your watchlist?