5 Top Consumer Tech Stocks To Watch In The Stock Market Today

With the stock market today seemingly on the decline, investors could be looking for stocks with pricing power. Accordingly, this would be where some of the top consumer tech stocks come into play. After all, these are companies that are constantly upgrading and optimizing their cutting-edge devices. In turn, there is always another bigger and better version of existing tech for consumers to consider coming around the corner. Because of that, pricing power, the ability to raise prices without impacting demand much, would be a factor to consider when investing in the sector.

Furthermore, even consumer tech service firms such as Netflix (NASDAQ: NFLX) would also fit the bill. Even as the streaming giant is looking to raise its U.S. and Canadian prices this year, consumers will likely still turn to Netflix. This could be the case as most of them have already cut their cable TV packages in favor of Netflix’s more curated content offerings.

Not to mention, there is also no shortage of exciting news in the consumer tech world as well. By and large, there are massive acquisitions constantly happening From Take-Two’s (NASDAQ: TTWO) $12.7 billion Zynga (NASDAQ: ZNGA) acquisition to Microsoft’s latest $68.7 billion play, this is apparent. With all this activity in this section of the stock market now, should you be watching these consumer tech stocks?

Top Consumer Tech Stocks To Buy [Or Sell] This Week

- Microsoft Corporation (NASDAQ: MSFT)

- Shopify Inc. (NYSE: SHOP)

- Samsung Electronics Company (OTCMKTS: SSNLF)

- Block Inc. (NYSE: SQ)

- Visa Inc. (NYSE: V)

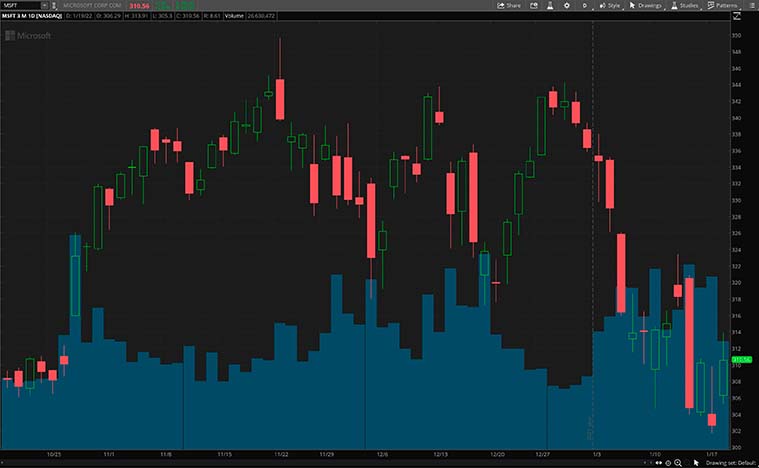

Microsoft Corporation

First up, we have Microsoft, a multinational tech corporation that produces both computer software and consumer electronics. Notably, it is best known for its Microsoft Windows line of operating systems used by billions all over the world. Its Xbox video game consoles are also loved by millions and continue to be at the forefront of the gaming industry. MSFT stock currently trades at $310.33 as of 12:54 p.m. ET and has enjoyed gains of over 40% in the past year. Yesterday, the company announced that it will be acquiring Activision Blizzard (NASDAQ: ATVI).

This acquisition will help accelerate growth in Microsoft’s gaming business across multiple platforms. Furthermore, it will also provide the building blocks for the company as it ventures into the metaverse. Microsoft will acquire Activision for $95 per share in an all-cash transaction valued at $68.7 billion. When the transaction closes, the company will be the third-largest gaming company by revenue. The acquisition will also include famous titles like Warcraft, Diablo, and Overwatch. “Gaming is the most dynamic and exciting category in entertainment across all platforms today and will play a key role in the development of metaverse platforms,” said Satya Nadella, chairman and CEO, Microsoft. Given this piece of news, is MSFT stock a buy?

[Read More] Top Stocks To Buy Now? 4 Renewable Energy Stocks For Your Watchlist

Shopify Inc.

Shopify is a multinational e-commerce company with headquarters in Ontario, Canada. The company’s global commerce operations continue to present growth prospects. This comes as it has a growing set of tools and capabilities that enable merchants of all sizes to sell to anyone, anywhere. It also boasts a data advantage, with tens of billions of interactions accumulated over the years that are now leveraged through machine learning. As of 12:55 p.m. ET, SHOP stock currently trades at $1,088.69.

The company has recently partnered with e-commerce giant JD.com (NASDAQ: JD) to help U.S. merchants sell their goods in the world’s second-largest economy. This would be impressive news for Shopify as it steps up its expansion into China and would also be another step in JD’s internationalization efforts. The two companies will also collaborate to simplify access and compliance for Chinese brands and merchants looking to reach international markets. With that being said, is SHOP stock worth buying today?

Samsung Electronic Company

Samsung is a consumer tech company that manufactures and distributes electronic products. It strives to constantly reinvent the future. Notably, it continues to develop next-generation products to ensure IT solutions continue to run smoothly for its users all over the world. From its flagship Samsung Galaxy smartphones to its wide range of home appliances, the company is a titan in the consumer tech space.

Yesterday, the company announced that it will be partnering with AMD (NASDAQ: AMD) to power up its mobile chips. In detail, it introduced the first mobile processors powered by AMD graphics. This comes as the company tries to compete with competitors like Apple. Dubbed the Exynos 2200, it features a freshly designed mobile processor with a powerful AMD RDNA 2 architecture-based GPU.

The new chip will enable the ultimate mobile phone gaming experience and also enhance the overall experience in social media apps and photography. All things considered, is SSNLF stock worth investing in right now?

[Read More] Best Lithium Battery Stocks To Buy Now? 4 To Know

Block Inc.

Block or formerly Square, is a financial services and digital payments company. It consists of several entities like Square, Cash App, Spiral, and Tidal among others, and continues to build the tools to help more people access the economy. For instance, its Square app helps sellers run and grow their businesses with its integrated ecosystem of commerce solutions. Cash App, on the other hand, will allow its users to easily send, spend, and invest money in stocks and crypto. SQ stock currently trades at $130.71 as of 12:56 p.m. ET.

Last week, it was reported that Block will be building a system for Bitcoin Mining. Block’s general manager for hardware, Thomas Templeton laid out the company’s plans for mining in a string of tweets. The company plans to make bitcoin mining more distributed and efficient in every way, from buying to set up, maintenance, and mining. Block is also open to making a new ASIC, which is a specialized gear used to mine Bitcoin. Having read all that, would you consider SQ stock a top consumer tech stock to know?

Visa Inc.

Another name to consider among consumer tech firms today would be Visa. All in all, most would be familiar with the company’s wide array of financial services. The most prominent of which in this current age would be its fintech solutions. Through Visa’s cards, consumers can make electronic funds transfers throughout the globe. Notably, the company’s cutting-edge global processing network, VisaNet, can handle over 65,000 transaction messages a second. As it stands, V stock currently trades at $217.52 as of 12:57 p.m. ET.

More importantly, thanks to an announcement from e-commerce goliath Amazon (NASDAQ: AMZN) this week, investors could be eyeing V stock. To explain, Amazon is suspending its initial plans to stop accepting Visa’s credit cards from U.K. consumers. In other words, Amazon shoppers in the U.K. can still use their Visa cards beyond January 19. Across the board, this serves to benefit both Visa and Amazon. Considering the sheer scale of both their respective operations this is apparent. As such, would you consider V stock a top buy in your books now?

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!