Do You Have These Top Shorted Stocks On Your Watchlist This Week?

Unless you’ve been living under a rock, you’ve likely heard about the David vs Goliath battle happening in the stock market right now. Retail investors have been going head-to-head with several hedge funds on Wall Street. For the uninitiated, this started when the Reddit community r/WallStreetBets started buying stocks that had a high short interest in them. They started to target names like GameStop, BlackBerry (NYSE: BB), and Koss Corporation (NASDAQ: KOSS). The group of retail traders started buying deeply-out-of-the-money call options that created a massive demand for shares of these companies.

This ignited an epic rally of short squeezes shooting some of these companies’ share prices to record levels. On the flip side, it caused some of the most respected hedge fund world to lose roughly $20 billion due to having to cover their short positions. Most notably, Melvin Capital lost 53% in January. The fund had to receive an emergency $2.8 billion investment from Citadel and Point72.

So what does this mean for the stock market this week? Well, this situation has now gained global attention, and retail investors are on the hunt for the most shorted stocks to buy in the market this week. Before we get into our list of stocks, I want to first answer the question you might be asking yourself. Which is “what does shorting a stock mean?” Let’s break it down.

What Is Short Selling?

One way for investors to make money in the stock market today is through short selling. You may have heard the traditional investing or trading phrase “buy low, sell high.” Short selling is the opposite. When a trader or investor sells short it’s because they are betting on that specific company’s stock price falling. The investor will likely have a fundamental or technical reason for betting that the stock price will drop.

Short selling is a relatively simple concept – An investor will borrow shares from their broker, sell the stock, purchase the stock back, and repay the lender. The short seller will profit from the difference between the selling price and the buy price.

Here’s An Example Of How To Short A Stock

For example, let’s say ABC stock is currently trading at $10. After doing your research and due diligence (DD) you think that ABC stock could fall to $5 a share. You will then contact your broker, and your broker will lend you shares of ABC stock that you will then sell in the open market. In this example, let’s say you short 10 shares of stock.

So, after selling those 10 borrowed shares of stock, you now have net positive $100 cash in your account. Next, ABC stock drops to $5 a share the following week. You will then do what’s called “cover your short position” by buying the stock back. In this case, you buy back at $5. Lastly, you will pay your lender back the shares you borrowed and profit the difference. So with 10 shares as the example, you, as the investor, would profit $50 shorting ABC stock from $10 to $5 a share.

It’s crucial to note that, despite some investors having made their fortunes by short selling, it’s considered a high-risk investment strategy. The reason being is because short selling has infinite risk. In simpler terms, the amount you can lose by shorting a stock is unlimited. You might be thinking, “how is that possible?” well stay with me here.

[Read More] 4 Top Epicenter Stocks To Watch Amid Novavax’s Vaccine News

What Is A Short Squeeze?

Hedge funds lost billions of dollars because of what’s known as a “short squeeze.” A short squeeze happens when the buying pressure in a stock outweighs the selling pressure, causing a jump in the stock price. This in turn will force short sellers to cover their short positions to cut their losses. If you remember what was mentioned above, short-sellers are betting on the stock going down. If those traders are wrong and the stock price goes up, they are now forced to buy back their shares at a higher price. Which will force them to pay the difference between the price they shorted at, and the higher price they need to buy back at. This is what is happening in the stock market right now between retail investors and hedge funds.

This has sparked investor interest and has them asking themselves “what are the best-shorted stocks to buy right now?” With all that being said, here is our list of the stocks with the highest short interest to watch this week.

Most Shorted Stocks To Watch This Week

- GameStop Corp. (NYSE: GME)

- AMC Entertainment Inc. (NYSE: AMC)

- Virgin Galactic Holdings, Inc. (NYSE: SPCE)

- Fubotv Inc. (NYSE: FUBO)

- Bed Bath & Beyond (NASDAQ: BBBY)

GameStop Corp.

First up on the list is GameStop or GME. GameStop was the Reddit investor’s first targeted company due to its extremely high short interest from institutional investors. This sparked a historic rally of GME stock to over 400% gains last week. The stock price has jumped more than 1,600% in January. The stock closed at $325 a share on Friday, January 29th, 2021. Just two short weeks ago GME stock was trading between $17-19 per share.

