Are These The Best Stocks To Invest In 2022?

Tech stocks have been among the hottest stocks in the stock market over the past decade. Certainly, there is plenty of movement in the tech space and this can be overwhelming for the average investor. Investing in tech stocks is also not as straightforward as some may think. Tech companies are constantly evolving and pushing their boundaries to look for the next breakthrough. Thus, investors may find it worthwhile to be regularly keeping tabs on companies in this industry.

Earlier today, South Korea’s SK Hynix announced that it had completed the first phase of acquiring Intel’s (NASDAQ: INTC) NAND flash memory chip business. This also marks SK Hynix’s biggest acquisition ever as it seeks to expand its area of expertise. With this sale, Intel would be able to place more attention on its smaller but more lucrative Optane memory business.

On another hand, tech giants such as Alphabet (NASDAQ: GOOGL) are not resting on their laurels. While it is primarily known for its Google services, Alphabet also has a presence in the autonomous vehicle space. Recently, the company’s Waymo announced that it will be partnering with China’s Geely to create a fleet of all-electric, self-driving robotaxis. With so much happening in the tech industry, let’s take a look at a list of the top tech stocks in the stock market today.

Best Tech Stocks To Watch Today

- Calix Inc (NYSE: CALX)

- Western Digital Corp (NASDAQ: WDC)

- Juniper Networks, Inc (NYSE: JNPR)

- Accenture Plc (NYSE: ACN)

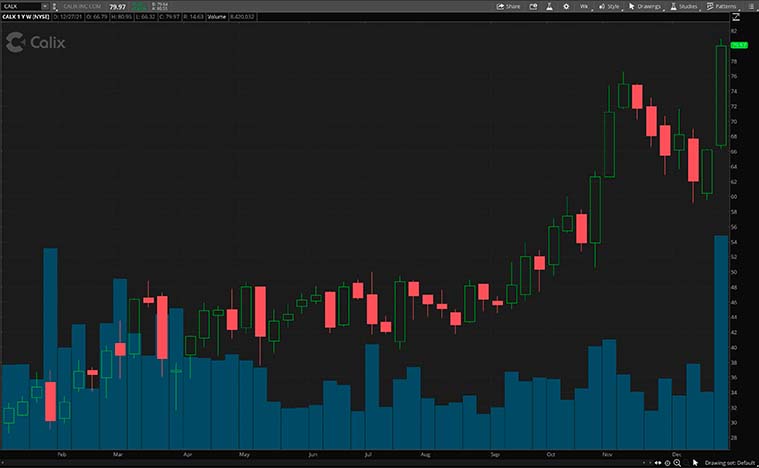

Calix

Calix is a provider of cloud and software platforms, systems, and services. In detail, it focuses on the access network, the portion of the network that governs available bandwidth, and determines the range of services that can be offered to subscribers. It has been a fruitful year for CALX stock, rising more than 160% over the past year.

The company continues its momentum as it will be added to the S&P MidCap 400 index prior to the market opening on January 4. It is a significant development as the index funds that track the mid-cap index will have to add the stock to their holdings. Consequently, driving up demand for the company stock. Now, this is a testament to Calix’s success over the years and represents a milestone for the company.

On top of that, Calix also announced earlier this month that UK-based Grayshott Gigabit Limited has chosen the company’s Intelligent Access EDGE to bridge the digital divide and raise home values in Eastern Hampshire and Surrey Hills. Grayshott hopes to accelerate subscriber turnups and reduce back-office integration by 83% through this integration. Given these positive developments, should you be keeping a close eye on CALX stock?

[Read More] Top Stocks To Buy For 2022? 4 Work-From-Home Stocks In Focus

Western Digital

Following that, we will be looking at Western Digital. This is a company that specializes in data storage devices and solutions. The company develops and manufactures hard disk drives (HDDs), and solid-state drives (SSDs) for computing devices, smart video systems, gaming consoles, and others. WDC stock has been picking up steam lately, rising over 14% within the past month.

The company received another indirect boost recently as China is seeing a COVID-19 outbreak. This has led to its South Korea-based rival Samsung Electronics to “temporarily adjust operations” at its manufacturing facilities in Xi’an, China. Now, this means that Samsung will be reducing production at its NAND memory chip plant as the region is seeing new lockdown restrictions.

Coupling this with Western Digital’s strong fundamentals, it should not be a surprise that investors are eyeing WDC stock. During its first fiscal quarter, the company posted revenue of $5.1 billion, an increase of 29% year-over-year. Out of which, cloud revenue increased by 72%. Meanwhile, its GAAP net income turned from a loss of $60 million to a positive $610 million. All in all, Western Digital appears to be trending in the right direction. So, would you consider investing in WDC stock now?

Juniper Networks

Next up, we have Juniper. For those unaware, the company develops and sells products and services for high-performance networks. These solutions would then enable customers to build networks for their businesses. Having its products in over 150 countries around the globe, JNPR stock is one that should not be overlooked.

Recently, the company has been chosen by the Aston Martin Cognizant Formula One™ Team as its Official Networking Equipment Vendor. Hence, Juniper will supply an agile and highly automated network platform across the team’s new technology campus. Well, Formula One is a sport that has extensive needs in performance, flexibility, and intelligence without any compromise. So, this decision by Aston Martin goes to show the kind of trust that it has in Juniper’s high-performance networks.

Not to mention, Juniper was also selected by India’s premier communications solutions provider, Bharti Airtel, to deliver network upgrades for the company. Juniper will play a significant role in delivering network upgrades for the expansion of Airtel’s nationwide broadband coverage across India. It will do so by supplying, installing, and providing support for upgrades to the MX Series routers and line cards. Ultimately, that is to ensure secure encryption across the network. With that in mind, would you consider adding JNPR stock to your watchlist?

[Read More] Best Lithium Battery Stocks To Buy Now? 4 To Know

Accenture

Last but not least, we have the professional services company, Accenture. Essentially, the company provides management and technology consulting services. Its segments include Communications, Media and Technology, Financial Services, Health and Public Services, Products, and Resources. ACN stock has been on a slow but steady incline this year. The stock has climbed more than 60% this year and shows little signs of slowing down.

Earlier this month, Accenture announced that it has acquired Zestgroup. This is a services firm specializing in energy transitions, net carbon-zero projects, and procurement of renewables. Accenture believes that Zestgroup will bring deep industry knowledge and expertise to help organizations move to net-zero. Hence, these capabilities will enhance Accenture’s ability to build more trusted, circular, and net-zero value chains while driving social and economic benefits for all stakeholders.

Furthermore, the company also signed a collaborative agreement with Spanish bank Banco Bilbao Vizcaya Argentaria last week. The partnership will focus on accelerating digital transformation and applying analytics and artificial intelligence (AI) to drive faster decision-making. It is a 10-year agreement where Accenture will help the company to improve the agility of its operations and adapt to new ways of working with AI and analytics. All things considered, would you say that ACN stock is a top tech stock to watch now?

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!