4 Top Fintech Stocks To Watch Right Now

The ongoing shift from traditional financial transactions and commerce has put fintech stocks into the limelight. For example, the ongoing fear of using banknotes as they could lead to coronavirus spread has encouraged individuals to resort to digital wallets like Square’s (NYSE: SQ) Cash App. You could almost say it acts as a bank-digitally storing and transferring money for users via smartphones. To top it off, the Cash App has also made it easier for people to accept stimulus checks and unemployment benefits.

Other old-school industries have plenty to gain from fintech. Take gambling for instance. You are no longer bound to contacting bookmakers to place your bets or having to physically be in casinos. That has drawn a lot of gamblers to continue to play online even at the peak of the pandemic. With investors realizing such potential, it has made bookmaker giant DraftKings (NASDAQ: DKNG) a favorite, rising nearly 50% this year alone.

The rising popularity of cryptocurrencies has also encouraged fintech companies to improve and adapt to current trends. Mastercard (NYSE: MA) is one of the most notable adopters. It is expanding its cryptocurrency programs via BitPay Card, which enables merchants to accept digital currencies like Bitcoin in transactions. Having read to this end, you might be wondering what are the next best fintech stocks to shake up the industry. With that in mind, here are the four top fintech stocks to watch this week.

Top Fintech Stocks To Buy [Or Sell] This Week

- Fintech Acquisition Corp V (NASDAQ: FTCV)

- Up Fintech Holding Ltd. (NASDAQ: TIGR)

- Futu Holdings Ltd. (NASDAQ: FUTU)

- Foley Trasimene Acquisition II Corp (NYSE: BFT)

Fintech Acquisition Corp V (FTCV)

Yesterday’s announcement of a merger between social trading and asset brokerage firm eToro and special purpose acquisition company (SPAC) Fintech Acquisition Corp. V has caused a frenzy among investors. The news sent FTCV stock on a bullish run, jumping over 43% yesterday. The deal foresees the new entity will have a market value of approximately $10.4 billion at closing.

The company intends to raise $650 million by selling shares to investment giants such as Softbank’s Vision Fund 2 and Daniel Loeb’s Third Point. With over 18.7 million registered users, eToro has made $605 million in revenue last year. That’s a 147% increase over 2019. Even with such strong performance, the company expects to break the $1 billion mark for the first time in its history by the end of 2021.

Further projections from eToro also show promising metrics. The company is expected to maintain an upward growth trend for the next four years. With a revenue projection of $2.5 billion by 2025, they also are looking to maintain a large number of active users with a consistently low churn rate of 1.5%. With such rapid growth and promising future numbers, does it merit FTCV stock to be on your watchlist?

Read More

- Are These The Best Entertainment Stocks To Watch This Week?

- Good Stocks To Buy Right Now? 4 Software Stocks In Focus

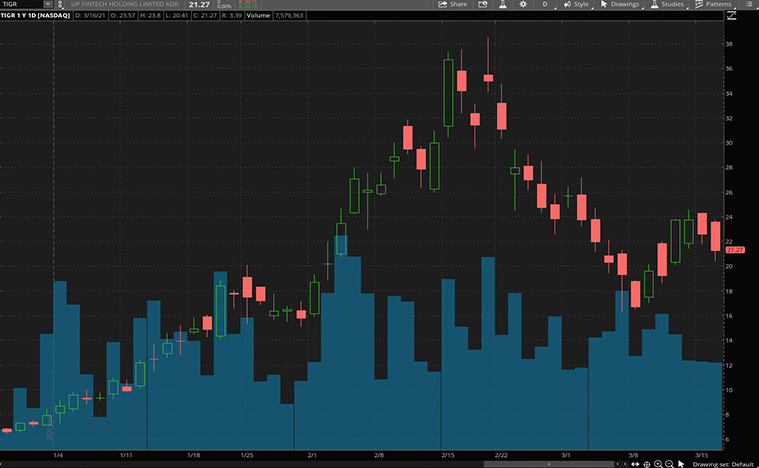

Up Fintech Holding Ltd (TIGR)

Much like eToro, Up Fintech which operates Tiger Brokers provides easy access to equity markets through its mobile application. By reducing the barrier to investment, it creates accessibility for Chinese investors, driving its user base through the roof. According to CEO and Director Wu Tianhua, Up Fintech has achieved its one millionth client account and expected to grow as they move into Q1 2021.

Many may find TIGR stock’s year-to-date gain of over 140% impressive. But it is easy to forget that the stock has fallen by over 40% since its peak in February. With the company announcing its fourth-quarter financial performance on March 26, how will the stock fare in the meantime?

