Are These The Best Retail Stocks To Watch This Week?

The coronavirus pandemic has undoubtedly been a massive challenge for retail stocks this year. Many top retail stocks saw large chunks of their market caps wiped off earlier in the year. However, in recent months, most players in the retail business appear to have put out the fires and regained their composure. They have done so by shifting towards e-commerce and digital sales. This has been a good move for most retail companies. Stores like Kohl’s (KSS Stock Report) and Dillard (DDS Stock Report) are some notable retail companies that have a strong e-commerce presence.

In recent news, Pfizer’s (PFE Stock Report) latest clinical trial results show a 95% efficacy for its coronavirus vaccine. This is excellent news as the company aims to be the first to apply for Emergency Use Authorization (EUA) through the U.S. Food and Drug Administration (FDA). With a EUA, Pfizer along with rival company Moderna (MRNA Stock Report) will be able to get its vaccines out to the masses as soon as possible.

This could foretell the return of brick-and-mortar stores for top retail stocks at the same time as well. Coupled with holiday seasons coming around the corner, the retail industry could be getting a well-deserved break from the financial onslaught of 2020. Can Black Friday add to the rising momentum of the industry? With all that said, here is a list of top retail stocks to watch this week.

Read More

- Are These The Best Airline Stocks To Buy Amid The Positive Vaccine News?

- Top Stocks To Watch As Bitcoin Heads To New Highs In 3 Years

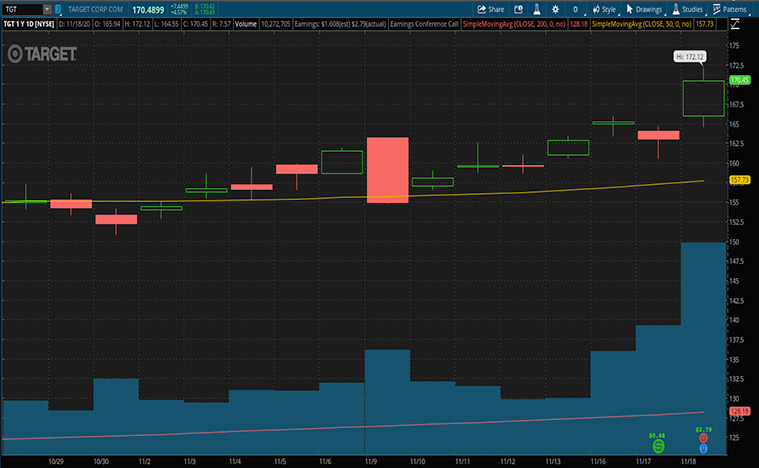

Top Retail Stocks To Watch For Black Friday: Target Corporation

Target (TGT Stock Report) is seeing a 52-week high with shares priced at $168.89 as of 10:22 a.m. ET. The retail giant is the 8th largest retailer in the U.S. This is due to its role as a provider of essential goods and materials which is steadily propelling the company to newer heights. In fact, this has made the company one of the few names in retail to see massive gains throughout the year.

In its recent third-quarter fiscal, the company reports a 21% increase in revenue year-over-year. This is because of its massive 155% increase in digital comparable sales which accounts for over 10% of the company’s sales growth. Additionally, the company also saw a 217% rise in same-day services for the quarter. All of this contributed to a 46% increase in earnings per share from a year ago. Target’s strong yet flexible business model is reflected in these strong results. This is likely why investors are watching the top retail stock closely.

In recent news, Target has just launched its Black Friday sales a week before Black Friday. This year at Target, Black Friday is not a single day but a month-long affair. This would provide ample time for shoppers to flock to the retail company’s store. Target is likely looking to help satisfy their holiday shopping needs with this move. The company is also giving out big savings on highly coveted tech like Apple’s flagship products. The coming holiday season will likely propel its end-year sales to new highs. In light of this, Target will aim to stand out amongst the competition in the weeks leading up to Christmas. Will all this be enough to make TGT stock a top retail stock to watch?