For those who are unfamiliar, Gamestop is a consumer electronics, video game, and gaming merchandise retailer. Its rally caused some of the biggest retail brokerages like Robinhood and TD Ameritrade to restrict the trading of GME stock this past week causing huge controversy among investors. GME even caught the attention of Tesla (NASDAQ: TSLA) CEO Elon Musk who tweeted in support of this retail stock. As of January 29th GME stock is still the most heavily shorted stock in the market, with a short interest of 121.07%.

Earlier in the month, the company reported its worldwide sales results for the nine-week holiday period that ended on January 2, 2021. GameStop reported a 309% increase in e-commerce sales for this period. Net sales for the period came in at $1.77 billion, a 3.1% decrease compared to the year prior. It stated that strong console demand was offset by store closures under the company’s planned densification strategy. However, the company has also added Ryan Cohen, the co-founder of e-commerce giant Chewy (NYSE: CHWY) to its Board of Directors. With how everything has been transitioning to e-commerce this is a good first step for GameStop to grow its e-commerce segment. With all that being said, it’s clear that GME stock will again be in focus this week for retail investors. Will you add it to your watchlist?

Read More

- How Old Do You Have To Be To Invest In Stocks?

- Best Stocks To Buy Right Now? 4 Tech Stocks To Watch On Monday

AMC Entertainment Inc.

Next on the list is entertainment stock AMC Entertainment. The company has also been in the spotlight as of late. AMC stock is being dubbed a “wall street bets stock” after a recent short squeeze from retail traders caused the top entertainment stock to fly this past week. This resulted in an increase in the share price of over 469% since January 15th. AMC stock closed at $13.26 a share this past Friday.

If you’re new to AMC, the Kansas-based company owns and operates movie theatres throughout the U.S and internationally. Needless to say, AMC was one of the entertainment companies that got badly beaten up by the global COVID-19 pandemic. Government shutdowns have caused them to close some of their theatres and with no end in sight, it pushed AMC to the edge of bankruptcy. Luckily, earlier this month, before the current price action, the company announced it had secured a new funding round of $917 million. The company reported this capital will be able to keep the business running “deep into 2021”. AMC Entertainment CEO, Adam Aaron stated in the company’s press release, “AMC has raised an additional $917 million capital infusion to bolster and solidify our liquidity and financial position. This means that any talk of an imminent bankruptcy for AMC is completely off the table“.

AMC stock as of January 29th, 2021 has a short interest percentage of 78.97%. Given its growing popularity among retail investors and the current technicals, do you think AMC stock should be at the top of your list of stocks to watch this week?

[Read More] Looking For The Best Biotech Stocks To Buy? 1 Reported Earnings Today

Virgin Galactic Holdings, Inc.

Third on the list of the top shorted stocks is Virgin Galactic Holdings, Inc, or also referred to as SPCE. Virgin Galactic is an early-stage growth company that focuses on commercial space travel. Its goal is to be able to provide suborbital space flights for space tourism. SPCE has been one of the most trending growth stories on Wall Street this past year. That momentum has carried over into the new year. In the 12 months, SPCE stock price is up 158.25%, and year-to-date the company’s share price is up another 90.82%. In the last 5 days, SPCE stock has gained another 25.79% closing Friday’s trading session at $44.29 a share.

So what caused the most recent rally for SPCE stock? Yes, you guessed right, it has a high short interest. The company’s stock has a current short interest of 71.95% making it one of the most shorted stocks in the stock market today. This past week retail investors on Reddit, Twitter, and other online forums caught wind of this, and before you know it SPCE stock was trending. As result, which created a short squeeze on the stock driving the share price higher.

Earlier this month, the company announced it will be reporting its fourth-quarter and full-year 2020 financial results on Thursday, February 25th, 2021 after the closing bell. It will be interesting to see how investors react to SPCE stock given the recent technical momentum and upcoming earnings report, don’t you think?

[Read More] MasterCard (MA) vs Visa (V): Which Is A Better Financial Stock To Buy?

FuboTV Inc.

Then we have trending streaming stock FuboTV or FUBO. In recent years, we’ve seen huge advancements in the way video entertainment is consumed by people. As more households move towards the cord-cutting trend, this has an increase in investors’ attention around FUBO stock. Its platform offers subscribers access to live streaming thousands of live sporting events annually. As of January 29th, 2021 FUBO stock has a short interest of 71.91%. In the last month of trading, FUBO stock price has jumped 50.89% closing Friday’s trading session at $42.50 a share.

