Are These 2 Best Health Care Stocks On Your Watchlist This Month?

Health care stocks have been some of the best-performing stocks since the market bottomed out in March. With a lot of coronavirus developments in play, this sector is racing to come up with a vaccine or treatment. The world desperately needs treatments or a cure for this dangerous virus. As companies continue to make developments, investors are watching the top health care stocks closely.

Given the market’s current volatility within the health care space, it will be interesting to see which health care stocks end up finishing first in the race to develop the first treatment or vaccine for mass distribution. Let’s take a look at some of the best health care stocks to watch in June.

Read More

- Top Tech Stocks To Watch In 2020; 2 Names To Know

- What Are The Best Tech Stocks Today? 2 Names To Know

Best Health Care Stocks To Watch #1: Eli Lilly and Company

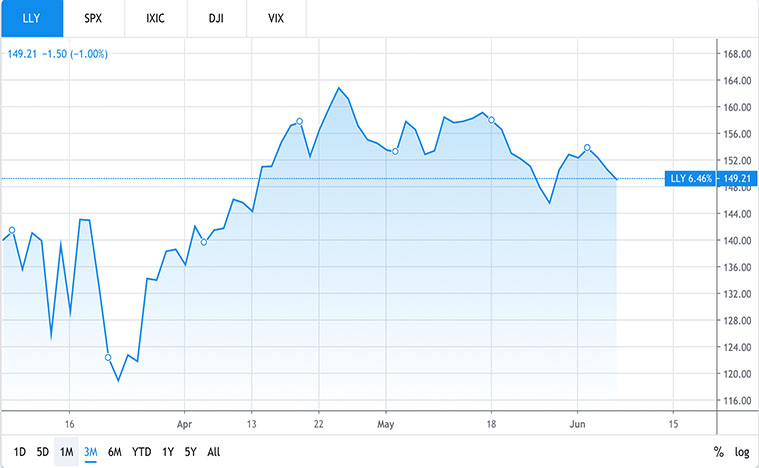

The first company on this list of healthcare stocks is Eli Lilly and Company (LLY stock report). This past week Eli Lilly started phase 1 study on a potential antibody therapy to help treat coronavirus.

The company reported that the first patients have been dosed in a phase 1 study on LY-CoV555, its lead antibody therapy candidate in partnership with AbCellera, a private biotech company. The study will evaluate the safety and tolerability in patients that are hospitalized with Covid-19. Results from this study are anticipated to be released in June.

Year to date LLY stock has seen a price change of 12.58%. This top healthcare stock to watch is a prime example of seeing results on the market after news about coronavirus trials. Will Eli Lilly be the first company to have a feasible coronavirus vaccine?

[Read More] 3 Best Cybersecurity Stocks To Watch In June 2020

Healthcare Stock To Watch #2: Myovant Sciences Ltd. (MYOV)

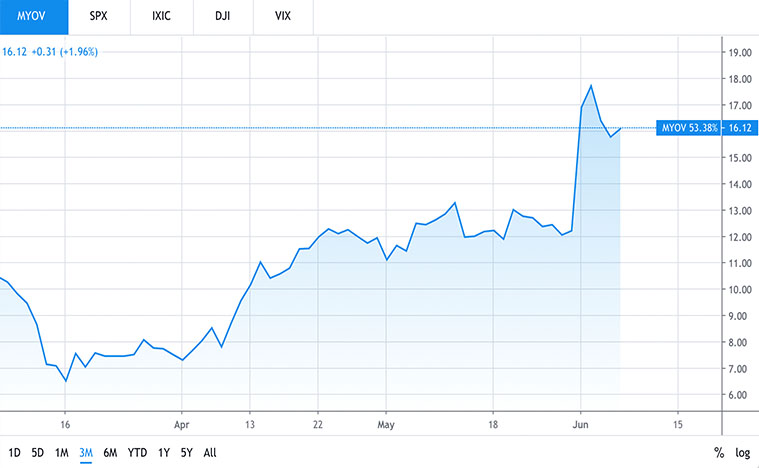

Myovant Sciences (MYOV stock report) is a clinical-stage biopharmaceutical company. Myovant has a primary focus on women’s health diseases. Recently, Myovant submitted a drug application to the FDA for a medication treating women with heavy menstrual bleeding associated with uterine fibroids. They did multiple Phase III studies and showed an 84.3% improvement with their medicine.

CEO of Myovant, Lynn Seely, said, “An estimated five million women in the U.S. suffer from symptoms of uterine fibroids, which may include heavy menstrual bleeding, pain, and anemia – yet effective non-invasive treatment options are very limited. If approved, we hope to redefine care for these women with relugolix combination tablet, a potential new treatment that demonstrated a predictable and clinically-meaningful reduction in menstrual blood loss while maintaining bone health in the Phase 3 LIBERTY program.”

After the reporting of this news, MYOV stock price surged. On May 29th, MYOV stock price was trading at $12.23 a share. After the release of this news shares hiked to $17.40 a share, reaching a high of $18.76. This 42.27% increase in stock price is very significant for the company.

Do you think that Myovant will continue to move higher if this drug is approved?

[Read More] 3 Health Care Stocks To Consider For Your Portfolio

Bottom Line

Though the COVID-19 crisis is affecting health care stocks in many ways as stated above. This doesn’t mean companies unrelated to Covid-19 like Myovant aren’t able to perform well too. The fact is everyone needs health care, or they will need it some point in their lives. If there’s something that everyone needs, there lies a potentially great opportunity for investors.