The technology sector has long been a driving force behind the global economy. It has also been a catalyst for innovative breakthroughs across various industries. As one of the fastest-evolving sectors, it encompasses a wide range of industries. Everything from software development and hardware manufacturing to artificial intelligence, cloud computing, cybersecurity, and more. The growth and expansion of the tech sector have been primarily fueled by the exponential increase in internet users, the proliferation of mobile devices, and the growing demand for data-driven solutions. As a result, technology stocks have consistently been a popular choice among investors. This is because they offer significant growth potential and, often, attractive returns on investment.

Investing in tech stocks provides exposure to a diverse set of companies, including well-established market leaders like Apple (NASDAQ: AAPL), Amazon (NASDAQ: AMZN), and Alphabet (NASDAQ: GOOGL). As well as smaller, innovative startups focusing on cutting-edge technologies. While the tech sector is known for its volatility, it has historically delivered robust returns for long-term investors. Particularly those who have been able to identify and capitalize on emerging trends and breakthrough innovations.

However, investing in technology stocks also entails a level of risk. As the sector’s rapid evolution can lead to shifts in competitive dynamics and the potential for disruptive technologies to upend established players. Therefore, it’s crucial for investors to conduct thorough research and due diligence before investing in tech stocks. This will help ensure they’re well-informed about both the opportunities and the risks. Having said that, let’s look at three trending tech stocks to watch in the stock market this week.

Tech Stocks To Watch Right Now

- NVIDIA Corporation (NASDAQ: NVDA)

- ON Semiconductor Corporation (NASDAQ: ON)

- Meta Platforms Inc. (NASDAQ: META)

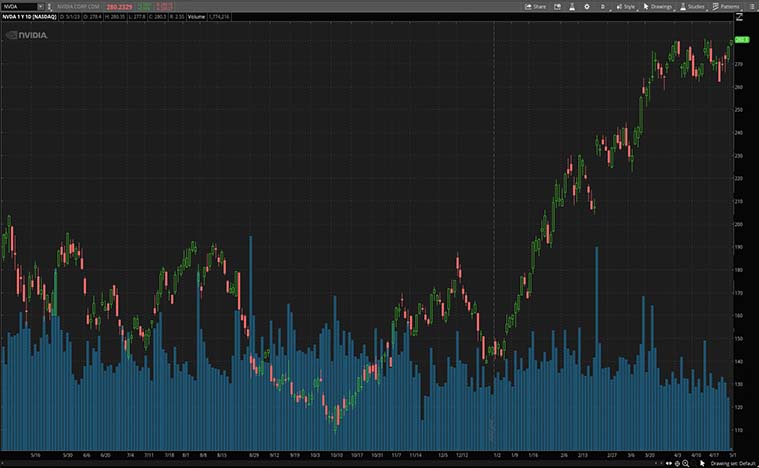

NVIDIA (NVDA Stock)

Starting off, NVIDIA Corporation (NVDA) is a leading global technology company specializing in the development and production of Graphics Processing Units (GPUs), System on a Chip (SoCs), and AI solutions. NVIDIA’s products have gained significant prominence in various sectors, such as gaming, professional visualization, data center services, and automotive applications.

In the company’s latest news release last month, NVIDIA launched the GeForce RTX 4070 GPU, which brings the advanced capabilities of the Ada Lovelace architecture and DLSS 3 technology to a broader audience of gamers and creators, starting at just $599. The new RTX 4070 offers exceptional performance, enabling real-time ray tracing and delivering more than 100 frames per second at a 1440p resolution in the majority of contemporary games.

Moving along, during Monday morning’s trading session, shares of NVDA stock are up another 1.41% off the open trading at $281.41 a share.

[Read More] Top Stocks To Buy Now? 2 Undervalued Stocks To Watch

ON Semiconductor (ON Stock)

Next, ON Semiconductor Corporation (ON) is a prominent player in the semiconductor industry, focusing on the design and manufacturing of energy-efficient electronic components and integrated circuits. The company’s product portfolio includes power management solutions, sensors, and connectivity devices, catering to diverse markets such as automotive, industrial, consumer electronics, and communications.

Today, Monday, ON Semiconductor reported a beat for its first quarter 2023 earnings results. Diving in, the semiconductor company posted Q1 2023 earnings of $1.19 per share on revenue of $2.0 billion. This is in comparison with Wall Street’s consensus estimates which were earnings of $1.09 per share. Additionally, the company said it expects Q2 2023 earnings in the range of $1.14 to $1.28 per share, with revenue of approximately $1.975 billion to $2.075 billion.

Following this news release, on Monday morning, shares of ON stock popped higher off the open by 6.49%, trading at $76.69 per share.

[Read More] 2 AI Stocks To Watch In May 2023

Meta Platforms (META Stock)

Last but not least, Meta Platforms Inc. (META), previously known as Facebook Inc., is a global technology giant that owns and operates a wide range of social media platforms and applications, including Facebook, Instagram, WhatsApp, and Messenger. Meta has recently ventured into the development of the metaverse, a virtual shared space that combines aspects of social media, online gaming, and augmented reality.

Last week, Meta reported its first quarter 2023 financial results. Diving in, the company notched in better-than-expected results for the quarter. Specifically, Meta posted Q1 2023 earnings of $2.64 per share on revenue of $28.6 billion. This is versus analysts’ consensus estimates for Q1 2023, which were earnings per share of $1.96 per share along with revenue estimates of $27.6 billion.

Over the past five trading days, shares of META stock have jumped by 13.76%. Meanwhile, during Monday morning’s trading session, META stock opened the day trading day flat trading at $240.14 a share.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!