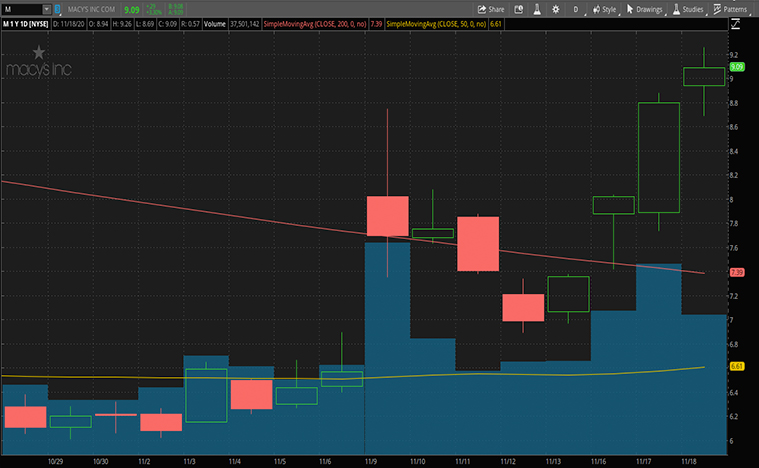

Top Retail Stocks To Watch For Black Friday: Macy’s Inc

The next top retail stock on this list is Macy’s (M Stock Report). Macy’s is a New-York based holding company and has been around since 1929. The company operates its subsidiaries Bloomingdale’s and the beauty store chain Bluemercury. With 771 locations across the U.S., Guam, and Puerto Rico, it is no wonder that Macy’s is the global leading fashion goods retailer. Additionally, the company is also amongst the largest retailers in the world.

In the last week, Macy’s share price is seeing a 12% increase. The company is set to release its third-quarter report tomorrow. In the previous quarter, the company saw a year-over-year decrease of 35% in selling, general, and administrative (SG&A) expenses. This shows its efficient expense management in response to the pandemic. Furthermore, Macy’s reported a 53% growth in digital sales year-over-year which accounted for 54% of total owned comparable sales. The company also finished the quarter strong with a liquidity of approximately $1.4 billion in cash.

Notably, the fashion retail giant announced its Black Friday sales earlier this week. This first wave of sales is likely targeting shoppers who are looking to stock up on ammunition for the upcoming gift-giving season. Macy’s is offering major markdowns on key categories such as holiday décor, cookware sets, and most importantly winter apparel. Holiday décor would help with the general public looking to celebrate a more hopeful holiday season. Additionally, new cookware would be appreciated seeing as people have been cooking at home more often this year. Finally, winter apparel could be the key market for Macy’s to return to as the winter season arrives. With that in mind, will you consider adding M stock to your portfolio?

[Read More] Are These The Best Epicenter Stocks To Buy After Moderna’s Vaccine News? 1 Making Headlines

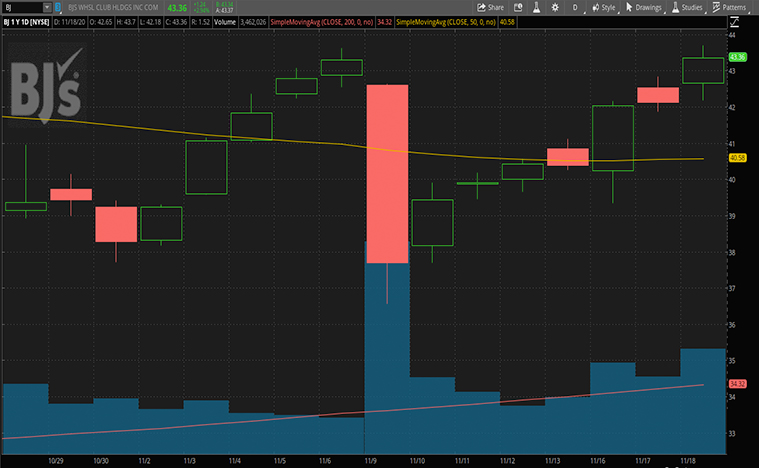

Top Retail Stocks To Watch For Black Friday: BJ’s Wholesale Club Holdings Inc

Finally, we have BJ’s Wholesale Club (BJ Stock Report). BJ’s is a membership-only warehouse club chain based in Westborough, Massachusetts. As of summer 2020, the company operates 216 outlets across 17 states in the U.S. It is known for offering a plethora of unique benefits to its members. Its “member pricing” entails a large variety of name-brand products at discounted wholesale prices and acceptance of coupons from said brands.

The company appears to be riding the pandemic tailwind as a shopping destination for many of its customers. This is evident as it is seeing a meteoric 85% increase in its share price year-to-date. The company is set to release its third-quarter financial report tomorrow. Investors are clearly watching BJ’s closely as share prices increased by 5% in the last week alone. In its second-quarter fiscal, the company reported an increase of 91% year-over-year in income from continuing operations. This was followed by a 41% increase in earnings at $216.9 million. BJ’s also reported an earnings per diluted share of $0.76, which reflected a 94.9% growth, year-over-year.

With six million members watching, BJ’s has also dropped its Black Friday sales early. This is no coincidence as the company has been fortifying its services for the coming holiday season. First, it introduced contactless, curbside pickup at all stores in August 2020. Next, it has noticeably improved its buy-online-pickup-in-store (BOPIS) services to include fresh and frozen grocery options. BJ’s has a smaller customer base than competitors like Walmart (WMT Stock Report) and Costco (COST Stock Report). However, it has shown that it knows how to win over its members and continues to attract a loyal following. Will this be enough to make BJ stock a top buy ahead of its earnings release tomorrow?