Are These The Best Software Stocks To Invest In Now?

While investors digest the latest data on the economy, software stocks are becoming a prominent theme in the stock market. For the most part, this seems to be the case this week, particularly. As some of the top software firms in the game continue to post solid earnings figures, this is understandable. Now, software stocks, among other tech stocks, are experiencing a recovery over the past week. After the broader tech sector was hit hard last month, this would be relieving for tech investors. Nonetheless, it would also serve to highlight how vital software services are in our increasingly digital world now.

For instance, we could take a look at social media firm Twitter (NYSE: TWTR). Twitter posted earnings of $0.33 per share on revenue of $1.57 billion for the quarter. This would be just shy of consensus estimates of $0.35 and $1.58 billion respectively. At the same time, Twitter also announced plans for a new $4 billion share buyback program. If all that wasn’t enough, new CEO Parag Agrawal notes that Twitter remains on track to meet its long-term goals. This would be despite macroeconomic and privacy policy-related challenges weighing in on other social media firms.

At the same time, more corporate-facing software firms like Digital Turbine (NASDAQ: APPS) could also be worth noting. Namely, Digital Turbine helps advertisers better monetize their ads on mobile platforms. In its latest earnings call the company saw its quarterly revenue surge by a whopping 324% year-over-year. By and large, these are but two examples of the software industry thriving now. Could one of these three be worth your attention in the stock market today?

Best Software Stocks To Buy [Or Sell] This Month

- Datadog Inc. (NASDAQ: DDOG)

- Twilio Inc. (NYSE: TWLO)

- Salesforce.com Inc. (NYSE: CRM)

Datadog Inc.

To begin with, we will be taking a look at DataDog. Overall, the company specializes in providing cybersecurity software services. Through its cutting-edge monitoring and security platform, Datadog primarily focuses on protecting cloud applications. In practice, the company’s services help organizations by facilitating safe and efficient cloud migration, collaborative development efforts, and digital transformation. DDOG stock is up by over 15% on today’s opening bell.

Today, the company announced its fourth-quarter financials. Diving in, revenue for the quarter was $326 million, growing by 84% year-over-year, demonstrating continued business efficiencies. GAAP net income for the quarter was $0.02 per diluted share. It also ended the quarter with $1.6 billion in cash and cash equivalents. Customers with an annual recurring revenue (ARR) of $1 million or more than doubled to 216 customers. It also announced a strategic partnership with Amazon (NASDAQ: AMZN) Web Services last month. The two companies are working together to develop and deliver tighter product alignment in the future.

Moreover, the company remains hard at work expanding its current portfolio as well. Alongside its impressive quarterly earnings, Datadog also revealed the completion of its acquisition of CoScreen. In essence, CoScreen is a platform where technical teams can work together in real-time. Because of all this, engineering teams on the Datadog platform can seamlessly share their screens and work together during incident and security response situations. With all this in mind, would DDOG stock be a top buy for you?

[Read More] Stock Market Today: Dow Jones, S&P 500 Down On Inflation Data; Twilio, Datadog Surges On Earnings Beat

Twilio Inc.

Twilio is a software company that provides programmable communication tools for a wide variety of purposes. In fact, millions of developers around the world use Twilio’s services to improve communications. The company has essentially democratized communication channels like voice, text, chat, and video by virtualizing the world’s communications infrastructure through application programming interfaces (APIs). TWLO stock is up by over 18% on today’s opening bell after reporting its earnings on Wednesday.

Diving in, the company announced a fourth-quarter revenue of $842.7 million, a 54% increase year-over-year. This was almost 10% more than what analysts predicted. “Our fourth quarter capped off an amazing year of results as we delivered more than $2.8 billion in revenue for the year, growing 61% year-over-year,” said Jeff Lawson, Twilio’s Co-Founder and CEO. “The combination of our leading cloud communications platform with Twilio Segment’s #1 customer data platform gives Twilio an unparalleled view into the customer journey, and I’ve never been more excited about the future of the company than I am today.”

The company also announced that active customer accounts increased by 15% year-over-year to 256,000. Twilio also saw gains from its acquisitions of Segment and Zipwhip. The company reported better-than-expected earnings at a loss of $0.20 per share against $0.22 per share. Besides, it issued an upbeat current-quarter revenue outlook, at a range from $855 million to $865 million. Given this piece of news, is TWLO stock worth investing in today?

[Read More] Top Stock Market News For Today February 10, 2022

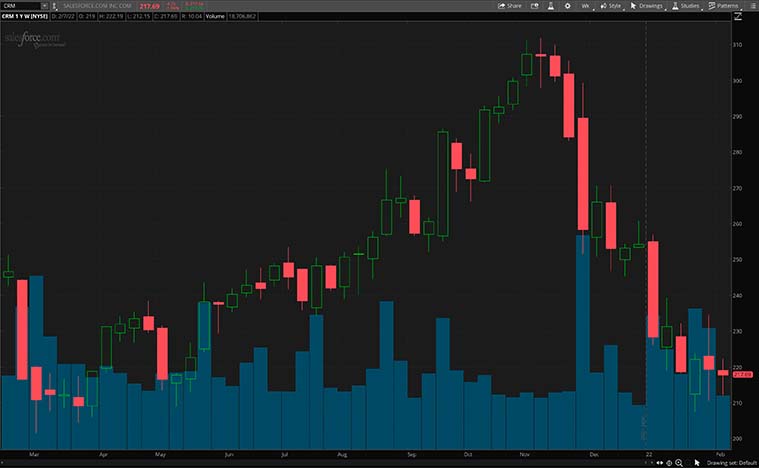

Salesforce.com

Salesforce is a customer relationship management (CRM) software company that provides enterprise applications focused on customer services. Its software is also used for application development, analytics, and marketing automation among others. The company says that more than 150,000 companies use its software to grow their businesses.

On February 9, 2022, Salesforce co-CEOs Marc Benioff and Bret Taylor spoke about the company’s vision for an NFT cloud service. NFTs are unique digital assets stored using blockchain technology. It has taken off in the world of art and collectibles and the company sees an opportunity to bring the technology to its enterprise software. People familiar with the matter say that Salesforce wants to offer a service for artists to create content and release it on a marketplace like OpenSea.

Earlier in the month, the company also announced Manufacturing Cloud for Service, a new industry-specific platform built on Service Cloud to automate service processes. With the new service, manufacturers can take advantage of Service Cloud’s ability to deliver faster and more personalized service across any channel or device to grow customer loyalty and satisfaction. Today, manufacturers are increasingly managing customers who expect 24/7, omnichannel digital service experiences. They also look for ways to strengthen customer loyalty while also automating customer service and turning it from a cost center into a revenue generator. All things considered, is CRM stock a top software stock to add to your portfolio right now?

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!