Even with such market volatility, Up Fintech still has a tremendous growth potential across the Asia Pacific. Its $65 million convertible notes issuance earlier this year has certainly strengthened the company’s financial position. Considering all these, would you invest in TIGR stock while prices are on the low side, or wait it out?

[Read More] Best Crypto Stocks To Buy Right Now As Bitcoin (BTC) Breached $60K?

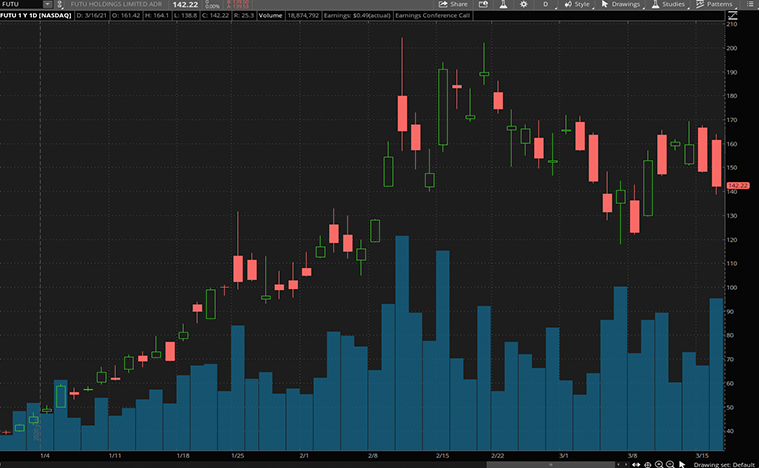

Futu Holdings Ltd. (FUTU)

You can’t go through fintech news and updates without hearing Futu being mentioned. Founded in 2011 as an online brokerage service in China and Hong Kong, it also has expanded to the US. What’s more, it has the backing of investment giants like Tencent (OTCMKTS: TCEHY), Matrix Holdings, and Sequoia Capital. With strong expectations of the company’s business performance, FUTU stock has risen by about 190% this year.

More importantly, 2020 marked a huge year for Futu, as earnings per share blew up 880% to 49 cents, handily beating expectations by 8 cents. The company’s revenue also jumped by 212% year-over-year to $427 million. “As we enhance our capital base, we are able to support larger margin financing balance and ramp out marketing effort in oversea markets, and further invest into tech infrastructures,” mentioned Futu’s CFO in a statement.

Despite the earnings beat, FUTU stock closed lower by 4.1% yesterday. You could say that the stock was priced to perfection. With such strong performance over the past year, can FUTU stock continue its momentum?

[Read More] 4 Cyber Security Stocks To Watch In March 2021

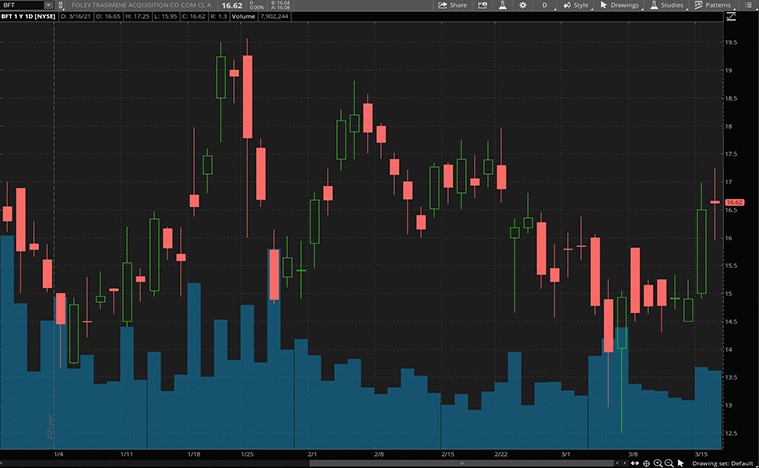

Foley Trasimene Acquisition II Corp (BFT)

Another SPAC that has engaged in a merger is Foley Trasimene Acquisition Corp (BFT). Back in December, the company inked a deal with Paysafe, a global platform for the online payment sector. Looking to be listed on the New York Stock Exchange under the ticket PSFE in the near future, Paysafe is looking to net at least $1.5 billion in gross revenue from $103 billion in transactions this year.

While Paysafe’s competitor PayPal is less prominent on gambling networks, Paysafe is able to support such transactions. This indirectly opens up an opportunity to fill such a void within the gaming segment. With its iGaming network used in over 50 markets, Paysafe continues to assert its dominance in the gaming market. Interestingly enough, the company estimates a compound annual growth rate (CAGR) of over 50% in the next four years.

Such merger was definitely music to investors’ ears, as BFT stock soared over 50% since the initial merger announcement. With the stockholders meeting taking place on March 25, could BFT stock be worth watching at this moment?