Aside from the recent momentum, FuboTV reported its preliminary fourth-quarter results earlier in the month. The company is anticipating top-line revenue growth of 84% year-over-year at $98 million. Its prior guidance was reported between $80-$85 million. The company also reported its paid subscribers at year-end are estimated to surpass 545,000, resulting in a 72% increase year-over-year.

Though the company is excited about its growth, bears on Wall Street still feel that FUBO’s primary service, which is streaming subscriptions, is a money-losing business. This could be the cause of the high short interest in FUBO stock right now. Though, one thing is certain, with all the investor attention going towards the “high short interest stocks”, It’s hard to ignore FUBO stock on your watchlist for tomorrow, isn’t it?

[Read More] Social Media Stocks To Buy In February 2021? 2 Releasing Earnings Next Week

Bed Bath & Beyond

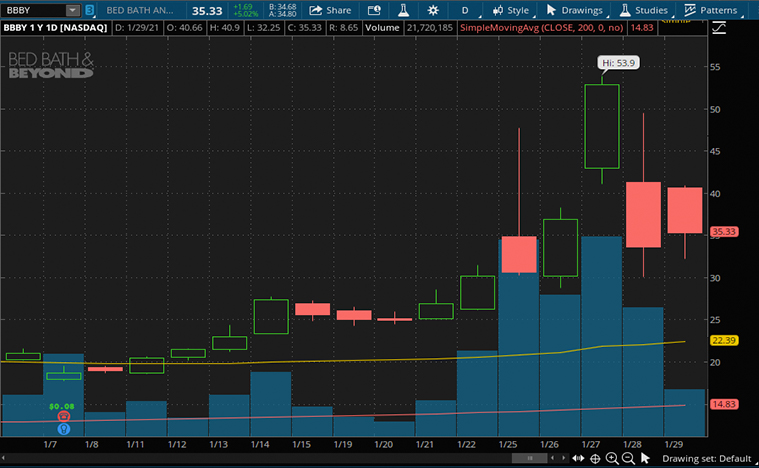

Last but not least, we have retailer Bed Bath & Beyond, also known as BBBY. As it stands on January 29th, 2021 BBBY stock has a short interest of 65.48%, making it to the list of the top short shorted stocks to watch this week. The company owns and operates a chain of domestic merchandise retail stores throughout the U.S, Canada, and Mexico. They offer a wide array of products in the home, beauty, baby, and wellness markets, along with many others. BBBY stock has more than doubled in the last week of trading due to the increased attention from retail investors and traders.

Like GameStop, BBBY was one of the stocks trending on Reddit and other online forums due to its high short interest from hedge funds. This resulted in shares of BBBY spiking to $52.89 a share this past Wednesday before eventually closing out the week at $35.33 a share. Month-to-date shares of BBBY stock have increased an impressive 98.93%. Obviously, BBBY stock was negatively impacted by the pandemic, it has since recovered from March lows.

Earlier in the month, the company announced its third-quarter fiscal with improved financial performance. BBBY reported a 94% increase for its core digital comparable growth and a 77% gain in its total enterprise comparable sales growth. Furthermore, the company recorded a positive cash flow of $244 million and $1.5 billion in cash and investments. BBBY also lowered its gross debt by about $500 million. Despite the stock’s impressive recovery in the last year, the current volatility of BBBY stock has sparked an increase from short sellers. With all that information, do you think BBBY stock is going to be a stock top shorted stock to buy tomorrow? Your guess is as good as mine.

[Read More] Apple (AAPL) Vs Microsoft (MSFT): Which Is A Better Tech Stock To Buy Right Now?

Bottom Line

As we continue to see how this battle unfolds, one thing we know for certain is that for the first time the “little guy” is more than holding its own against some of the big bad bears on Wall Street. There’s no telling when or how this will end, but if you’re an active investor or trader, you’re likely loving the volatility the market is giving us to start off the new year. Understand trading stocks with high-volatility like some of the names we mentioned above are high-risk. If your risk tolerance and investment strategy aren’t in line with how these stocks are trading then it’s in your best interest to watch from the sidelines. The choice is yours.